According to VietinBank Securities Joint Stock Company (HoSE: CTS), in the short term, the VN-Index recorded a recovery from the 1,212 point area, however, technical indicators show that there is still the possibility of continued correction pressure.

The medium and long-term uptrend has been confirmed, so market corrections will be good opportunities to buy new or increase stock holdings.

Investors are recommended to maintain the stock/cash holding ratio at 70/30. If profit-taking pressure increases, the index will likely return to test around 1,212 points again.

In case the index fluctuates in the range of 1,200 - 1,212 points, investors can proactively increase the ratio of stocks/cash holdings to the threshold of 90/10. Expectations of positive cash flow entering the market at this point and there is a high possibility that the index will move towards the resistance zone of 1,247 - 1,255 points in September 2023.

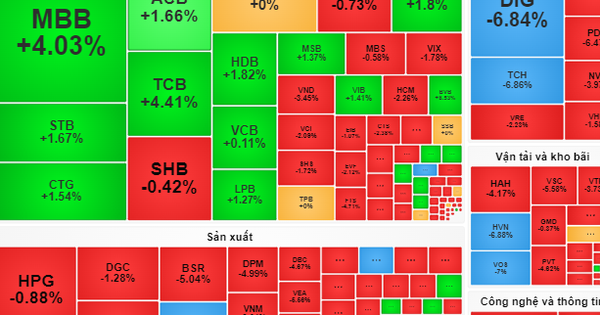

Groups of stocks that investors may pay special attention to:

Public investment: HHV

Stocks: HCM, SHS, VIX, SSI

Real estate: TCH, DIG

Industrial Park Real Estate: IDC

Seaport: HAH

Steel: HSG

Bank: VIB, SSB, ACB, TPB, VPB

Retail: DGW, MWG, MSN

Energy: PC1

Oil and gas: BSR

Textile: TNG

Others: PNJ, GEX, GVR, DBC.

Business news:

REE: The largest shareholder of Refrigeration Electrical Engineering is determined to collect more company shares.

SJE: Song Da 11 expects to collect 236 billion VND through offering 18 million shares,

POW: PV Power may lose more than 1,000 billion VND in revenue due to the slow progress of Nhon Trach 3 and 4 gas power plants.

HBC: Hoa Binh Construction is late in paying social insurance by more than 38 billion VND.

NLG: Final date for 2024 Annual General Meeting of Shareholders.

NVL: Novagroup has sold more than 12 million NVL shares.

VC2: The State Securities Commission fined Vina2 for not disclosing information.

VJC: Vietjet opens flight route connecting Ho Chi Minh City to Vientiane.

VCA: Vicasa Steel is struggling with the problem of moving the factory out of Bien Hoa 1 Industrial Park.

KDH: Wants to increase capital to 9,094 billion VND by issuing 110.09 billion shares .

Source

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

Comment (0)