|

| NCB iziBankbiz "powerful assistant" for corporate customers |

A powerful "digital assistant" for businesses

Accompanying businesses in business operations and digital transformation, NCB iziBankbiz with two convenient versions - Internet Banking on browsers and Mobile Banking on phones via the NCB iziMobiz application - has quickly affirmed its role as a "powerful assistant" for thousands of businesses since its launch. NCB iziBankbiz creates seamless connections with all online financial services to meet customer needs, allowing business owners and specialized departments to easily operate and experience consistently on all devices, from computers to mobile phones or tablets 24/7.

With the ability to provide comprehensive solutions and outstanding utilities, helping businesses "free" themselves completely from paper documents like traditional methods, optimizing operating and personnel costs, NCB iziBankbiz digital bank has been increasingly loved and used by Vietnamese businesses and has been honored for two consecutive years at the "Top 50 Trusted Products - Services in Vietnam" award.

|

| NCB iziBankbiz has been honored for 2 consecutive years at the "Top 50 Trusted Products - Services in Vietnam" Award |

With just a few simple steps, all transactions such as cash flow management, information lookup, account reporting, bill payment, periodic money transfer or salary payment to employees... are all done online quickly, safely and proactively. Meanwhile, NCB iziBankbiz's flexible authorization mechanism allows users to proactively set up permission groups and create authorizations by account. This feature not only helps managers operate businesses effectively according to the appropriate model but also reduces the burden of personnel, optimizes operating processes and promotes sustainable development.

Smart features, smooth experience

Constantly striving to digitize financial work, bringing modern and convenient financial solutions to corporate customers, especially providing useful tools to accompany small and medium enterprises, NCB continues to upgrade the outstanding NCB iziBankbiz Digital Bank version 2025.

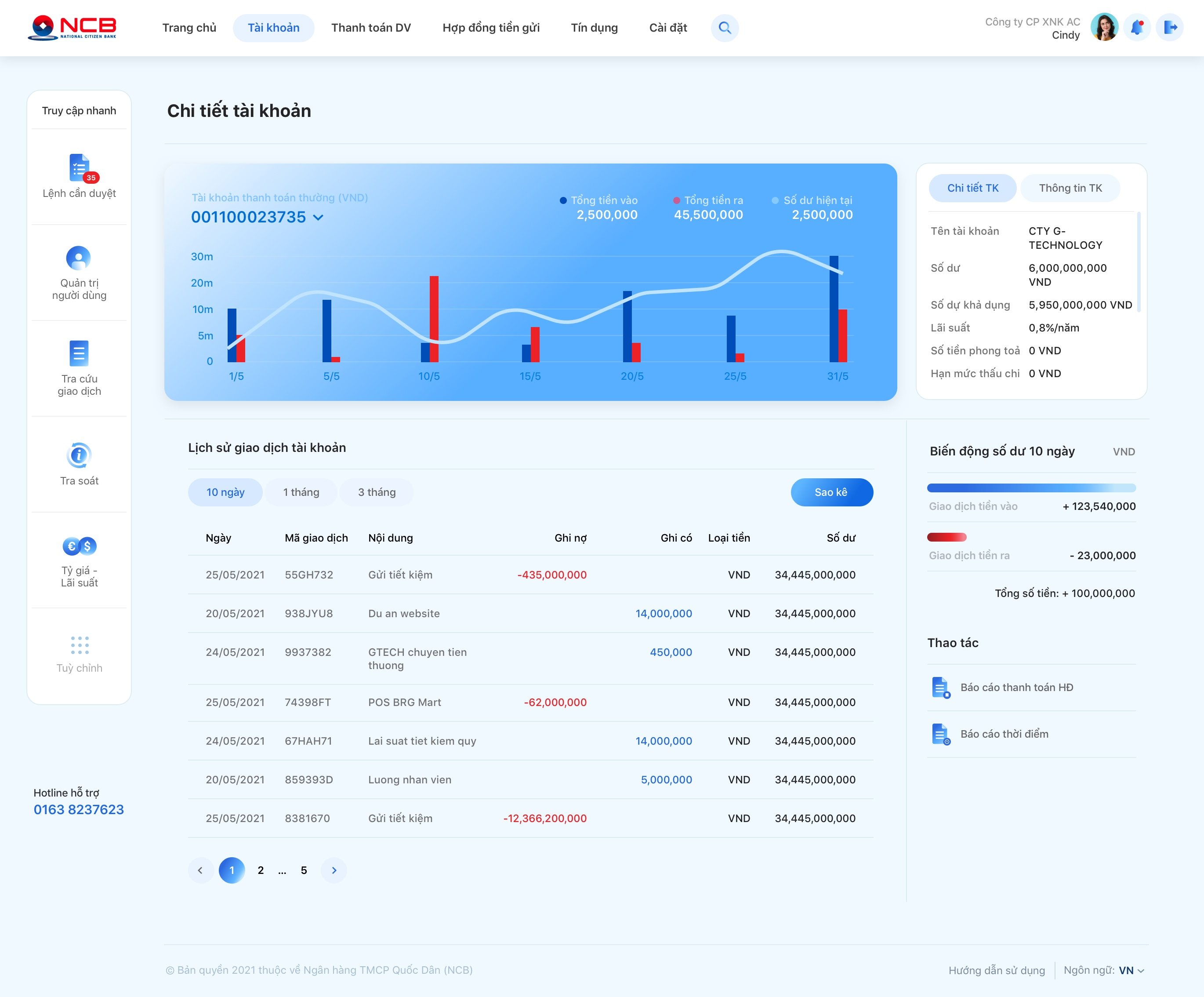

Still user-friendly and convenient, the new version impresses with a youthful, modern interface and a layout that optimizes the experience. In particular, the home screen has been upgraded with a smart, intuitive design. Most notably, the improved Account Management List displays an overview of cash flow generated in the last 7 days in the form of a vivid graph. Thanks to that, managers can easily and quickly grasp information about the financial situation, supporting trend analysis to make accurate and timely decisions.

“NCB iziBankbiz’s new interface really impressed me. The necessary information is displayed clearly, intuitively, and more professionally. The features are also arranged very scientifically, allowing for quick operations and easy information lookup,” Ms. Nguyen Thi Lan, Director of a business, excitedly shared.

|

| The new version impresses with a youthful, modern interface and layout that optimizes the experience. |

Also in the new version, the transaction approval notification feature has been strongly upgraded. As soon as there is an order pending approval, the notification will be sent immediately, helping the account holder quickly grasp the information and make decisions. The new version also allows unlimited one-time approval of transactions in both Internet Banking and Mobile Banking (NCB iziMobiz), helping users save maximum time waiting for approval. Thanks to that, the cash flow is always maintained continuously, helping businesses maintain smooth operations without having to worry about cash flow interruptions.

NCB iziBankbiz 2025 version also launched a new feature to create convenient QR codes. With just one simple operation, businesses can quickly create and share account information, helping to save time and minimize the risk of errors.

Continuing to upgrade the user experience and promote flexibility, the new version of NCB iziBankbiz also expands the user scope, meeting the needs of businesses of different sizes. The authorization feature allows business owners to flexibly assign work through 5 separate permission groups, which was previously very popular with customers, and has now been expanded by NCB to 12 permission groups, providing maximum flexibility. This smart authorization system not only helps businesses manage closely at each level, but also ensures absolute security and optimizes operational efficiency.

With strong improvements in version 2025, NCB iziBankbiz continues to affirm its position as a digital banking platform loved by many users, helping businesses optimize financial management and improve operational efficiency.

For more detailed information about NCB's products and services, customers can contact NCB's transaction offices/branches nationwide or Hotline (028) 38 216 216 - 1800 6166.

Comment (0)