Stock Market Perspective Week 15-19/4: Choose stocks that are stronger than the market to participate in trading

The positive point is that the risk of the VN-Index falling below 1,250 points in the short term is low.

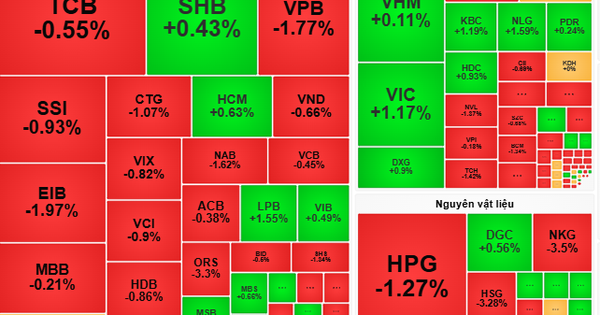

Last week, the stock market fluctuated narrowly with low liquidity.

At the beginning of the week, the market received negative news, that is, the exchange rate continued to heat up and officially exceeded 25,000 VND/USD; interbank interest rates remained high; deposit interest rates of some banks showed signs of increasing again, causing investors to be cautious.

VN-Index fell to the 1,250 point range, then balanced at this level and recovered. Notably, on April 11, the market was under great pressure from the outside, when US stocks fell sharply after the CPI report. However, due to investors ' calmness, VN-Index did not fall much at the end of the session.

Following the balanced session was a session of acceleration of more than 18.4 points at the end of the week, helping the index close the week at 1,276.60, up 21.49 points (+1.71%) during the week and successfully surpassing the 1,270 point mark.

The index's upward movement during the week was supported by the banking stocks group when they suddenly accelerated in the Friday session with strong liquidity improvement, notably ending the week with CTG (+8.13%), BID (+6.37%) LPB (+14.33%)..., some stocks adjusted STB (-1.69%), VCB (-0.32%).

The group of securities stocks has some outstanding codes such as CTS, FTS, AGR, SHS... In the group of real estate stocks, there is still strong differentiation, increasing in price despite the information that thousands of billions of VND must be returned related to the Van Thinh Phat case, but QCG stock of Quoc Cuong Gia Lai still recorded a fairly good increase, more than 17% in the week; in addition, there are DIG (+5%), VHM (+3,615)..., while there are DRH (-8.33%), FIR (-6.54%%)...

The oil and gas group also received attention, many codes increased well such as POS, PVP, PVS... On the contrary, there were codes that adjusted strongly such as PSH (-28.49%) with a lot of information about mortgage liquidation from some securities companies, PGS (-5%).

During the week, liquidity on HoSE reached VND94,837.79 billion, down sharply by 25.4% compared to the previous week, below average.

Foreign investors continued to net sell on HoSE, the net selling level decreased by one point compared to last week, with a value of VND1,164 billion on HoSE. This is a series of consecutive net selling by foreign investors on HoSE. The top net sellers of the week were VHM (VND1,125 billion), VN-Finlead fund certificates (MCK: FUESSVFL) (VND318 billion) and NVL (VND267 billion). Meanwhile, the leading net buyer was MBB with a value of VND427 billion.

The news of the weekend was notable as Iran launched an attack on Israel, firing more than 100 missiles at the country. Accordingly, investors are eagerly awaiting the stock market’s reaction to this news.

As Nguyen Thanh Trung, Director of Investment Consulting at Thanh Cong Securities, puts it, the money market, which had predicted the Fed would cut interest rates three times this year just a few weeks ago, has already reduced those expectations. When the market opens on Monday, those expectations could be further dented. The main concern will be a spike in oil prices, which could boost inflation.

Oil surged on Friday, with global benchmark Brent rising as much as 2.7% to $92 a barrel – a level last reached in the early days of the Israel-Hamas war. Any initial crude oil rally could be extended if pipelines or tanker movements beyond the Houthi-threatened waters of the Red Sea are disrupted.

Gold is likely to push to a new all-time high ( the highest price an asset has ever reached in its trading history) when trading resumes on Monday as safe-haven demand from people in the Middle East soars, Trung said. The metal has set a record this year, up nearly 14% year-to-date. Silver is also likely to be in demand and could rise to multi-year highs.

The red spread across the US stock market on Friday due to concerns about the attack, the Dow Jones index fell 476 points (1.24%), the S&P 500 and Nasdaq also fell deeply, reflecting the market's fear. In particular, the VIX index increased 16.1% to 17.31, reflecting the sell-off sentiment on Friday.

Bitcoin fell to around $61,000 this morning (Sunday, April 14, 2024), its biggest drop in more than a year, also partly due to risk aversion following news of Iran's attack on Israel. Bitcoin fell 7.7% on Saturday, its biggest drop since March 2023.

Returning to the Index of the Vietnamese stock market, thanks to the strong increase on Friday, the VN-Index closed the week at 1,276.6 points, up 18.4 points, temporarily considered to have successfully tested the support level of 1,250 points and created an accumulation base to be able to overcome the 1,300 point barrier in the short term.

Of course, because 1,300 points is a strong resistance level, there is still the possibility of hesitation and some shake-offs when approaching this area. On the positive side, the risk of the VN-Index turning around and falling below 1,250 points in the short term is low.

For this week's trading strategy, investors can explore with a proportion of 50% of stocks in the total NAV. In the short term, investors should have criteria for choosing stocks that are stronger than the market to participate in trading, limiting the search for profit opportunities in stocks that have "broken the support base" earlier than the market. When the index approaches the strong resistance level of 1,300 points, investors should avoid chasing buying.

In the medium term, investors can wait for more market dips to accumulate more positions in stocks with potential growth in the medium term (from 1 to 2 quarters to come), you can refer to TCB, MBB, CTS, SHS, GVR, SZC.

Source

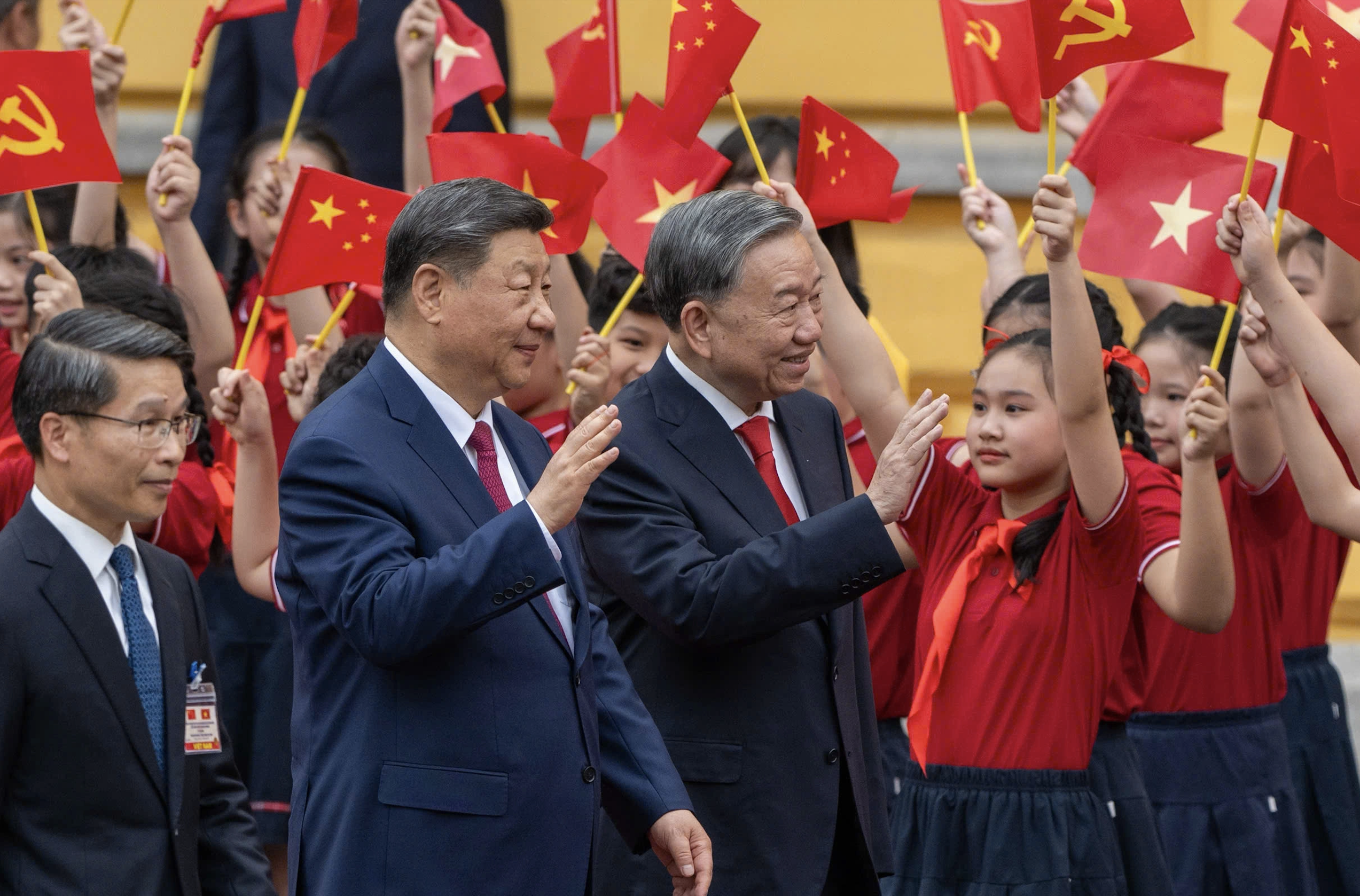

![[Photo] General Secretary To Lam holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/b3d07714dc6b4831833b48e0385d75c1)

![[Photo] Hanoi people warmly welcome Chinese General Secretary and President Xi Jinping on his State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/d6ac6588b9324603b1c48a9df14d620c)

![[Photo] Ceremony to welcome General Secretary and President of China Xi Jinping on State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/5318f8c5aa8540d28a5a65b0a1f70959)

![[Photo] Prime Minister Pham Minh Chinh chairs conference to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/dcdb99e706e9448fb3fe81fec9cde410)

Comment (0)