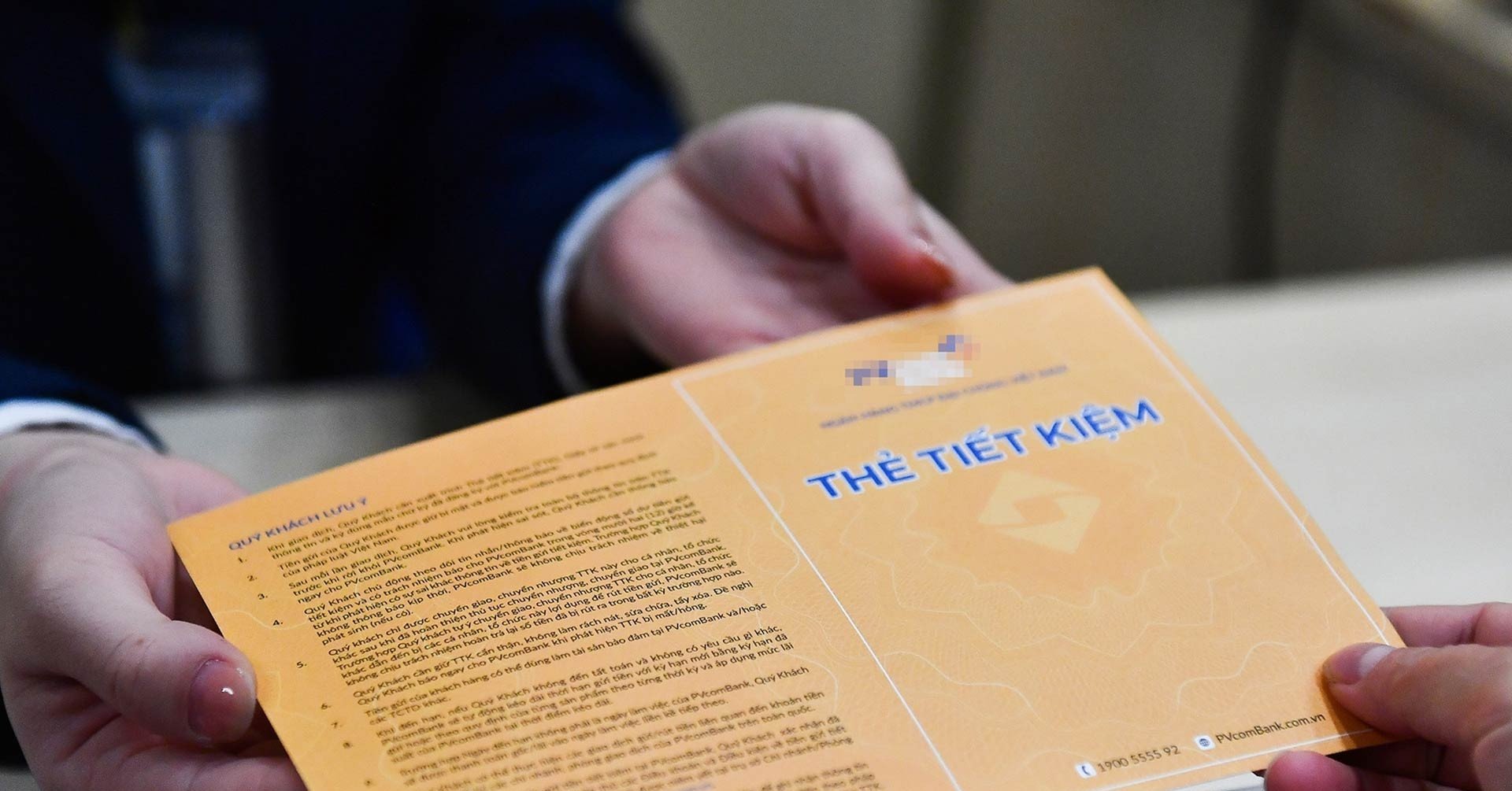

Regulations relating to savings accounts, especially those in which savings accounts may be frozen, directly affect the rights and ability of depositors to use their assets.

According to the law, the freezing of savings accounts is usually at the request of customers, or to prevent the dissipation of assets, to serve the investigation, trial, and settlement of cases related to the owner.

In addition, for customers who use savings accounts as collateral to obtain mortgage loans or open credit cards, the bank will also freeze the savings account until the customer has fulfilled the related obligations.

Each bank has its own regulations on savings deposits, including interest rates, deposit procedures, interest payments, early withdrawals, freezing of savings accounts, etc. However, all must be applied in accordance with the general provisions of the law.

Accordingly, banks are allowed to freeze part or all of customers' savings deposit balances in the following cases:

Upon written request or decision of competent authorities as prescribed by law;

Upon written request from the customer or all customers (for joint savings deposits);

When customers use the deposit in the savings book as collateral;

When there is a written, telephone or other form of contact accepted by the bank from the customer or the customer's legal representative notifying about the loss of the savings book;

When there is a written request from one of the customers for the joint savings deposit to freeze the joint savings deposit on the grounds that the joint savings depositors have a dispute over the joint savings deposit;

Or other cases as prescribed by law.

During the blockade, blocked savings deposits are strictly controlled by the bank and will only be released when the blockade ends.

If a savings deposit is partially blocked, the unblocked amount can still be used normally.

In addition, frozen savings deposits will continue to earn interest at the agreed interest rate and the accrued interest will be automatically frozen along with the frozen savings deposits, unless otherwise specified in the freezing request document.

The freezing of savings deposits ends when: The freezing period ends as agreed between the customer, all customers (for joint savings deposits) and the bank; the customer has fulfilled the obligations secured by the savings book; there is a decision or written request from a competent authority requesting the termination of the freezing; other cases as prescribed by law and the bank agrees to terminate the freezing.

In what cases is a bank account frozen?

Why haven't banks taken strong action to block or lock fraudulent accounts?

A Vietnamese oil and gas company has its accounts at 7 banks frozen due to tax debt.

After the Ba Ria-Vung Tau Provincial Tax Department sent a document requesting 7 banks to freeze accounts to enforce tax debt collection of less than VND850 million, PXT shares, a member company of PVC, immediately fell in price.

Source: https://vietnamnet.vn/truong-hop-nao-so-tiet-kiem-tai-ngan-hang-bi-phong-toa-2377278.html

![[Photo] National Assembly Chairman Tran Thanh Man meets with outstanding workers in the oil and gas industry](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/1d0de4026b75434ab34279624db7ee4a)

![[Photo] Closing of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/c0a0df9852c84e58be0a8b939189c85a)

![[Photo] General Secretary To Lam receives CEO of Warburg Pincus Investment Fund (USA)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/7cf9375299164ea1a7ee9dcb4b04166a)

![[Photo] The beauty of Ho Chi Minh City - a modern "super city" after 50 years of liberation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/81f27acd8889496990ec53efad1c5399)

![[Photo] Air Force practices raising flag in Ho Chi Minh City sky in preparation for April 30th holiday](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/de7139d9965b44f8ac1f69c4981196fd)

![[Photo] Nhan Dan Newspaper announces the project "Love Vietnam so much"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/362f882012d3432783fc92fab1b3e980)

Comment (0)