(Quang Ngai Newspaper) - In recent years, the Farmers' Association (FA) of Tu Nghia district and grassroots organizations have closely coordinated with the Vietnam Bank for Social Policies (VBSP) to effectively carry out the task of lending. Thanks to that, hundreds of poor households, near-poor households and other policy beneficiaries have been able to borrow capital to do business, expand production scale, develop the economy and stabilize their lives.

Mr. Le Thanh Don, in Phu Son village, Nghia Ky commune (Tu Nghia), has just borrowed 90 million VND from the capital source of the Social Policy Bank. He said, “With this money, I will buy 3 more breeding cows and plant 3 more hectares of forest. With this new investment direction, I hope my family will have more income in the next few years.”

Mr. Don's household is eligible for policy capital support to create jobs, maintain and expand production scale. Previously, Mr. Don's family raised cows and planted forests, bringing in a good income for the family. Before the Lunar New Year of At Ty, through the People's Committee of Tu Nghia district, Mr. Don learned that the Transaction Office of the district's Social Policy Bank was implementing a loan program to support job creation, maintain and expand employment with preferential interest rates. He was consulted and introduced to access policy loans by the head of the savings and loan group (TK&VV) of the residential area. “Thanks to the dedicated guidance of the Savings and Credit Group, my family was able to borrow a large amount of money for a period of 5 years to buy more breeding cows and expand the forest area. Thanks to that, my family's forest area has increased to 7 hectares and the herd of cows has also increased to 11. With this investment, in about 2-3 years, my family will fully repay the loan and at the same time create seasonal jobs for local workers,” said Mr. Don.

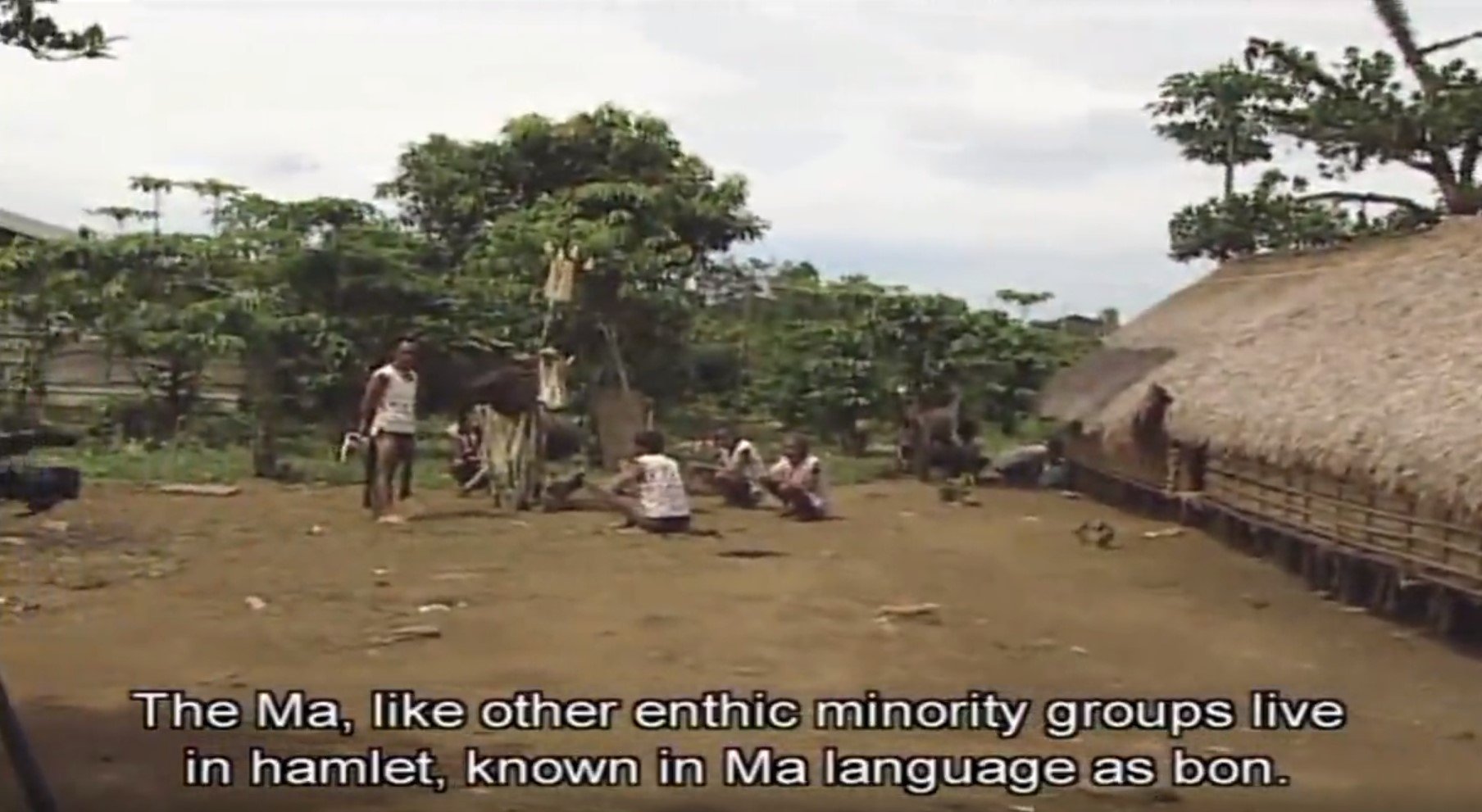

|

| Thanks to social policy loans, Mr. Nguyen Van Tot's household in An Tan village, Nghia Thang commune (Tu Nghia) invested in raising cows, bringing economic efficiency. |

According to Le Thi Phuong Lan, Head of the Credit and Credit Group 2 of La Ha town, there are many households in the locality who know how to calculate and do business, but lack investment capital. After understanding the regulations on policy loans, I guided people through the loan procedures to invest in production and livestock farming. Up to now, the group has 52 members who have borrowed, with a total outstanding debt of more than 4.5 billion VND. Many households have used the policy capital effectively, improving their lives.

Chairman of the Farmers' Association of Tu Nghia district, Le Anh Duc, said that the district currently has 14 associations, 79 branches, and 65 savings and credit groups. Every year, the Farmers' Association of the district has closely coordinated with the Transaction Office of the District Bank for Social Policies to implement the Government's preferential credit programs to all associations and savings and credit groups. Since then, the Farmers' Association of the district has received loans with increasing sales. By the end of 2024, the district had more than 3,000 households borrowing policy loans with outstanding loans, raising the total outstanding loans of the Farmers' Association of the district to more than 154 billion VND, an increase of more than 10 billion VND compared to 2023, a growth rate of 7%. With good credit quality, the mobilization of savings through savings and credit groups was more than 10 billion VND. The quality of the activities of the Savings and Credit Teams is classified as good at 100% and 100% of the commune and town Farmers' Associations have good quality of entrusted activities.

Director of the Transaction Office of the Social Policy Bank of Tu Nghia District, Tran Thi Hong Oanh, said that in 2025, the unit received more than 48 billion VND in local investment capital (nearly 35 billion VND from the provincial budget; more than 13.5 billion VND from the district budget). In order for the capital to continue to be effective, the unit will continue to coordinate with local authorities, associations, and unions at all levels to inform, propagate, and disseminate the credit policy programs being implemented to the people; strengthen inspection and supervision of loans to ensure that the capital is used for the right purpose.

Article and photos: TRUONG AN

RELATED NEWS:

Source: https://baoquangngai.vn/kinh-te/202503/dua-nguon-von-chinh-sach-den-voi-nong-dan-2e559fa/

![[Photo] Overview of the Workshop "Removing policy shortcomings to promote the role of the private economy in the Vietnamese economy"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/d1c58c1df227467b8b33d9230d4a7342)

![[Photo] Prime Minister Pham Minh Chinh receives the head of the Republic of Tatarstan, Russian Federation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/7877cb55fc794acdb7925c4cf893c5a1)

![[Photo] Prime Minister Pham Minh Chinh receives French Minister in charge of Transport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/aa649691f85546d59c3624b1821ab6e2)

Comment (0)