On the morning of November 27, at the National Assembly House, continuing the 8th Session Program, under the chairmanship of National Assembly Chairman Tran Thanh Man, the National Assembly discussed in the hall the draft Law on Employment (amended).

Commenting on the draft Law on Employment (amended), National Assembly Delegate Vo Manh Son (National Assembly Delegation of Thanh Hoa Province), Provincial Party Committee Member, Chairman of the Provincial Labor Federation, gave some comments, specifically:

Regarding unemployment insurance payment. Accordingly, the provision in Clause 5, Article 58 of the Draft "...employees are allowed to choose to pay the amount into the Unemployment Insurance Fund that is their responsibility to pay unemployment insurance (UI) but the employer has not paid it to the social insurance agency to carry out the procedures to settle the UI benefits" is unreasonable, because:

The responsibility of the state management agency in urging the collection and handling of violations of late payment and evasion of unemployment insurance is to prevent unemployment insurance from occurring. When unemployed, workers are already in difficulty, have no source of income, and have to continue paying their contributions that the enterprise has collected but not paid for the employee, making it even more difficult for the employee. Moreover, when state management measures cannot completely handle the violations of the enterprise, pushing the burden onto the employee, and then waiting for "When the social insurance agency recovers the amount of late payment and evasion of unemployment insurance from the employer, then refund the money that the employee has paid" is not ensuring the rights of employees when participating in unemployment insurance.

The implementation of the Law on Employment shows that there are still a number of employees who, when they quit or lose their jobs, do not enjoy unemployment insurance benefits because the business is not operating effectively, leading to dissolution or bankruptcy, or the business owner intentionally absconds... does not pay, owes payment, evades payment, and in some cases, even appropriates the unemployment insurance contributions of employees, leading to a huge disadvantage for employees who have quit or lost their jobs, which means loss of income... Employees want the state to have timely support solutions for cases where businesses owe payment or evade payment of unemployment insurance so that employees can enjoy unemployment insurance benefits in accordance with regulations, ensuring their lives and developing new jobs.

To ensure the rights of employees, it is recommended to study the regulation to set aside a content of the Unemployment Insurance Fund to support employees to pay the amount into the Unemployment Insurance Fund that is the responsibility of the employee to pay the Unemployment Insurance but the employer has not paid to the social insurance agency to complete the procedures to receive the Unemployment Insurance regime. When the social insurance agency recovers the amount of late payment or evasion of Unemployment Insurance payment from the employer, it will return the Unemployment Insurance Fund money that has supported the employee.

In fact, the source of the Unemployment Insurance Fund, in addition to the profitable investment, interest..., basically comes from 3 main sources: the State, employers and employees. Thus, the deduction from this Fund still ensures fairness and does not affect the contribution of other employees when participating in Unemployment Insurance. It is only in the part supported by the State and the part that enterprises are responsible for paying.

Regarding the period of social insurance payment, it is not reserved to calculate unemployment benefits for the next time (point d, clause 2, Article 60). Accordingly, point d, clause 2, Article 60 stipulates: "The period of social insurance payment is not reserved to calculate unemployment benefits for the next time in the following cases: d) The period of social insurance payment is over 144 months".

National Assembly Deputy Vo Manh Son said that not calculating unemployment benefits for “social insurance contribution period of over 144 months” will greatly affect the psychology of workers, easily leading to the situation where workers find ways to “reduce losses” for themselves, by quitting their jobs to receive unemployment benefits when reaching the threshold. This will disrupt the labor market, affecting the production and business of enterprises when they lose long-term employees or when workers collaborate with employers to take advantage of unemployment insurance policies.

Not calculating the period of social insurance payment of more than 144 months also does not ensure the principle of social insurance benefit level: "The social insurance benefit level is calculated based on the contribution level and period of social insurance payment" Clause 3, Article 54 of the Draft.

Unemployment benefits are a humane policy for workers who have quit their jobs and have not yet found new ones. This benefit helps workers reduce the burden of life while looking for work. Therefore, the unemployment insurance benefit policy needs to be built on equality in contributions; for example, those who have contributed more time receive more than those who have contributed less.

Therefore, the delegate said that the regulation on unemployment benefits should be considered based on the number of months of social insurance contributions. For every 12 months of contributions up to 36 months, one will receive 3 months of unemployment benefits; after that, for every additional 12 months of contributions, one will receive 1 more month of unemployment benefits until a new job is found.

Regarding recognition of equivalence or exemption from national vocational skills assessment. Accordingly, Point b, Clause 3, Article 41 of the draft stipulates on Recognition of equivalence or exemption from national vocational skills assessment: ...“Employees with certificates, certificates of performance capacity, practice certificates, practice licenses or skills, and the ability to practice a profession at a high level according to the provisions of relevant laws shall be considered for exemption from national vocational skills assessment or recognition of equivalence with national vocational skills level”.

National Assembly Deputy Vo Manh Son suggested that it is necessary to clarify the content of consideration for exemption from national vocational skills assessment or recognition of equivalence with national vocational skills level to be suitable and compatible with other legal documents, especially Law No. 15/2023/QH15 on medical examination and treatment effective from January 1, 2024, for those working in the health sector, to avoid creating administrative procedures and overlapping between documents. Because people who practice medical examination and treatment often have to go through a long-term training and probationary process, a lot of pressure and costs, and on the other hand, have been granted a practice license. If more procedures are required to consider exemption from national vocational skills assessment or recognition of equivalence with national vocational skills level, it will be more difficult in terms of time and costs for those working in the health sector.

Regarding unemployment insurance. According to current regulations, there are no regulations for employees to comply with and fully participate in unemployment insurance. To encourage employees to actively participate in unemployment insurance, it is recommended that further research be conducted and there should be regulations to support this group when they retire or to support employees' relatives when they face employment risks.

Regarding unemployment benefits (Clause 1, Article 65). Accordingly, the current regulation of monthly unemployment benefits equal to 60% of the average monthly salary for the last 6 months of unemployment insurance contributions before unemployment is low, unattractive, and does not attract workers to participate and stick with the unemployment insurance policy for a long time.

In fact, most businesses currently pay unemployment insurance for their employees, which is only equal to or slightly higher than the regional minimum wage set by the Government, while the current regional minimum wage is still low, not ensuring the minimum living standard of employees and their families. When unemployed, employees have no source of income, their lives and those of their families face many difficulties, with unemployment support equal to 60% of the average monthly salary for the 6 months of unemployment insurance payment, which is not enough to cover living expenses, lower than the regional minimum wage set by the Government.

It is recommended to consider increasing the unemployment benefit level for employees to 75% instead of 60% of the average monthly salary for social insurance contributions of the 6 consecutive months before leaving work as it is currently.

In the case of laid-off employees, unemployment benefits are not provided. According to the provisions of Point b, Clause 1, Article 64 of the Draft, it is stipulated that: “Employees who are laid off in accordance with the law on labor...” are not provided with unemployment benefits. This needs further study and consideration, because:

The reality of the current labor market shows that many businesses want to fire employees without a legitimate reason, so they have used many tricks such as pushing the work efficiency evaluation index to an unachievable level, issuing regulations to deduct salaries, bonuses and other income when the work efficiency evaluation index is not guaranteed, violating minor mistakes during the work process... to deduct most of the salary and bonus of employees, causing employees to fall into extremely difficult circumstances, with income too low, not enough to cover basic daily living needs. Through that, they force employees to unilaterally terminate their labor contracts. For older employees, especially female employees, over 40 years old, employers and company managers often find ways to terminate their jobs for many different reasons. With workers who persevere and patiently work, employers find ways to find fault, penalize wages, bonuses... to terminate the contract and hire younger workers to replace them.

The labor relationship between employers and employees, in reality, is often "multi-faceted" in terms of being fired or disciplined and forced to quit. Not to mention the right or wrong of being fired, but the employee is always at a disadvantage. When forced to quit or disciplined, the employee will have reduced job opportunities at other companies; especially immediately losing the source of income to take care of living expenses, family, and children. If they cannot find a job immediately, the employee can only rely on unemployment benefits. Meanwhile, the draft law does not allow employees to receive unemployment benefits during the difficult time of finding a new job, which does not ensure the purpose of the unemployment insurance policy to support employees who are really having difficulty finding a job.

In addition, the regulation that those who are fired or disciplined and forced to quit their jobs are not entitled to unemployment benefits is also inconsistent with the principle of "contribution - enjoyment" stipulated in the law on social insurance. Employees themselves must deduct their salary to pay for social insurance during their working period, but are not entitled to unemployment benefits when they are fired or forced to quit their jobs, which does not ensure the legitimate rights of employees.

National Assembly Deputy Vo Manh Son suggested reviewing and studying appropriate regulations related to the issue of continued participation in social insurance of laid-off employees. In case the employer does not accept the employee, the employee will still receive unemployment benefits or consider studying and developing regulations in principle to ensure the rights of this group. It is possible to study regulations allowing them to receive unemployment benefits when there is sufficient evidence of being refused a job because of being fired or forced to quit at the previous enterprise or unit. From the employment perspective, it is necessary to have appropriate regulations or control mechanisms to avoid discrimination in labor recruitment related to the issue of previously fired or forced to quit employees.

Quoc Huong

Source: https://baothanhhoa.vn/dbqh-vo-manh-son-doan-dbqh-tinh-thanh-hoa-tham-gia-gop-y-ve-du-an-luat-viec-lam-sua-doi-nbsp-nbsp-231633.htm

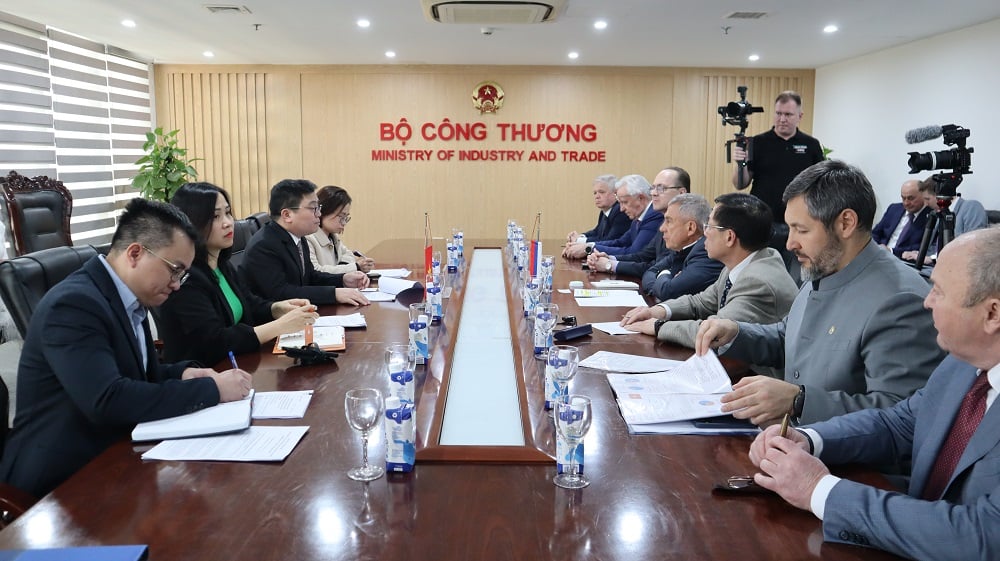

![[Photo] Prime Minister Pham Minh Chinh receives the head of the Republic of Tatarstan, Russian Federation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/7877cb55fc794acdb7925c4cf893c5a1)

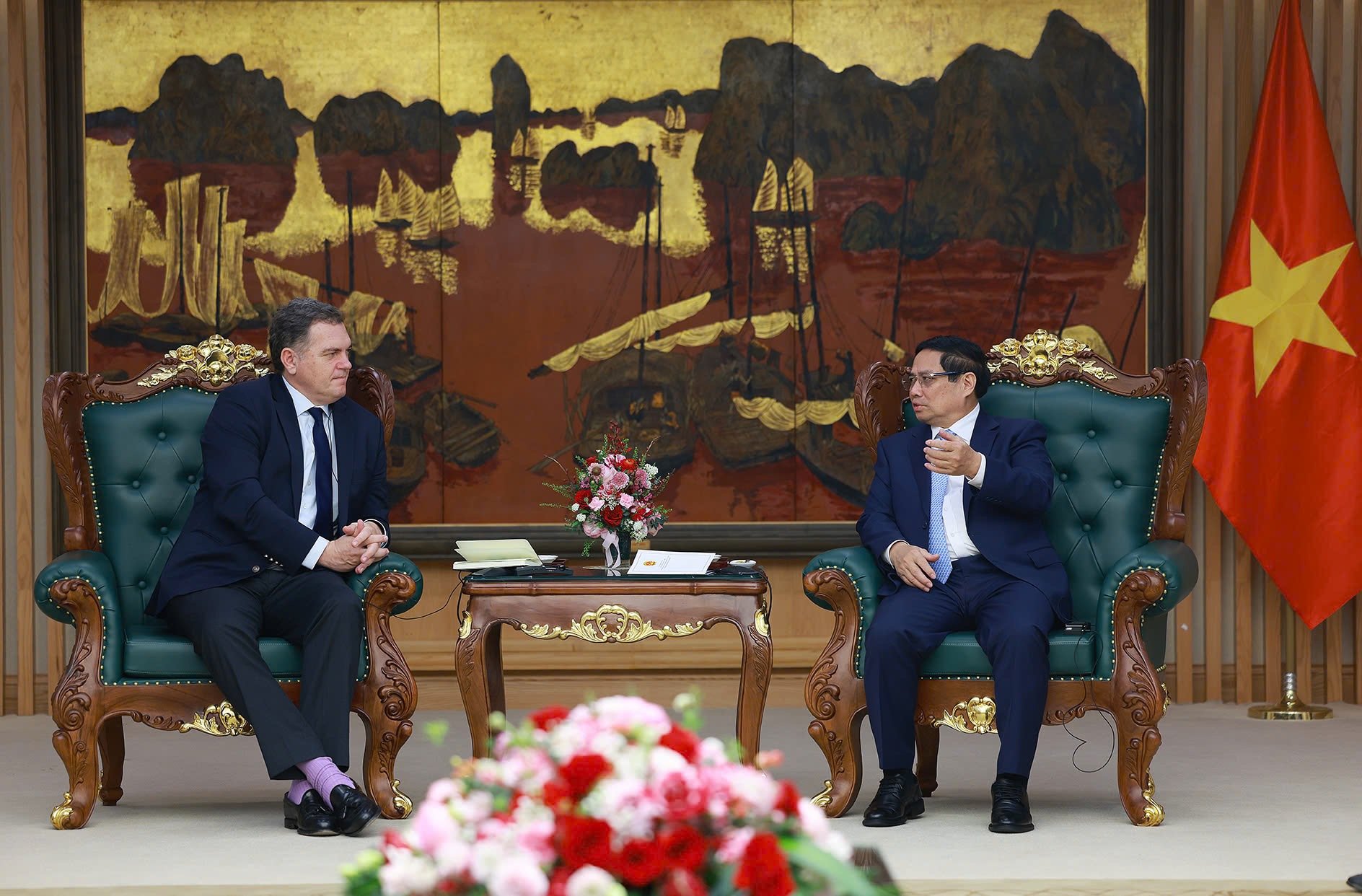

![[Photo] Prime Minister Pham Minh Chinh receives French Minister in charge of Transport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/aa649691f85546d59c3624b1821ab6e2)

![[Photo] Overview of the Workshop "Removing policy shortcomings to promote the role of the private economy in the Vietnamese economy"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/d1c58c1df227467b8b33d9230d4a7342)

![[Photo] Meet the pilots of the Victory Squadron](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/fd30103acbd744b89568ca707378d532)

Comment (0)