Right in the first month of 2025, many banks adjusted their deposit interest rates to attract idle cash flow.

|

| Deposit interest rates increased by 0.71% last year, contributing to attracting a significant cash flow from people into the banking system. (Source: Zing) |

Interest rates above 6%/year are applied more often to long terms of 12 months such as at Vietnam Export Import Commercial Joint Stock Bank (Eximbank), Global Petroleum Commercial Joint Stock Bank (GPBank), An Binh Commercial Joint Stock Bank (ABBank)...

However, by February, the interest rate trend is showing signs of reversing.

Interest rates for many terms at Vietnam Bank for Agriculture and Rural Development (Agribank), Tien Phong Commercial Joint Stock Bank (TPBank), Bac A Commercial Joint Stock Bank (Bac A Bank)... have been adjusted down again.

According to the latest published data, deposits at banks will continue to increase sharply in 2024 with total capital mobilization exceeding VND 12.8 million billion, an increase of nearly 12.9% compared to the end of 2023. This strong increase comes from the trend of adjusting savings interest rates starting from the second quarter of 2024.

Statistics from the State Bank show that deposit interest rates increased by 0.71% last year, contributing to attracting significant cash flow from people into the banking system.

In terms of growth rate, some commercial banks recorded remarkable results such as Military Commercial Joint Stock Bank (MB) with a strong increase of 25.4% compared to 2023, reaching 714,066 billion VND; Vietnam Technological and Commercial Joint Stock Bank (Techcombank) increased by 17.3% with 536,746 billion VND; Saigon - Hanoi Commercial Joint Stock Bank (SHB) increased by 11.6% recording 496,106 billion VND...

However, in terms of capital mobilization scale, the "Big 4" group still leads the system even though deposit interest rates have little change, and some terms are even lower than the same period last year, in the context of the group of small and medium-sized commercial banks tending to continuously adjust savings interest rates to attract investment capital.

Accordingly, banks in the "Big 4" group including Vietnam Joint Stock Commercial Bank for Foreign Trade (Vietcombank), Vietnam Joint Stock Commercial Bank for Industry and Trade (VietinBank), Vietnam Joint Stock Commercial Bank for Investment and Development (BIDV) and Vietnam Bank for Agriculture and Rural Development (Agribank) recorded total capital mobilization in 2024 exceeding VND 7 million billion, accounting for 56% of the industry's market share.

Specifically, Agribank is the bank with the largest mobilized capital, reaching VND2 million billion for the first time, an increase of about 10% compared to 2023. BIDV recorded VND1,929 million billion, an increase of 14.5%; VietinBank reached more than VND1,603 million billion, an increase of 13.8%; while Vietcombank mobilized more than VND1,515 million billion, an increase of 8.1% compared to the previous year.

Apart from this group, no bank has reached the 1 quadrillion VND mark in capital mobilization.

The trend of increasing bank deposits is related to people's cautious psychology in the face of fluctuations in the global economy.

Rising inflation, geopolitical instability and a slowdown in many important export markets have driven money to safer investment channels. In addition, the State Bank’s flexible monetary policy and the stability of the financial system have also contributed to strengthening depositors’ confidence.

Economist Dinh Trong Thinh assessed: "In the context of the stock market fluctuating erratically, real estate facing liquidity difficulties and fluctuating prices, while gold and foreign currencies are unstable, increasing risks for investors, bank deposits are still an attractive option."

Source: https://baoquocte.vn/ngan-hang-van-la-mot-lua-chon-hap-dan-nen-gui-tien-o-dau-304409.html

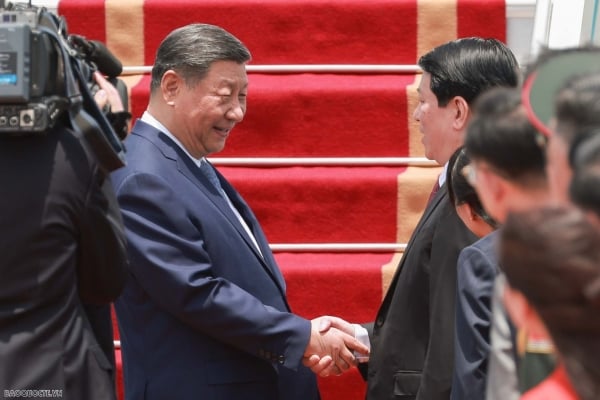

![[Photo] Reception to welcome General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9afa04a20e6441ca971f6f6b0c904ec2)

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

![[Photo] Prime Minister Pham Minh Chinh meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/893f1141468a49e29fb42607a670b174)

![[Photo] General Secretary To Lam holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/b3d07714dc6b4831833b48e0385d75c1)

Comment (0)