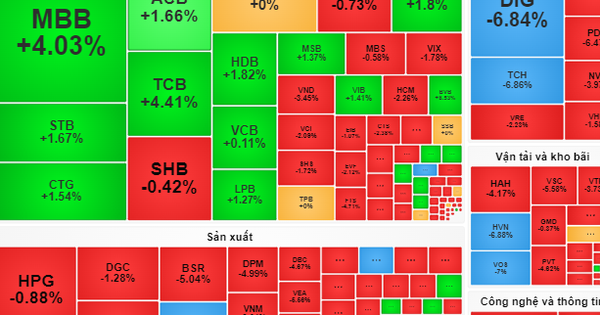

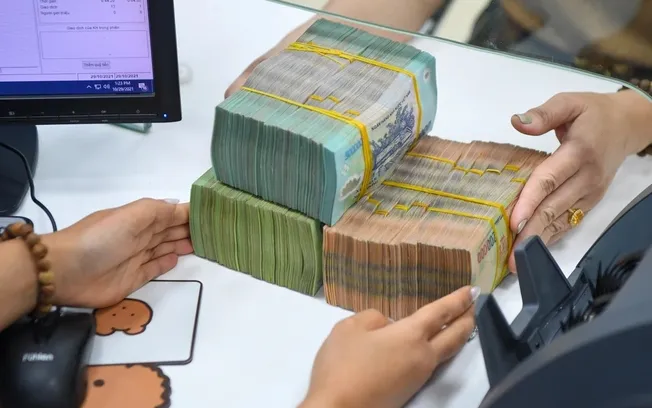

According to VietinBank Securities (HoSE: CTS), in the short term, the VN-Index recorded a sustained upward trend, fluctuating in the resistance zone of 1,247 - 1,255 points with the support of the steel industry group and some pillar stocks such as MSN with active cash flow. However, profit-taking pressure is showing signs of increasing in this area.

The medium and long-term uptrend has been confirmed, so market corrections will be good opportunities for investors to buy new stocks or increase their stock holdings.

VietinBank Securities recommends investors to have a stock ratio of 80% - 90% with new buy codes, confirming that the room for price increase continues to be maintained with cash flow participating in the market remaining positive, expecting that after successfully conquering the resistance zone of 1,247 - 1,255 points, the index can continue to increase to challenge the zone of 1,265 - 1,270 points.

In case profit-taking pressure increases and the index returns to retest the support zone of 1,200 - 1,212 points, investors can proactively increase the proportion of stock/cash holdings in the portfolio to 90/10.

Groups of stocks that investors may pay special attention to:

Public investment: HHV

Stocks: HCM, SHS, VIX, SSI

Real Estate: TCH, DIG, CEO

Industrial Park Real Estate: IDC

Seaport: HAH

Steel: HSG, HPG

Bank: VIB, SSB, ACB, TPB, VPB

Retail: DGW, MWG, MSN, FRT

Energy: PC1

Oil and gas: BSR

Textile: TNG

Others: PNJ, GEX, GVR, DBC.

Business news:

TNH: Groundbreaking ceremony of Lang Son hospital

CII: BOT toll cash flow increases, CII continues to pay cash dividends

TNG: Pouring 800 billion into ESG projects, borrowing green credit

POM: Pomina brings 2 factories worth 6,700 billion VND to contribute capital to investors

MWG: "No intention to lead the price war in 2024"

VGI: Stock price increased by one and a half times, CEO's wife wants to sell all shares

HQC: Has paid more than 80 billion VND in tax debt, will handle the rest in the first quarter

NKG: Plans to hold the 2024 Annual General Meeting of Shareholders at the end of April

ACV: Calculating plans to sue airlines for service debt

VNM: Vinamilk closes the right to pay cash dividend for the 3rd period of 2023 .

Source

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's special meeting on law-making in April](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/13/8b2071d47adc4c22ac3a9534d12ddc17)

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

Comment (0)