In the draft Resolution of the National Assembly on reducing value-added tax (VAT), the Ministry of Finance proposed extending the 2% VAT reduction period for some goods and services by 18 months, instead of ending in June this year.

Thus, goods and services subject to a tax rate of 10% can be subject to a tax rate of 8% until the end of 2026. Accordingly, the sectors that will continue to not receive this tax reduction include: Telecommunications, financial activities, banking, securities, insurance, real estate business, metal products, mining products (except coal), goods and services subject to special consumption tax (except gasoline).

|

| The Ministry of Finance proposes to add gasoline and oil to the group of goods eligible for tax reduction. Illustrative photo |

Along with that, the list of products that are eligible for a 2% VAT reduction is expanded, such as information technology products and services, washing machines, microwave ovens, and data processing services. This number also includes prefabricated metal products such as barrels, tanks, and metal containers, and boilers. Coal, gasoline, fertilizers, plastics, synthetic rubber in primary form, and imported coal... are also proposed for tax reduction.

According to the Ministry of Finance, previously, gasoline and oil were not subject to the 2% VAT reduction, because gasoline is in the group of goods subject to special consumption tax, while oil is a mineral product. However, these are important goods that directly affect domestic production, consumption and macroeconomic stability, so the agency plans to add gasoline and oil to the group of goods eligible for tax reduction.

VAT is an indirect tax, levied on the final consumer. Unlike other taxes, VAT has the characteristic that the tax burden is shared between businesses and consumers, so when it is reduced, both parties benefit.

Specifically, according to the Ministry of Finance, for the people, this is the group that will directly benefit from this policy. The 2% reduction in VAT will directly contribute to reducing people's costs in consuming goods and services serving people's lives.

For businesses, the 2% reduction in VAT will help reduce production costs and lower product prices through businesses that produce and trade goods and provide services that are subject to VAT reduction, leading to a reduction in the selling price of goods and services for consumers. This will help businesses increase their competitiveness, increase the consumption of goods and services, and expand production and business, contributing to creating more jobs for workers.

In particular, tax reduction also contributes to creating a driving force, helping the economy achieve a growth rate of at least 8% this year and double digits in the coming period. Because VAT reduction will contribute to reducing the cost of goods and services, thereby promoting production, business and creating more jobs for workers, contributing to stabilizing the macro economy and economic growth in the last 6 months of 2025.

The VAT reduction policy has been implemented since 2022 to support people and businesses to recover from the Covid-19 pandemic. Over the past three years, the value of support from this policy has reached VND123,800 billion. In the first two months of this year alone, the VAT reduction is estimated at VND8,300 billion. Extending this tax reduction period until the end of 2026 is expected to reduce budget revenue by about VND121,740 billion. Of which, the last 6 months of this year will reduce by about VND39,540 billion, and next year it will be VND82,200 billion. |

Source: https://congthuong.vn/de-xuat-keo-dai-thoi-gian-giam-thue-vat-den-nam-2026-379787.html

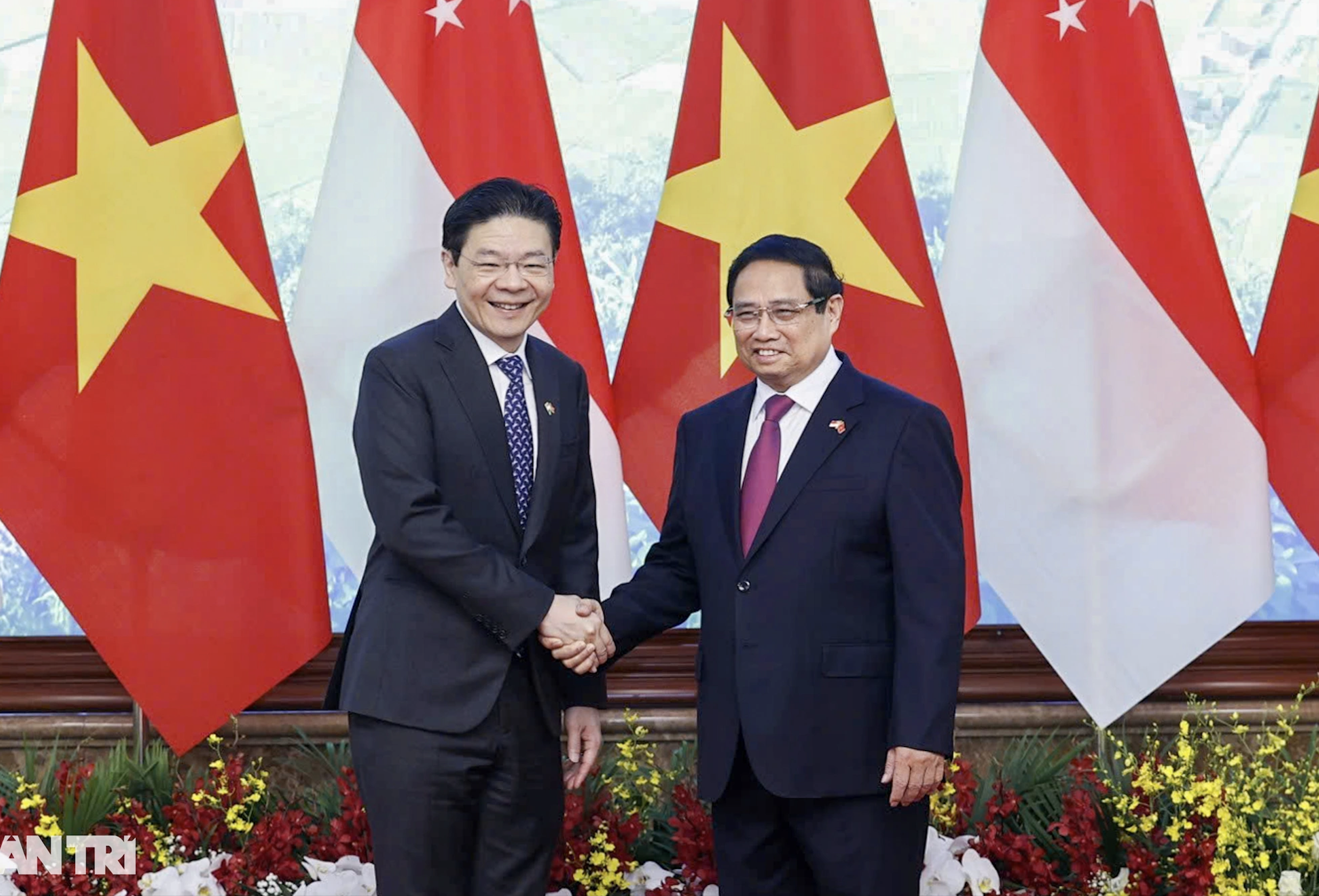

![[Photo] Welcoming ceremony for Prime Minister of the Republic of Singapore Lawrence Wong on an official visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/445d2e45d70047e6a32add912a5fde62)

![[Photo] Prime Minister Pham Minh Chinh holds talks with Singaporean Prime Minister Lawrence Wong](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/04f6369d4deb43cfa955bf4315d55658)

![[Photo] Head of the Central Propaganda and Mass Mobilization Commission Nguyen Trong Nghia works with key political press agencies](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/3020480dccf043828964e896c43fbc72)

![[Photo] Close-up of old apartment building waiting to be renovated](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/bb2001a1b6fe478a8085a5fa20ef4761)

Comment (0)