|

| Deputy Governor of the State Bank of Vietnam Doan Thai Son, Speaking at the conference |

Specify development goals

With the strong direction of the National Assembly, the Government and the Prime Minister, the SBV has promptly concretized the goals and solutions of the banking sector to contribute to socio-economic development in 2025. The solutions focus on implementing tasks related to currency, credit, banking restructuring, bad debt handling, administrative procedure reform, etc. and digital transformation in banking activities. One of the main priorities of the SBV in 2025 is to promote credit development to contribute to economic growth.

In particular, the State Bank has assigned credit growth targets to each credit institution (CI) with the goal of the entire banking sector growing by about 16% (adjusted according to the actual situation). This helps CIs to be proactive in business activities, while implementing reasonable credit growth solutions right from the beginning of the year.

Deputy Governor Doan Thai Son said that in the context of the economy facing many difficulties, the banking sector is also not immune to challenges. The Government has set a target of double-digit economic growth in 2025. To contribute to realizing this goal, the SBV has directed credit institutions to make efforts to reduce costs in order to continue to reduce lending interest rates, while maintaining stable deposit interest rates; focusing credit on priority areas such as agriculture, aquaculture, exports and key national projects, etc.

The State Bank of Vietnam, Region 11, includes 5 provinces in the Central Highlands: Dak Lak, Kon Tum, Gia Lai, Dak Nong, Lam Dong, with its headquarters in Dak Lak. According to Mr. Nguyen Kim Cuong, Acting Director of the State Bank of Vietnam, Region 11, the Central Highlands has great advantages in agricultural development, especially long-term industrial crops such as coffee, rubber, and pepper. In addition, this region also has great potential for eco-tourism, renewable energy, and mineral resources. By 2024, the region's GRDP will reach 4.6%, with a GRDP scale of up to VND 485 trillion, and an average GRDP per capita of VND 78.5 million, an increase of 16% over the previous year.

However, localities in the region still face many difficulties in developing their key industries.

|

| Deputy Governor Doan Thai Son and Mr. Duong Cong Thai, Vice Chairman of Dak Lak Provincial People's Committee co-chaired the conference. |

Efforts to reform and support businesses

One of the important issues mentioned at this conference is expanding access to credit for businesses.

Business representatives such as Mr. Le Duc Huy, Chairman of the Board of Members of Dak Lak 2-9 Import-Export Company Limited, shared: Banks have provided great support in providing credit to coffee exporting enterprises in the Central Highlands. However, businesses hope that banks will continue to support in simplifying procedures and increasing lending levels, especially in the context of economic difficulties.

At the same time, Mr. Pham Dong Thanh, Chairman of Dak Lak Young Entrepreneurs Association, also acknowledged the support of the banking sector in reducing interest rates and extending debt repayments, helping businesses overcome difficulties. However, businesses also proposed that banks increase the level of mobile loans and be more flexible in accepting property mortgages.

On the credit institution side, Mr. Nguyen Quang Hung, Deputy General Director of Agribank, affirmed that the bank will continue to accompany businesses with preferential credit programs. Agribank has implemented many programs to support businesses, especially in the fields of agriculture and agricultural exports, with measures to reduce interest rates and provide financial support for agricultural projects.

Ms. Do Thi Viet Hang, Director of Vietcombank Gia Lai, also shared: The bank has implemented many programs to support businesses exporting agricultural products, especially coffee, and renewable energy projects. Vietcombank is taking the lead in developing green credit products, supporting renewable energy projects and environmental protection...

On the local government side, Mr. Vo Ngoc Hiep, Vice Chairman of Lam Dong Provincial People's Committee, emphasized that the banking sector has been making important contributions to the local economic development. Currently, the total outstanding credit balance in Lam Dong province has reached 191 trillion VND, which is an important resource supporting socio-economic development; hoping that the banking sector will continue to accompany the local government in removing difficulties, supporting businesses and people to develop production and business.

Concluding the conference, Deputy Governor Doan Thai Son welcomed the attention of local leaders to the banking sector's activities. The Deputy Governor hoped that local leaders would continue to closely coordinate with the State Bank of Vietnam Regional Branch 11 to support businesses and people in developing production and business.

For credit institutions, the Deputy Governor noted that credit growth must go hand in hand with ensuring safety and efficiency, especially in areas with potential risks. Credit institutions continue to reform administrative procedures, promote digital transformation and provide credit products in line with the economic development strategy of the region 11. The goal is to promote regional economic growth, supporting localities to achieve socio-economic goals in 2025 and the following years.

| The State Bank of Vietnam held a ceremony to announce the Decision to establish the State Bank of Vietnam Branch in Region 11, based on the merger of the State Bank branches in 5 Central Highlands provinces: Dak Lak, Kon Tum, Gia Lai, Dak Nong, Lam Dong. The headquarters of the State Bank of Vietnam Branch in Region 11 is in Dak Lak. The State Bank of Vietnam, Region 11 Branch, has the function of advising the Governor of the State Bank of Vietnam in performing state management of currency, banking and foreign exchange activities in localities and performing a number of Central Bank operations under the authorization of the Governor of the State Bank of Vietnam. Previously, on February 24, 2025, the Governor of the State Bank of Vietnam signed a decision to appoint Mr. Nguyen Kim Cuong, Director of the State Bank of Vietnam, Dak Lak Province, to hold the position of Acting Director of the State Bank of Vietnam, Regional Branch 11, and Deputy Directors of the Branch. The organizational structure of the regional State Bank after the arrangement includes 7 departments: Regional State Bank Inspectorate; General Department; Management and Supervision Department 1; Management and Supervision Department 2; Accounting - Payment Department; Currency - Treasury Department; Administration - Personnel Department. |

![[Photo] Prime Minister Pham Minh Chinh receives the head of the Republic of Tatarstan, Russian Federation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/7877cb55fc794acdb7925c4cf893c5a1)

![[Photo] Meet the pilots of the Victory Squadron](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/fd30103acbd744b89568ca707378d532)

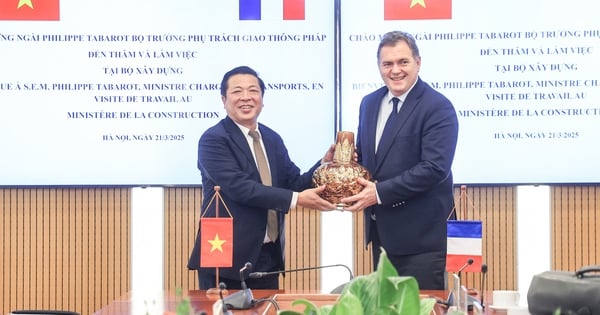

![[Photo] Prime Minister Pham Minh Chinh receives French Minister in charge of Transport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/aa649691f85546d59c3624b1821ab6e2)

Comment (0)