Nowadays, when having idle money, many people often choose to save money in the bank to earn interest, this is considered the safest and least risky way to keep money, anyone can do it. When saving money at the bank, to be most effective, you should clearly understand the issues related to bank savings, including the maturity of savings books. So what is a non-maturity savings deposit? How to calculate interest when the maturity is not revolving?

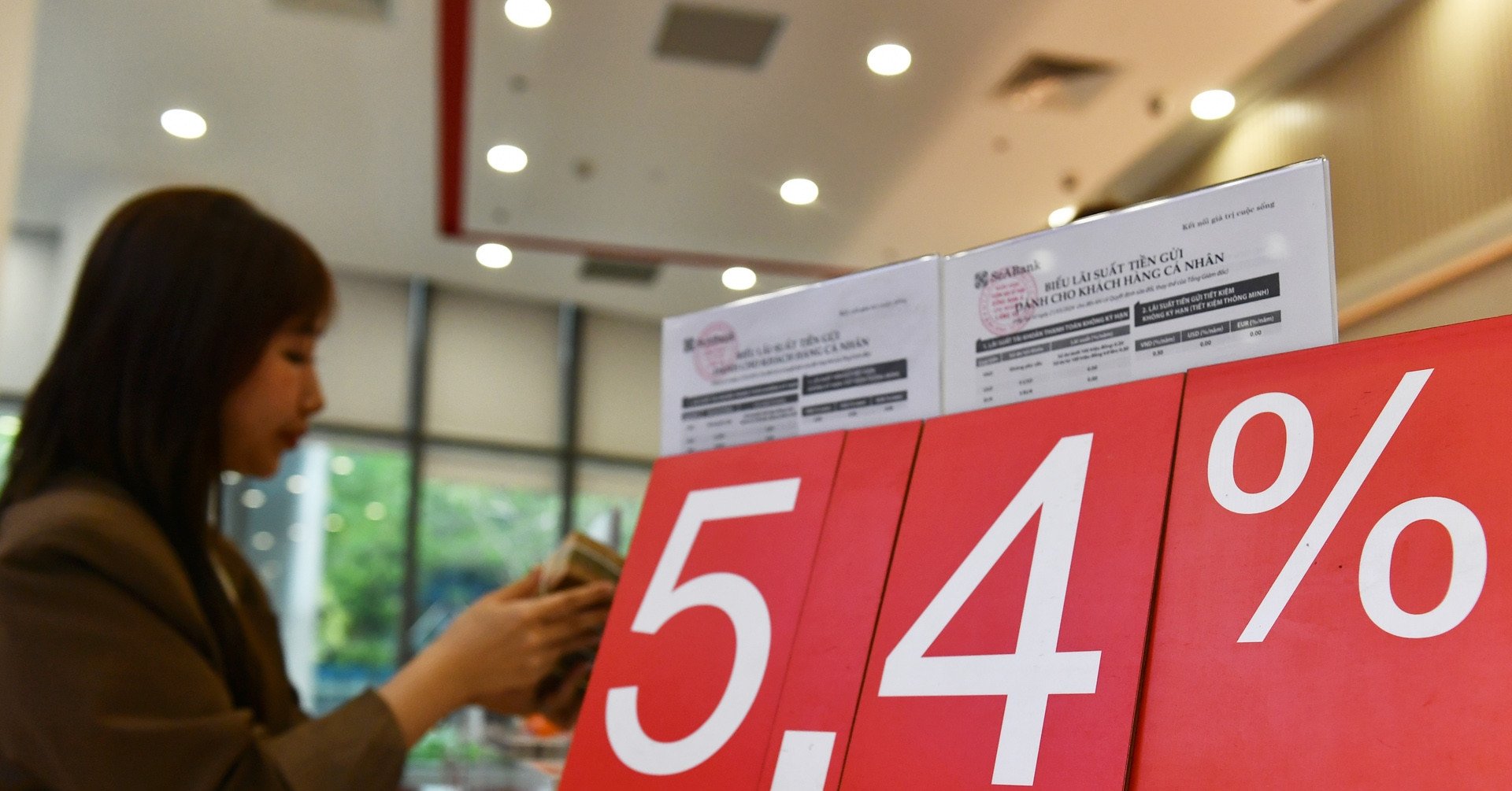

Many people often choose to deposit savings in banks to earn interest.

What is a non-revolving savings deposit?

Non-revolving savings deposits, also known as non-revolving maturity deposits, are when the term expires and the customer must go to the bank to complete the procedure, withdraw both principal and interest, and no longer deposit. With the non-revolving maturity deposit method, the customer must remember the end date of the term to go to the bank to complete the withdrawal procedure.

Currently, banks allow customers to make term and non-term savings deposits. With term deposits, customers can close their savings books at any time. But with term deposits, the time will depend on the expiration date of the book.

Conditions for non-revolving maturity

To make a non-revolving deposit, customers must fully meet the conditions set forth by the bank as follows:

- Have a savings account or loan at the bank and it is due for payment.

- Customers are between 22 and 65 years old, with full civil capacity.

- Customers have household registration/KT3 in areas where the bank has branches.

Non-rotating maturity profile procedures

After the savings period expires, if the customer does not want to continue the deposit, they can go to the bank to pay off both principal and interest to the owner, whose name is on the savings book. The maturity date is the last day of the deposit term. When the savings book expires, it does not rotate. The customer only needs to bring the savings book and ID card to the bank for the staff to guide them.

In case the customer does not come to the bank to retrieve the savings at the maturity date, the bank will automatically renew the savings with the old term. The interest rate will be calculated at the time the bank renews the savings.

How to calculate non-revolving savings interest

When making a deposit, the interest rate is the thing that most customers are most concerned about. Normally, the maturity interest rate will be different if the settlement time is different from the savings deposit customer. In case of settlement on the maturity date of the deposit term, you will receive a fixed interest rate according to the term.

When saving, interest rates are what most customers are most concerned about.

In case the savings book expires and the customer does not make a full payment, the bank will automatically extend the deposit period and the interest of the previous term will be automatically added to the principal and transferred to the new term. Accordingly, the interest if the book expires will be calculated according to the following formula:

Interest amount = Deposit amount x interest rate (%/year) x actual number of days deposited/365

In case the customer wants to close the savings book earlier than the maturity date in the book, the bank interest rate will be calculated according to the non-term deposit rate. Accordingly, the number of days to receive interest will be calculated from the first day of the term to the date you close the book.

Semi-annual interest = 500,000,000 x 0.5%/365 x 180 = 1,233,000 VND

Ganoderma (Synthesis)

Source

Comment (0)