“King of luxury goods” Jonathan Hanh Nguyen and his business own many famous fast food brands covering airports, selling food at “luxury” prices.

When mentioning Jonathan Hanh Nguyen, most people only know that this businessman is famous in the field of luxury goods business in Vietnam. But few people know that this businessman also owns a multi-field business ecosystem called Imex Pan Pacific Group (IPPG).

IPPG is a corporation operating in many countries, with the core being the Inter-Pacific Import-Export Company Limited (IPP). This company has a charter capital of 3,000 billion VND, headquartered at Opera View Building 161 Dong Khoi, District 1, Ho Chi Minh City, with the main business line being retail of garments, footwear, and leather goods. In which, Mr. Johnathan Hanh Nguyen and his wife, Ms. Le Hong Thuy Tien, own 60% of the charter capital. The remaining capital is divided equally between Mr. Nguyen Phi Long and Mr. Nguyen Quoc Khanh, each holding 20%.

Mr. Johnathan Hanh Nguyen, Mrs. Le Hong Thuy Tien

According to the introduction, IPPG has developed an “ecosystem” of up to 17 member companies and 18 joint ventures. The group has accounted for nearly 70% of the domestic distribution market for international luxury goods, bringing to Vietnam more than 100 high-end and mid-range fashion brands, owning more than 1,200 stores.

Besides trading in luxury goods, another important link in the aviation service value chain of Johnathan Hanh Nguyen's "home" ecosystem is Autogrill VFS F&B Company Limited.

Accordingly, Autogrill VFS F&B was established in 2013 as a joint venture between Autogrill and Vietnam Food and Beverage Services Company. The current legal representative of this company is Mr. Truong Thanh Tung with the title of General Director. The charter capital of the enterprise is at 104 billion VND, of which 70% is foreign capital, 30% is private capital. In its member structure, Autogrill VFS F&B also has "relative" enterprises, which are all companies related to the ecosystem of Johnathan Hanh Nguyen.

Autogrill VFS F&B’s international brands include the world’s second largest fast food chain – Burger King, the 45-year-old fried chicken brand – Popeyes Louisiana Kitchen, the Costa Coffee chain, and one of Asia’s most prominent restaurant chains – Crystal Jade Kitchen. Autogrill VFS F&B also covers airports with brands such as: Big Bowl Pho, Sandwiches, Saigon Cafe.Bar.Kitchen, and Hanoi Cafe.Bar.Kitchen, selling products at “branded” prices.

Once earning trillions of dollars each year from airport service business, how is the business that owns the "branded" Big Bowl pho restaurant doing business now?

Big Bowl Pho Restaurant has always been quite quiet and respectful, few people know about it, but it is one of the exclusive brands sold at the airport, belonging to the chain of service stores of Autogrill VFS F&B. Due to its advantage, the stores of this business are always located in prime locations and sell products at prices considered "branded" when compared to regular bowls of pho.

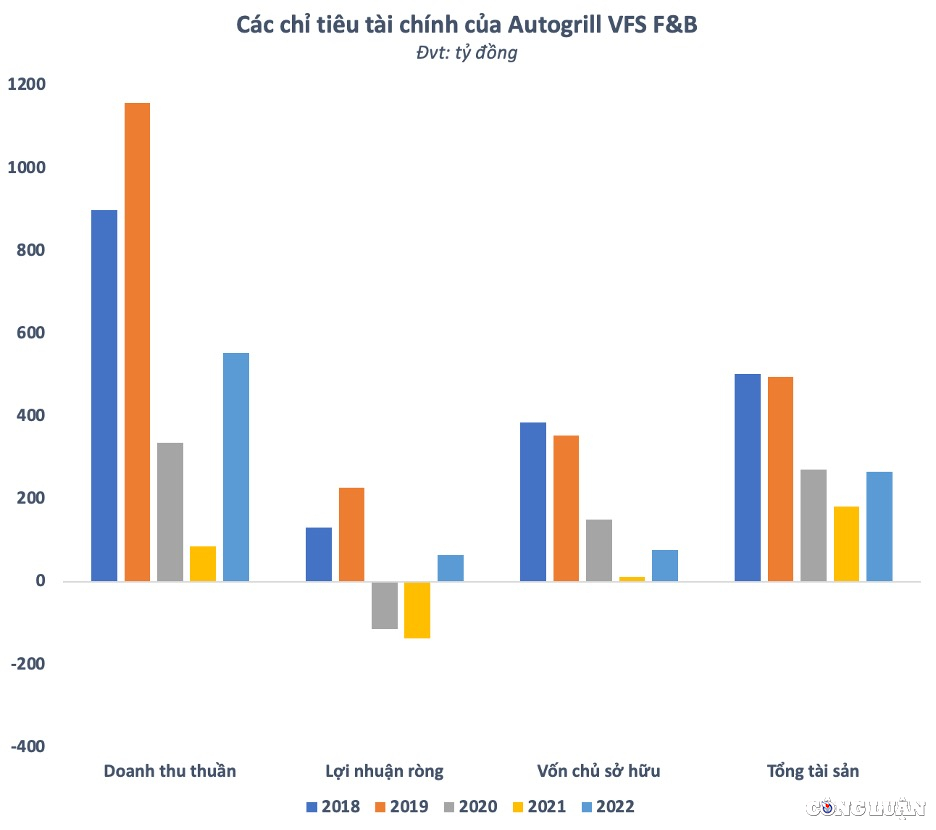

Therefore, according to the investigation of the Journalist & Public Opinion newspaper, with such a "unique" position, it is not surprising that the business results of Autogrill VFS F&B recorded that from 2015 to 2019, the company's revenue doubled from 500 billion VND to 1,158 billion VND. Profit also increased from 76 billion VND to 286 billion VND.

Thus, on average, these restaurants bring in nearly 800 million VND in profit each day. Big Bowl's profit margin at this point has reached 25%, much higher than other businesses in the same industry.

However, in 2020 and 2021, due to the impact of the COVID-19 pandemic, a large number of domestic and international flights were delayed or canceled, causing Autogrill VFS F&B's revenue to decline rapidly. In 2021, Autogrill VFS F&B's revenue reached only 85 billion VND, which is less than 1/10 of the pre-pandemic period. Revenue was not enough to cover expenses, and the company suffered a net loss for 2 consecutive years, respectively 114 billion in 2020 and 137 billion in 2021. This result caused the company's equity to drop sharply to only 12 billion VND by the end of 2021.

By 2022, when the epidemic is under control, economic activities will gradually return to normal. The aviation industry in general will also begin to recover and Autogrill VFS F&B's business results will also improve. In 2022, the company's revenue will skyrocket to over VND 550 billion, with after-tax profit of VND 65 billion, better than the losses of more than a hundred billion in the 2020-21 period but less than 1/3 of the results achieved in 2019. Equity has also increased again, reaching VND 77 billion at the end of 2022 but is still much lower than the previous period. Autogrill VFS F&B's asset size has also shrunk significantly compared to before the epidemic, to VND 266 billion as of December 31, 2022, which is only half of the peak period of 2018-2019.

Branded goods business unexpectedly reported losses?

While the ecosystem in the aviation service industry has gradually "taken off" again, moving from loss to profit, on the contrary, the branded goods sales activities of "them" Johnathan Hanh Nguyen have moved from profit to loss.

Accordingly, Duy Anh Fashion and Cosmetics Joint Stock Company (DAFC) is a name that cannot be ignored in Johnathan Hanh Nguyen's ecosystem. The enterprise has a charter capital of 200 billion VND, with Ms. Le Hong Thuy Tien (wife of Mr. Johnathan Hanh Nguyen) holding the position of Chairwoman of the Board of Directors and also the legal representative. DAFC specializes in trading high-end products of brands such as Rolex, Cartier, Burberry,...

In the first half of 2023, DAFC lost about 7.4 billion VND after tax. On average, this branded goods trading company lost about 41 million VND per day. Meanwhile, in the same period last year, the company made a profit of 130.6 billion VND. Equivalent to a profit of 726 million VND per day. It can be seen that the business situation of this branded goods trading company has declined significantly after only one year.

In mid-2023, DAFC slightly reduced its debt-to-equity ratio to 1.42 times compared to 1.56 times in the same period last year. With equity of about VND 570 billion, debt payable as of June 30, 2023 was about VND 810 billion. The shift from profit to loss caused the return on equity (ROE) to drop sharply from 22.87% to negative 1.3%.

Source

![[Photo] Head of the Central Propaganda and Mass Mobilization Commission Nguyen Trong Nghia received the delegation of Nhan Dan Daily](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/25/cdb71275aa7542b082ec36b3819cfb5c)

![[Photo] Prime Minister Pham Minh Chinh meets with the Ministry of Education and Training; Ministry of Health on the draft project to be submitted to the Politburo](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/25/c0e5c7348ced423db06166df08ffbe54)

![[Photo] Nhan Dan Newspaper Youth Union visits Vietnam Military History Museum](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/25/374e4f70a35146928ecd4a5293b25af0)

![[Photo] General Secretary To Lam chairs the Standing Meeting of the Central Steering Committee on preventing and combating corruption, waste and negativity](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/25/839ea9ed0cd8400a8ba1c1ce0728b2be)

Comment (0)