Hearing that the price of gold was going down, many customers rushed to sell their gold. A few days later, the price of gold reversed and went up again, causing many people to suffer losses of tens of millions of VND per tael.

World gold prices fluctuated sharply after the US presidential election results, Mr. Donald Trump won the election. Domestic gold prices also reversed continuously, surprising many people. Many customers suffered heavy losses due to buying and selling at the wrong time.

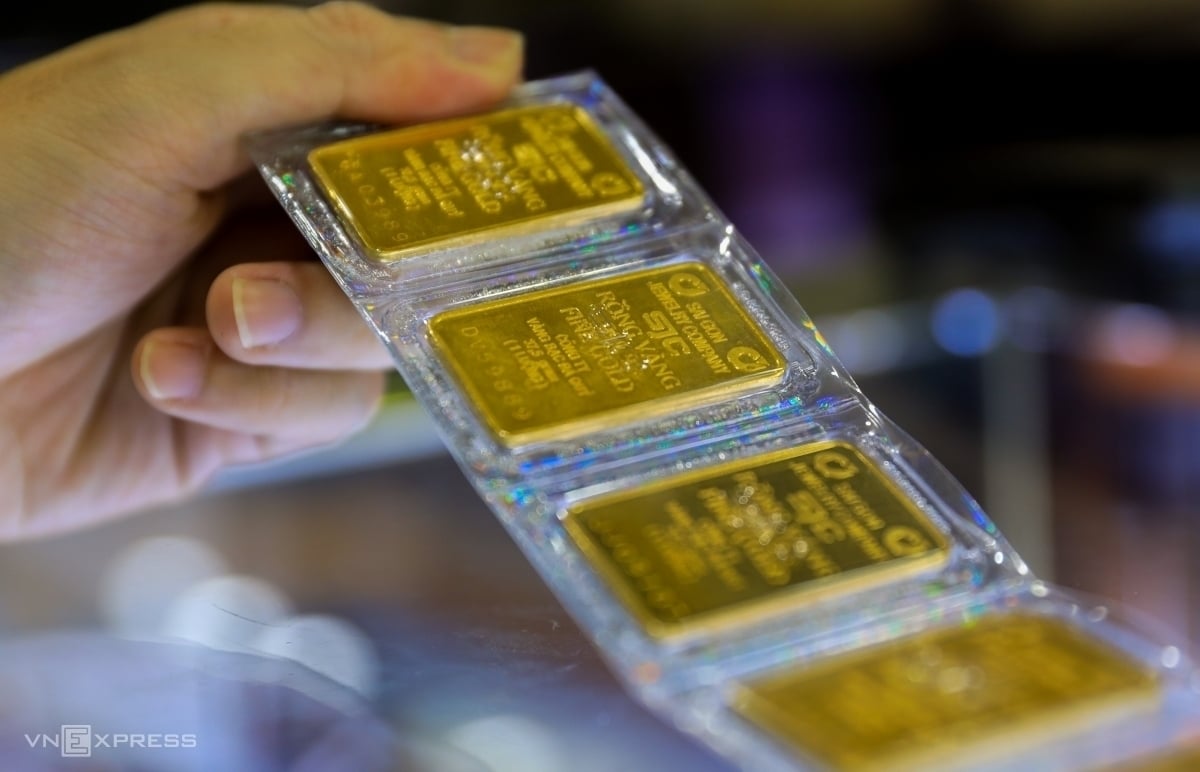

Ms. Tran Thu Thao (Cau Giay, Hanoi) said that on November 14, seeing the sharp drop in gold prices, she decided to sell 2 SJC gold bars. At the time she bought them, the price of gold was up to 89 million VND/tael. Fearing that the price of gold might drop further, she decided to "cut her losses" at 80 million VND/tael. She suffered a loss of 18 million VND in this gold trading deal.

These past few days, seeing the domestic gold price rise, she felt heartbroken. If she sold now, Ms. Thao would only lose more than 10.5 million VND. “It’s true that the market cannot be predicted. Amateur gold traders only lose money,” she said.

Also regretting the increase and decrease in gold prices is the case of Mr. Nguyen Van Giang (Thanh Xuan, Hanoi). 4 years ago, Mr. Giang borrowed 5 taels of gold to buy a house. The price of gold increased and it was difficult to buy, so he could not save enough to pay his relatives. He constantly listened to the market to buy gold.

Seeing the price of gold drop, Mr. Giang was happy because he could buy it at a good price and without any quantity restrictions. On November 14, he went to the gold shop to check the situation. Seeing that the gold shop was open for sale and many people were able to buy, Mr. Giang was worried that the price of gold might drop further, so he decided not to buy it and wait for it to drop further.

Mr. Giang's expectations were not as expected. The domestic gold price continued to increase in the following days. Gold shops limited the quantity sold. People who needed a large quantity like Mr. Giang could hardly buy. "If I had known, I would have bought gold the other day, and I would have bought as many trees as I could. In this situation, it is difficult to know when the price is good to buy," Mr. Giang shared.

Gold prices fluctuate strongly

On November 12, the price of SJC and Doji gold bars was listed at 80.6-84.1 million VND/tael (buy - sell). SJC lowered the price of gold rings of type 1-5 to only 79.9-82.4 million VND/tael (buy - sell). Doji listed the price of 9999 gold rings at 80.9-83.2 million VND/tael (buy - sell).

On November 14, the price of gold bars continued to decrease to 80-83.5 million VND/tael (buy - sell). Doji lowered the buying - selling price of 9999 gold rings to 79.8-82.1 million VND/tael. SJC listed the price of gold rings of type 1-5 at only 79-81.7 million VND/tael (buy - sell).

In the following sessions, domestic gold prices unexpectedly increased. On November 16, SJC listed the price of gold rings of type 1-5 at only 79.8-82.3 million VND/tael (buy - sell). At Doji, the buying - selling price of gold rings of type 1-5 was only 81-82.7 million VND/tael.

On November 19, SJC raised the price of 1-5 tael gold rings to 82-84.2 million VND/tael (buy - sell). Doji listed the buying - selling price of 9999 gold rings at 83.7-84.7 million VND/tael.

On November 21, the price of 9999 gold of SJC and Doji increased simultaneously to 86.2 million VND/tael (sell) and 83.7 million VND/tael (buy). Doji adjusted the price of 9999 gold rings to 84.8-85.8 million VND/tael (buy - sell). Meanwhile, SJC listed the price of gold rings of type 1-5 at only 83.6-85.6 million VND/tael (buy - sell).

Thus, compared to the lowest gold price on November 14, SJC gold bars increased by VND2.7 million/tael (sell) and VND3.7 million/tael (buy). The price of plain round gold rings at Doji increased by VND5 million/tael (buy) and VND3.7 million/tael (sell). The price of 9999 gold rings of type 1-5 at SJC increased by VND4.6 million/tael (buy) and VND3.9 million/tael (sell).

Speaking to VietNamNet , Dr. Nguyen Tri Hieu said that the gold market is strongly affected by geopolitical fluctuations in the world. If tensions continue, gold prices will increase again. The pressure on gold prices may only last for a short time.

Gold experts recommend that if people do not really need money, they should not rush to sell gold, especially at a loss, because the probability of gold prices recovering is very high.

According to experts, in the medium and long term, gold prices are still expected to increase. Gold often benefits from the Fed's loose monetary policy and Mr. Trump's stronger fiscal policy. Goldman Sachs forecasts the world gold price to reach $3,000/ounce in 2025.

Source: https://vietnamnet.vn/gia-vang-vua-ha-voi-ban-thao-nhieu-nguoi-tiec-dut-ruot-khi-vang-tang-vot-2344400.html

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)