According to the proposal of the Ministry of Finance, the preferential import tax rate of some types of cars will be significantly reduced - Photo: NHU BINH

This is to respond to economic, trade and tariff policies in the world.

Some car types will have their MFN import tariffs cut by up to half.

On the afternoon of March 25, the Ministry of Finance said it had proposed a draft decree amending Decree 26 of 2023 to adjust import tax rates on a number of groups of goods.

Regarding the upcoming adjustment of tax rates for groups of goods, Mr. Nguyen Quoc Hung - Director of the Department of Management and Supervision of Tax, Fee and Charge Policies (Ministry of Finance) - said that in the draft decree, the Ministry of Finance proposed to reduce MFN import tax (the tax rate applied to countries in the WTO) for groups of goods.

Specifically, cars under the three HS codes 8703.23.63, 8703.23.57, 8703.24.51 are proposed to have their import tax reduced from 64% and 45% to the same tax rate of 32%.

Import tariffs on other items such as ethanol are expected to decrease from 10% to 5%; frozen chicken thighs from 20% to 15%; pistachios from 15% to 5%; almonds from 10% to 5%; fresh apples from 8% to 5%; sweet cherries from 10% to 5%; raisins from 12% to 5%.

Wood and wood products in headings 44.21, 94.01 and 94.03 with tax rates of 20% and 25% will be reduced to the same tax rate of 5%. Tax on liquefied natural gas (LNG) will be reduced from 5% to 2%.

To respond to changes in world economic, trade and tariff policies

The reason for the above proposal, the Ministry of Finance explained, is to respond to the complicated and unpredictable developments of the world's geopolitical and economic situation, especially changes in economic, trade and tariff policies, affecting the global economy, investment and trade, including Vietnam. The Prime Minister has directed the Ministry of Finance to urgently submit to the Government a draft amendment to Decree 26 of 2023 to adjust tax rates on a number of groups of goods to ensure harmony and rationality.

Adjusting the MFN import tax rates for some of the above-mentioned items is necessary to ensure fair treatment among Vietnam's comprehensive strategic partners.

Regarding the purpose of building the new decree, according to Mr. Nguyen Quoc Hung, it is to contribute to improving the trade balance with trading partners. At the same time, it encourages businesses to diversify imported goods, creating purchasing power for consumers; ensuring simplicity, ease of understanding, ease of implementation, and convenience for taxpayers.

On the other hand, the principle of drafting the decree is to ensure adjustment of import tax on domestically produced goods or goods that have been produced but cannot meet demand.

Focus on adjusting import tax on goods with high import turnover that countries are interested in; the basic adjusted tax rate is not lower than the tax rates of free trade agreements of which Vietnam is a member;...

The Decree was developed in a simplified manner and will take effect from the date of signing and promulgation this March.

Regarding trade relations with other countries, the Ministry of Finance said that on September 11, 2023, Vietnam and the United States established a comprehensive strategic partnership for peace, cooperation and sustainable development.

This is an important milestone in Vietnam's political and economic diplomacy, contributing to enhancing Vietnam's geopolitical position in the world. In the Joint Statement on economic, trade and investment, the two countries agreed to create more favorable conditions and open markets for each country's goods and services.

Although Vietnam and the United States have established a bilateral trade agreement since 2001, Vietnam and the United States do not have a free trade agreement on tariff reduction. Therefore, the United States is still a partner subject to the preferential import tax rate (MFN) applied to all WTO member countries.

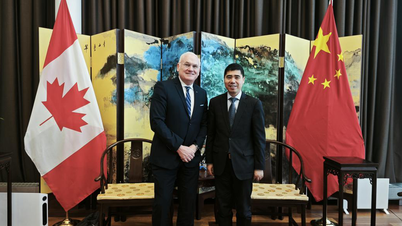

In addition, Vietnam has established Comprehensive Strategic Partnerships with 11 other countries: China, Russian Federation, India, South Korea, Japan, Australia, France, Malaysia, New Zealand, Indonesia, and Singapore.

Of these, 11/12 countries are in bilateral and multilateral trade agreements, and Vietnam is a member and enjoys tariff incentives in these agreements.

In order to proactively, flexibly, promptly, appropriately and effectively adapt to the world and regional situation in order to achieve growth targets, maintain macroeconomic stability, control inflation, and ensure major balances of the economy in 2025 and the following years, it is necessary to adjust the MFN import tax rates for a number of goods to ensure fair treatment among Vietnam's comprehensive strategic partners.

Source: https://tuoitre.vn/se-giam-sau-thue-nhap-khau-mfn-loat-mat-hang-trong-do-co-mot-so-loai-o-to-20250325194331362.htm

![[Photo] Prime Minister Pham Minh Chinh chairs a special Government meeting on the arrangement of administrative units at all levels.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/6a22e6a997424870abfb39817bb9bb6c)

![[Photo] Magical moment of double five-colored clouds on Ba Den mountain on the day of the Buddha's relic procession](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/7a710556965c413397f9e38ac9708d2f)

Comment (0)