Benchmark three-month copper on the LME rose 0.2% to $9,923 a tonne. Copper hit a five-month intraday high of $9,937 on Wednesday.

Earlier, US President Donald Trump ordered an investigation into the possibility of imposing new tariffs on copper, causing the gap between copper prices on Comex and LME contracts to widen, reaching a record $1,192/ton on Tuesday.

“Potential US tariffs on copper are something we are watching closely, and the spread between Comex and LME copper continues to widen, as the market speculates on the possibility of a 25% tariff on copper by Trump,” said a trader.

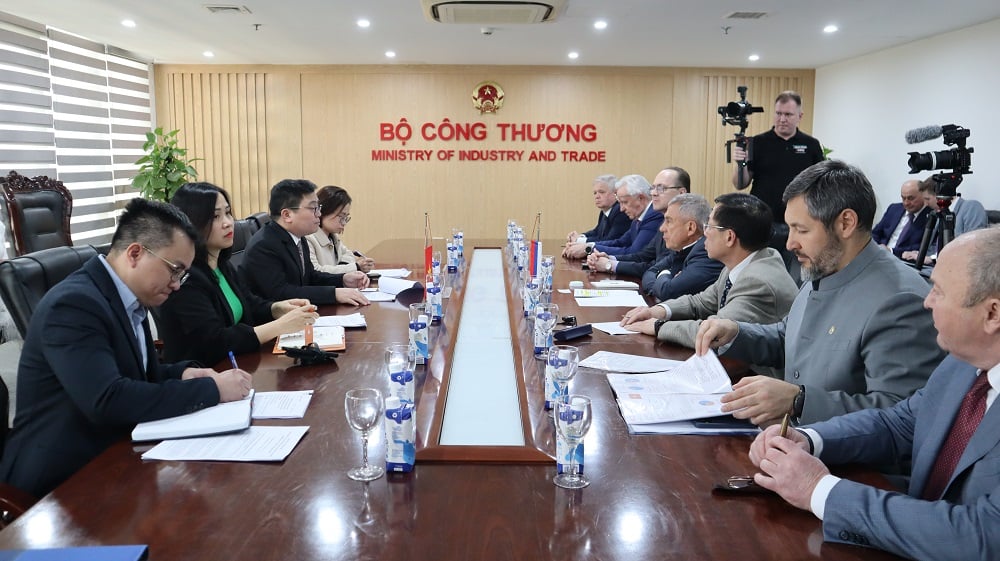

Meanwhile, the CEO of Russian metals and mining group Nornickel, Vladimir Potanin, said on Tuesday that he expected updates on a copper joint venture project in China in the coming months.

Nornickel is in talks for a joint venture in China, with potential investments in initial financing plans for 2025-2026.

LME aluminium rose 0.1% to $2,657 a tonne, lead was unchanged at $2,095, zinc fell 0.2% to $2,958.5 and tin was unchanged at $35,420. Nickel rose 1.1% to $16,425.

On the Shanghai Futures Exchange (SHFE), copper rose 0.7% to 80,890 yuan a tonne, SHFE aluminium fell 0.6% to 20,705 yuan a tonne, zinc fell 0.2% to 23,895 yuan, lead rose 0.6% to 17,690 yuan and nickel rose 0.7% to 131,660 yuan. Tin rose 0.4% to 281,780 yuan.

Source: https://kinhtedothi.vn/gia-kim-loai-dong-ngay-21-3-tang-tro-lai.html

![[Photo] Prime Minister Pham Minh Chinh attends the 2024 Outstanding Young Vietnamese Faces Award Ceremony](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/24/910d105845ce406ba15ed33625975a78)

![[Photo] Renovating the "green gem" in the heart of the capital](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/24/e5a1627db4504cd88b6b81163df1b18b)

Comment (0)