Kinhtedothi - According to Deputy Prime Minister Le Thanh Long, the amendment of the Law on Special Consumption Tax aims to meet the requirements arising from practical situations, create a unified and synchronous legal environment applied in the economy, and overcome the limitations and inadequacies of the current Law.

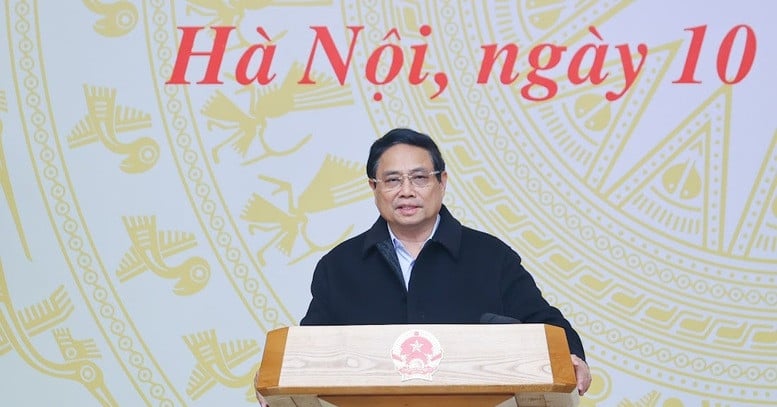

On November 22, continuing the 8th Session, the National Assembly listened to the Presentation and Review Report on the Draft Law on Special Consumption Tax (amended).

Improve the capacity and efficiency of tax management activities

Presenting the Report on the draft Law on Special Consumption Tax (amended), Deputy Prime Minister Le Thanh Long emphasized the necessity of promulgation to implement the Party and State's policies and guidelines on perfecting tax collection policies towards expanding the tax base; amending and supplementing to regulate consumption in accordance with consumption trends in society and the Party and State's orientations on protecting people's health and the environment. At the same time, meeting the requirements arising from practice, creating a unified and synchronous legal environment applied in the economy, overcoming the limitations and shortcomings of the current Law on Special Consumption Tax; in line with the trend of special consumption tax reform in other countries.

According to Deputy Prime Minister Le Thanh Long, the Draft Law adds taxable subjects to soft drinks with a content of over 5g/100ml, applies mixed tax on cigarettes, increases special consumption tax rates on alcohol, beer..., ensuring transparency, ease of understanding, and ease of implementation of the law to contribute to improving the capacity and effectiveness of tax management activities in preventing and combating tax evasion, tax losses and tax debts, ensuring correct and sufficient collection to the state budget, and ensuring stable state budget revenue sources.

Specifically, for alcohol and beer, the Draft Law stipulates a tax rate in percentage terms that will increase annually in the period from 2026 to 2030 to achieve the goal of increasing the selling price of alcohol and beer by at least 10% according to the World Health Organization's tax increase recommendation. The Draft Law proposes two options, of which the Government is leaning towards the second option. For alcohol with 20 degrees or more, the Government is leaning towards increasing the tax rate from the current level of 65% to 80%, 85%, 90%, 95%, 100% each year in the period from 2026 to 2030. For alcohol with less than 20 degrees, the Government is leaning towards increasing the tax rate from the current level of 35% to 50%, 55%, 60%, 65%, 70% each year in the period from 2026 to 2030.

Regarding beer, the Government is leaning towards increasing the tax rate from the current 65% to 80%, 85%, 90%, 95%, 100% each year in the period from 2026 to 2030. According to the Government, option 2 will have a stronger effect on reducing the affordability of alcohol and beer products, and will have a better impact on reducing the rate of alcohol and beer consumption and reducing the related harms caused by alcohol and beer abuse.

Sugary soft drinks expected to be subject to 10% excise tax

In the review report, Chairman of the National Assembly's Finance and Budget Committee Le Quang Manh said that most of the review opinions agreed with the tax increase as option 2 of the Draft Law. Some opinions suggested considering and calculating, proposing a reasonable increase to achieve the set goals. Some opinions said that regulating the tax rate on beer equal to the tax rate on alcohol over 20 degrees is not really appropriate because the harmful effects of alcohol or beer depend mainly on the alcohol concentration.

Regarding the Draft Law on adding soft drinks according to Vietnamese Standards with sugar content over 5g/100ml to the list of subjects subject to special consumption tax, with a tax rate of 10%, examining this content, according to the Finance and Budget Committee, some opinions said that the main goal of the proposal to add sugary drinks to the list of subjects subject to tax is to regulate and orient the production and consumption behavior of this product, contributing to protecting people's health.

However, the tax rate of 10% is quite low, and may not be enough to impact and change people's consumption habits, leading to failure to achieve the goals set in the policy. Therefore, it is necessary to consider proposing a higher tax rate to achieve the goal of regulating consumption and protecting people's health.

At the same time, some opinions suggested a clearer explanation of the ability to achieve the goal of this policy in contributing to protecting people's health. Because sugary soft drinks are not the main and only cause of overweight and obesity.

“Adding sugary drinks to the list of special consumption tax not only affects the production and business activities of beverage manufacturing enterprises but can also affect supporting industries, and at the same time, can increase the use of informally produced beverages or handmade products,” said the Chairman of the Finance and Budget Committee.

Regarding tobacco products, according to the Draft Law, the tax rate of 75% will be maintained and an absolute tax rate will be added according to the roadmap to increase each year from 2026 to 2030. The goal of the regulation is to contribute to achieving the goal of reducing the rate of tobacco use among men aged 15 and over to below 36% in the period 2026 - 2030 according to the National Strategy on Prevention and Control of Tobacco Harms and towards achieving the tax rate on retail price of tobacco as recommended by the World Health Organization.

Source: https://kinhtedothi.vn/de-xuat-ruou-bia-thuoc-la-nuoc-giai-khat-co-duong-chiu-thue-tieu-thu-dac-biet.html

Comment (0)