Gold prices today, February 4, 2025, on the international market increased slightly due to profit-taking activities from some investors. Gold rings increased by a record 1.5 million VND per tael, to 89.5 million VND at the close of yesterday's session, while SJC gold bars approached 90 million VND/tael.

The price of gold on the Kitco floor at 8:00 p.m. (February 3, Vietnam time) was trading at $2,809.3/ounce, up 0.38% from the beginning of the session. The price of gold futures for April 2025 delivery on the Comex New York floor was trading at $2,848.5/ounce.

At the beginning of the trading session on February 3 (US time), the world gold price increased slightly amid profit-taking pressure from a few investors. Experts said that in the short term, gold prices will continue to increase. Many forecasts show that gold prices will continue to set new records.

This is also the scenario put forward by experts, that before continuing a new bullish cycle, gold prices will decrease due to profit-taking activities.

According to Colin Cieszynski, market strategist at SIA Wealth Management, gold will not stop at a new record of $2,829.8 per ounce. He analyzed that gold is in a new bullish cycle due to the impact of President Trump's tax policies.

Gold has been particularly strong in recent weeks due to concerns about U.S. tariffs, said Colin Cieszynski. While the tariffs may not be as severe as feared, these concerns will not go away and will continue to weigh on gold in the near term.

Rich Checkan, President and CEO of Asset Strategies International, said that gold is likely to face profit-taking pressure in the short term.

However, Checkan noted, news of a gold shortage in London, tariffs from US President Donald Trump and persistent inflation will all push gold prices higher.

In the domestic market, at the end of the session on February 3, the price of 9999 gold bars at SJC and Doji was 87.8 million VND/tael (buy) and 89.8 million VND/tael (sell).

SJC announced the price of gold rings of type 1-5 at only 87.5-89.2 million VND/tael (buy - sell). Doji listed the price of 9999 smooth round gold rings at 88.1-89.5 million VND/tael (buy - sell).

Gold Price Forecast

Gold is on a strong uptrend and is heading towards its ultimate target of $3,000 an ounce, which seems to be very close, said Daniel Pavilonis, senior commodities broker at RJO Futures.

Experts say that Mr. Trump has officially imposed a 25% tariff on imported goods from Canada and Mexico as well as 10% on China. This poses economic and geopolitical risks, so investors' need to hedge against risks is even greater. Accordingly, gold plays its role as a safe haven even better.

Some other experts predict that gold will flow more and more into New York vaults as central banks and investors are hoarding gold to hedge against the risk of a trade war launched by President Donald Trump.

Source: https://vietnamnet.vn/gia-vang-hom-nay-4-2-2025-the-gioi-chot-loi-sjc-va-nhan-tang-khong-ngung-2368160.html

![[Photo] Nearly 2,000 people enthusiastically participated in the Olympic Running Day - For the security of the Fatherland](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/33bed26f570a477daf286b68b14474d4)

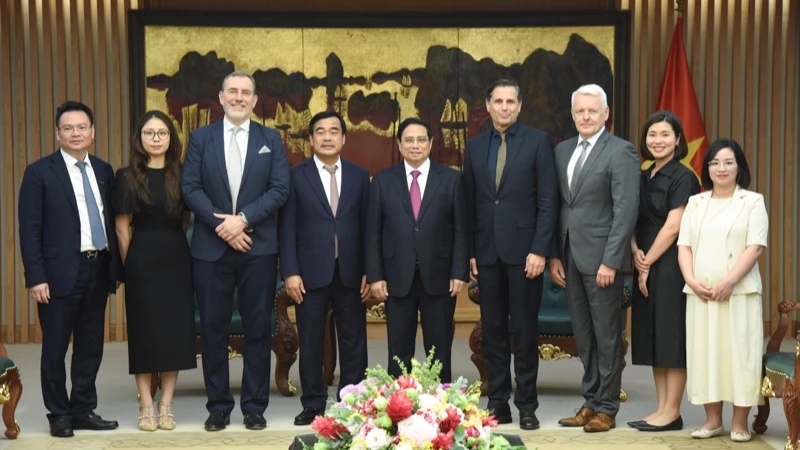

![[Photo] Prime Minister Pham Minh Chinh receives Chairman of Skoda Auto Group](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/298bbec539e346d99329a8c63edd31e5)

Comment (0)