Digital transformation is creating strong changes in the banking sector, becoming the "key" to help financial institutions modernize operations, expand services and enhance customer experience. In Thai Nguyen province, banks are promoting digital transformation with many technological solutions to modernize the system, promote cashless payments...

|

| Vietcombank Thai Nguyen Branch staff update biometric information for customers to increase security during digital transformation. |

There are currently 35 credit institutions and credit institution branches operating in the province. In recent times, credit institutions have actively invested in technology infrastructure, strongly developing digital banking applications, such as: Mobile Banking, Internet Banking, eKYC (electronic customer identification)... These services help people and businesses easily access, open accounts, and make transactions anytime, anywhere.

Military Commercial Joint Stock Bank (MB) is one of the leading units in promoting digitalization, aiming to build a "smart bank" and promote a cashless society.

Ms. Tran Thi Hoai, Director of MB Services Thai Nguyen Branch, said: MB has deployed 3 digital platforms, including: MBBank App for individual customers, BIZ MBBank for businesses and Banking-as-a-Service (BAAS) - providing MB services on partner platforms. In particular, MBBank App maintains its top 1 position in financial applications on the App Store and is among the most downloaded applications for the past 3 consecutive years. MBBank currently allows more than 90% of transactions to be performed directly on smartphones (from money transfers, bill payments to online loans), helping MB strongly expand its digital customer base and reduce the workload at the counter...

Similarly, Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank) also promotes the development of digital platforms suitable for each customer segment.

Mr. Pham Quang Dat, Deputy Director of Vietcombank Thai Nguyen Branch, informed: We have VCB Digibank for individual customers, VCB Digibiz for business households and SMEs, VCB Cash-up for large enterprises. These platforms help transactions be convenient, safe and support businesses in managing cash flow effectively. Vietcombank also cooperates with many units to implement cashless payments via QR Pay, 24/7 money transfer, and connect e-wallets, helping small and medium-sized enterprises easily access capital and financial services.

For banks such as VietinBank, Agribank, Techcombank, etc., digital transformation is also promoted with the deployment of digital banking applications, e-banking services and the expansion of the cashless payment ecosystem. These banks focus on digitizing internal processes, expanding financial services on digital platforms, integrating bill payments, money transfers, savings and online loans, bringing increasing convenience to people and businesses.

Mr. Nguyen Van Cuong, Director of Cuong Dai Company Limited (Pho Yen City), shared: Thanks to digital banking services, I can make financial transactions anytime, anywhere without having to go to the counter. This helps my business save time and increase the efficiency of cash flow management.

Ms. Tran Thi Lan, in Quang Vinh ward (Thai Nguyen city), said: Before, I was only used to cash transactions, now using banking apps is more convenient and safer.

Not only bringing benefits to people and businesses, digital transformation also helps banks optimize operations, reduce operating costs, increase management efficiency and expand market share.

Data collected from digital platforms helps banks analyze customer behavior, thereby personalizing products and services and improving service quality.

|

| MBbank Thai Nguyen Branch staff guides customers to use financial services on digital platforms. |

According to the assessment from the State Bank of Region 5, digital transformation has brought about clear results for state management. Specifically, the supervision and management of the activities of credit institutions in the area are increasingly stricter, more accurate and timely thanks to the digital data system.

State Bank Region 5 is also a pioneer in applying information technology in the management, operation and supervision of the monetary and credit markets in the area.

Although digital transformation is an inevitable trend, according to experts, this process still faces many difficulties and challenges. Representatives of some commercial banks frankly admitted: Unsynchronized technology infrastructure, high investment costs, especially the lack of technology human resources are major barriers.

Furthermore, changing people's habits, especially in remote areas, is also very difficult. In reality, many elderly customers or those in rural areas are still hesitant about online transactions because of concerns about information leakage. This requires banks to increase communication, guide people to access technology, and invest heavily in information security...

Banks have determined that digital transformation does not stop at online transactions but also requires the application of artificial intelligence (AI), big data, and blockchain in risk management and service personalization. This is the direction that helps banks improve their competitiveness and accompany the development of the local digital economy.

At the conference on promoting bank credit to contribute to economic growth recently held by the State Bank of Region 5, Director Le Quang Huy affirmed: We will continue to accompany commercial banks to promote digitalization, ensure system safety, gradually build a modern digital financial ecosystem, and better serve people and businesses.

Source: https://baothainguyen.vn/kinh-te/202503/chuyen-doi-so-nganh-ngan-hangnguoi-dan-va-doanh-nghiep-huong-loi-5b60d13/

![[Photo] Overview of the Workshop "Removing policy shortcomings to promote the role of the private economy in the Vietnamese economy"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/d1c58c1df227467b8b33d9230d4a7342)

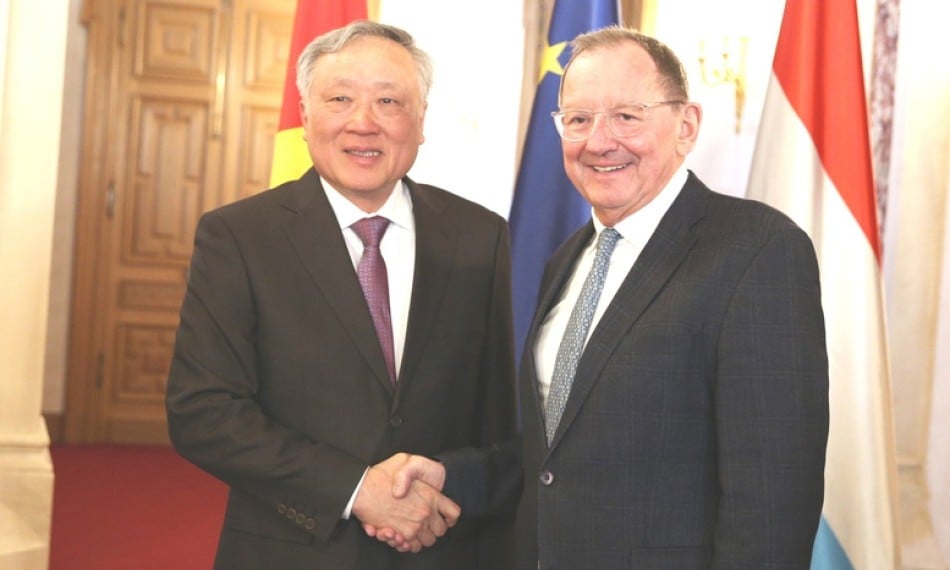

![[Photo] Prime Minister Pham Minh Chinh receives the head of the Republic of Tatarstan, Russian Federation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/7877cb55fc794acdb7925c4cf893c5a1)

Comment (0)