|

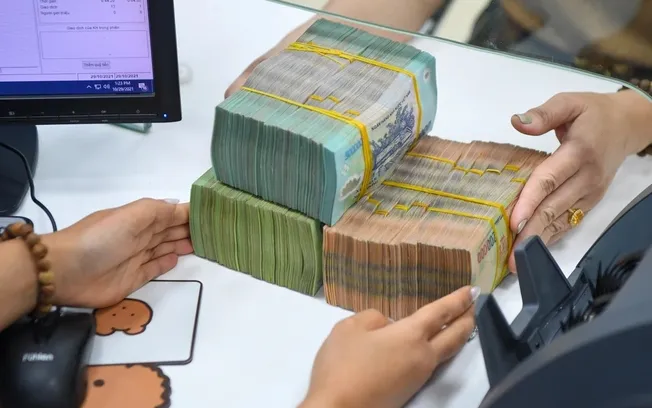

| Preferential credit stimulates real estate market |

According to the State Bank of Vietnam, under the direction of the Prime Minister, the State Bank has called on 9 banks to register about 45,000-55,000 billion VND to lend to young people for a period of 15 years, with an interest rate about 1-3% lower.

Although low-interest credit packages are expected to help young people access housing more easily, it cannot be denied that these preferential interest rate loan packages also carry many risks.

According to experts, first of all, the interest rate reduction in the initial period can make borrowers subjective about their ability to repay the debt later. When the preferential period ends, the interest rate will be adjusted according to the market, possibly skyrocketing, borrowers will face a large debt that they will find difficult to pay, requiring careful calculation of their personal financial plan before deciding to borrow to buy a house. On the other hand, those with unstable income or without large collateral will have difficulty accessing these loan packages. Therefore, many people with real needs still cannot take advantage of the opportunity to access cheap home loan packages.

Economist Dr. Can Van Luc said that loan procedures are still a hidden barrier. Therefore, banks need to be more flexible in assessing customers' financial capacity. For example, accepting non-traditional forms of income proof such as bank transactions and business invoices. Besides, interest rates are not the deciding factor. Currently, real estate prices are far beyond the financial capacity of many young people, especially in large cities. "Without a suitable housing supply, lower interest rates may not make it easier for young people to own a house," Dr. Can Van Luc commented.

According to vtv.vn

Source: https://baokhanhhoa.vn/kinh-te/tai-chinh-ngan-hang/202504/nhieu-ngan-hang-trien-khai-cac-goi-vay-mua-nha-uu-dai-c6f701f/

![[Photo] Prime Minister Pham Minh Chinh meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/893f1141468a49e29fb42607a670b174)

![[Photo] Reception to welcome General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/ef636fe84ae24df48dcc734ac3692867)

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

![[Photo] Tan Son Nhat Terminal T3 - key project completed ahead of schedule](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/85f0ae82199548e5a30d478733f4d783)

Comment (0)