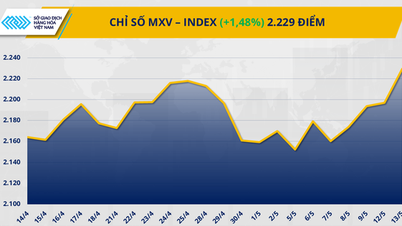

| Robusta coffee prices increased for three consecutive sessions amid a slight decline in the US dollar and a surge in gold. The US dollar weakened, and coffee export prices recovered. |

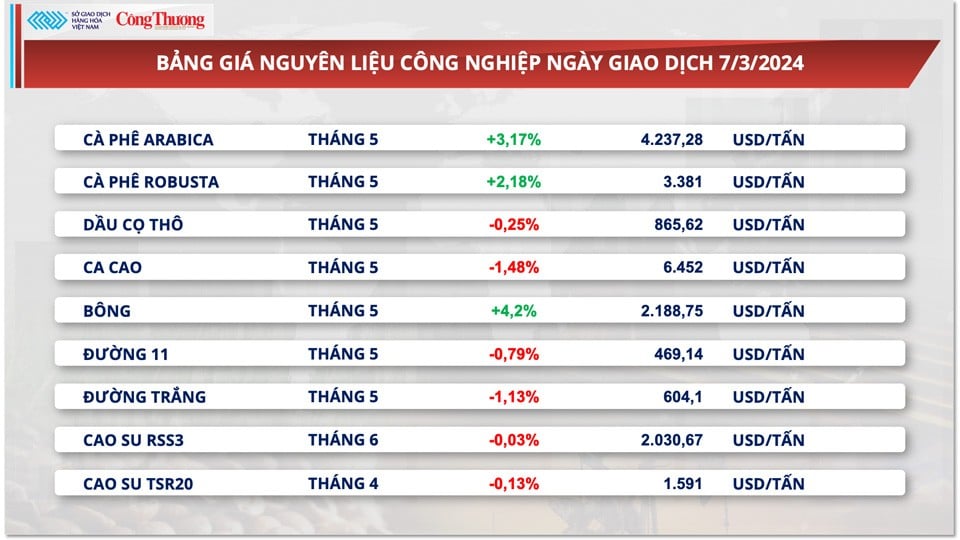

At the close of trading on March 7, Arabica prices jumped 3.17% to a one-month high, while Robusta prices rose 2.18% to a new 30-year peak. The risk of supply shortages is the main factor keeping Robusta prices high.

Persistent heat in Vietnam’s coffee growing regions has raised concerns about a poor supply outlook for the new crop. In addition, Robusta inventories on the ICE-EU exchange are at historic lows, at 23,750 tonnes at the close of trading on March 6.

|

| Arabica prices jumped 3.17% to a one-month high and Robusta prices rose another 2.18% to a new 30-year peak. |

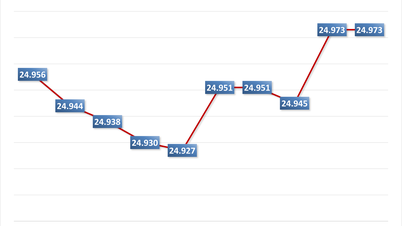

On March 8, today's coffee prices in the Central Highlands provinces were recorded at 90,400 VND/kg (Lam Dong) to 91,800 VND/kg (Dak Nong), an increase of 1,400 - 1,700 VND/kg compared to the previous day.

The price of coffee on the London exchange for May delivery was also at $3,381/ton, up $72/ton compared to March 7.

Coffee prices have been increasing continuously since the beginning of the year, up about 50%, and compared to the same period last year, coffee prices have doubled.

A coffee production and trading enterprise in Gia Lai predicts that coffee prices will continue to increase, at least in the next 2 months when the world has more coffee supplies from other producing countries such as Indonesia and Brazil. The next price peaks could be 100,000 VND/kg, or even 120,000 VND/kg due to coffee scarcity.

For Arabica, the recovery in inventories on the ICE-US Exchange was still not strong enough to withstand the pressure from the USD. Specifically, the 0.54% decrease in the Dollar Index attracted money flows into markets such as coffee and made buying power overwhelming. At the same time, the weakening USD pulled the USD/BRL exchange rate down 0.2%. The narrowing exchange rate gap limited the demand for coffee sales from Brazilian farmers.

|

Coffee prices continue to set records, farmers win big |

Robusta coffee prices have skyrocketed largely due to concerns about a decline in domestic and Asian supplies. Currently, coffee in the Vietnamese market is very difficult to buy, forcing traders and businesses to push prices very high.

In Asia, Indonesia reported a 79.73% year-on-year decrease in January 2024 exports, bringing exports for the first 10 months of the current coffee crop year (April 2023 to March 2024) to a total of 1,935,960 bags, down 2,687,457 bags, or 60.72%, from the same period last year.

ICE-Europe data shows that Robusta coffee inventories certified and monitored by the London exchange fell by another 1,180 tons, or 4.81%, compared to a week earlier, to 23,350 tons (about 389,167 bags, 60 kg bags), continuing to stand at a low level since 2014.

Early this morning in the US market, the US Dollar Index (DXY) measuring the greenback's fluctuations against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF) decreased by 0.55% to 102.82.

The US dollar fell as US Federal Reserve Chairman Jerome Powell said the US central bank is confident that inflation is moving towards its 2% target, and may start cutting interest rates.

Meanwhile, the General Statistics Office of Vietnam estimates that coffee exports in February 2024 will only reach 160 thousand tons, down nearly 20% year-on-year, due to the long Lunar New Year holiday.

The Vietnam Coffee and Cocoa Association (Vicofa) estimates that the current crop year 2023/2024 output will decrease by another 10% compared to the previous crop. According to records, coffee in the domestic market of Vietnam is currently very difficult to buy, and traders have to push prices very high, adding 220 - 280 USD/ton compared to the futures price to buy goods.

According to the Vietnam Commodity Exchange, Robusta prices are likely to remain at a 30-year peak, at least until the end of the first quarter of this year. In the domestic market, green coffee prices may set new peaks amid increasingly serious supply risks. The prolonged drought in the Central Highlands, the country's main coffee growing region, is leading to concerns about a less positive coffee supply outlook for the new crop 24/25.

In addition, the current supply problem has not been resolved with the prolonged Red Sea tension and low inventories in consuming markets. As of March 4, Robusta volume on the ICE-EU continued to decrease by 120 tons, down to 23,470 tons, precariously at the historical low.

Source

Comment (0)