Foreign exchange rate, USD/VND exchange rate today, March 24, recorded USD standing at 104.15, while EUR turned down, unable to surpass the 1.0950 mark.

Foreign exchange rate update table - USD exchange rate Agribank today

| 1. Agribank - Updated: March 24, 2025 08:00 - Time of website supply source | ||||

| Foreign currency | Buy | Sell | ||

| Name | Code | Cash | Transfer | |

| USD | USD | 25,390 | 25,410 | 25,750 |

| EUR | EUR | 27,151 | 27,260 | 28,371 |

| GBP | GBP | 32,460 | 32,590 | 33,551 |

| HKD | HKD | 3,225 | 3,238 | 3,345 |

| CHF | CHF | 28,392 | 28,506 | 29,402 |

| JPY | JPY | 167.31 | 167.98 | 175.20 |

| AUD | AUD | 15,766 | 15,829 | 16,350 |

| SGD | SGD | 18,816 | 18,892 | 19,434 |

| THB | THB | 735 | 738 | 771 |

| CAD | CAD | 17,521 | 17,591 | 18,103 |

| NZD | NZD | 14,472 | 14,975 | |

| KRW | KRW | 16.73 | 18.45 | |

Exchange rate developments in the domestic market

In the domestic market, according to TG&VN at 8:00 a.m. on March 24, the State Bank announced the central exchange rate of the Vietnamese Dong to the USD increased by 17 VND, currently at 24,807 VND.

The reference USD exchange rate at the State Bank of Vietnam is listed at: 23,617 VND - 25,997 VND.

USD exchange rates at commercial banks are as follows:

Vietcombank: 25,350 - 25,740 VND.

Vietinbank: 25,225 - 25,805 VND.

|

| Foreign exchange rates, USD/VND exchange rate today, March 24: Fed fails to pull USD up, market 'turns on' anxiety mode. (Source: Getty Images) |

Exchange rate developments in the world market

The US Dollar Index (DXY) measures the greenback's movements against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF) at 104.15.

The results of the US Federal Reserve (Fed) meeting failed to boost the greenback.

Basically, it was not a newsworthy event because the Fed kept interest rates unchanged at 4.25-4.5% as expected.

The US dollar has been under pressure since the beginning of this year due to concerns about the impact of President Donald Trump's tariff policies on US economic growth.

The greenback rallied this week after the Fed said it would be in no rush to cut interest rates. Fed policymakers signaled two 25 basis point rate cuts by the end of the year, the same median forecast as three months ago.

The DXY index remained stable and closed the week slightly higher than the previous week. The index is finding support around 103.20. It is likely to correct to the 105-105.50 zone in the coming time.

However, after this increase, the DXY index may turn down again and continue the downtrend. That decline could drag the DXY index down to the 102-101 zone and even 100 in the medium term.

Meanwhile, the EUR/USD pair has turned down, failing to break above 1.0950. The support level for this pair is currently at 1.08. If the EUR falls below this level, it could see the EUR drop to the 1.0730-1.0700 range.

The market expects the EUR to reverse higher from 1.08 or around 1.07. Such a recovery would keep the overall bullish view intact.

Currency markets have been volatile in recent months as traders reassess their initial expectations that President Trump's economic policies would support the dollar and weaken other currencies.

This has caused the USD to fall 6% against the EUR since mid-January.

Source: https://baoquocte.vn/ty-gia-ngoai-te-ty-gia-usdvnd-hom-nay-243-fed-khong-keo-duoc-usd-di-len-thi-truong-bat-che-do-lo-lang-308610.html

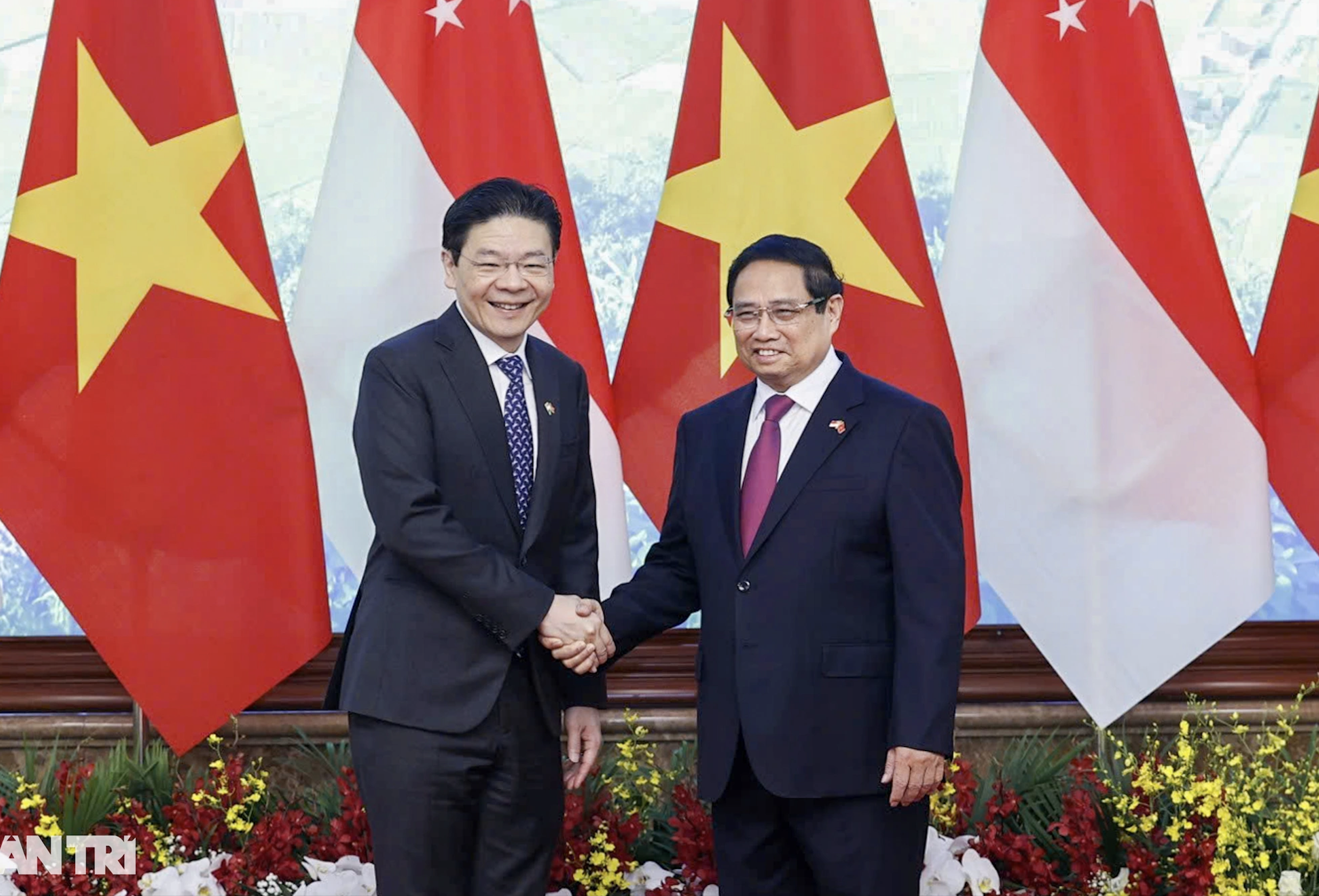

![[Photo] Prime Minister Pham Minh Chinh holds talks with Singaporean Prime Minister Lawrence Wong](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/04f6369d4deb43cfa955bf4315d55658)

![[Photo] Head of the Central Propaganda and Mass Mobilization Commission Nguyen Trong Nghia works with key political press agencies](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/3020480dccf043828964e896c43fbc72)

![[Photo] Welcoming ceremony for Prime Minister of the Republic of Singapore Lawrence Wong on an official visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/445d2e45d70047e6a32add912a5fde62)

![[Photo] Close-up of old apartment building waiting to be renovated](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/bb2001a1b6fe478a8085a5fa20ef4761)

Comment (0)