Collecting a flat tax of 0.1% helps reduce the time for settling personal taxes on securities investments, which is very complicated because securities accounts are not fixed and even fluctuate hourly.

Many experts are concerned that changing the way securities income is taxed will cause a lot of trouble for investors and securities companies - Photo: Quang Dinh

Furthermore, the proposed 20% tax rate is too high.

Many securities experts have recommended this, although they admit that imposing a 0.1% tax on the value of each securities sale, regardless of whether the investor makes a profit or a loss, is unreasonable.

Previously, in a recent report assessing the impact of personal income tax (PIT), the Ministry of Finance admitted that selling securities at a loss and still paying a 0.1% tax is "inappropriate", and said it would redefine how to calculate income tax from securities.

Collecting 0.1% is simple, transparent, limits surfing...?

Talking to us, Mr. Lan Hoang, a stock investor (Hanoi), said that with the current 0.1% calculation, when selling securities for 100 million VND, investors will have to pay personal income tax of 100,000 VND, regardless of profit or loss.

"When selling stocks at a loss, meaning losing income and having to pay taxes, it is unreasonable. It is necessary to reconsider this tax method," said Mr. Hoang.

A stock expert said that in 2007, the tax authority proposed a plan to temporarily collect a 0.1% tax on securities transfers, and after final settlement, deduct 20% from income.

Specifically, the securities company will temporarily deduct 0.1% of the total transfer value, the investor will make tax settlement and declaration later. If the amount of provisional tax paid is larger, the investor will be refunded and vice versa, must pay more if there is a shortage.

In case the cost price and related costs cannot be determined, investors will have to pay 0.1% tax on the total price of each sale. However, in 2014, the tax authority decided to apply the current method of collecting 0.1% on all transactions.

According to Mr. Nguyen Van Phung, former Director of the Large Enterprise Tax Department, General Department of Taxation, the basic principle of personal income tax is to "tax" on actual income, losses do not need to be paid.

However, speaking with us, Mr. Bui Van Huy - Director of DSC Securities Ho Chi Minh City branch - said that applying the current rate of 0.1% on the value of each sale is simple, transparent and convenient for both investors and securities companies.

For investors who are making good profits, this tax calculation will be more beneficial than paying 20% tax on the profits earned.

"Moreover, the current tax collection method will not benefit speculative investors and short-term traders with high frequency. The more investors trade stocks, the more tax the State collects. This will contribute to promoting the market towards more long-term investment," said Mr. Huy.

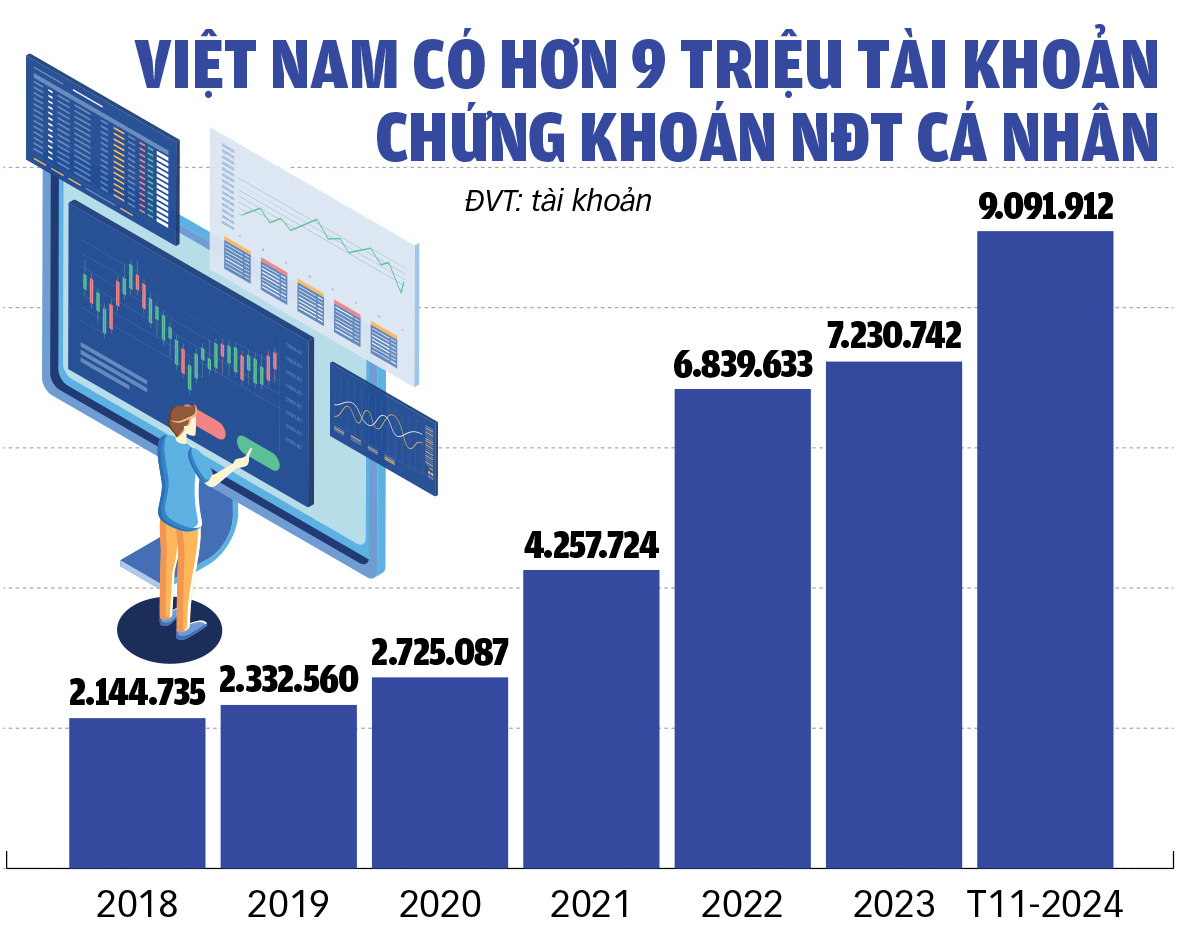

Source: VSDC - Graphics: TUAN ANH

Investors face difficulties in settling securities tax

According to Mr. Huy, with the management information system still quite fragmented, the connection of databases between securities companies is still separate as it is now, if tax settlement is required, it will be quite complicated, and will take more time for both investors and securities companies.

The director of another securities company expressed concern that if the amendment is to collect 20% of profits but losses are not deductible from tax in the following years, it will become unreasonable. Because collecting 20% of profits from securities investment is high, it is necessary to consider tax deduction if investors suffer losses.

"Researching and amending tax rates and how to calculate them also needs to take into account the impact on the stock market. This is an important capital mobilization channel for the economy, and we should not let excessively high or unreasonable tax collection affect this market," he said.

Mr. Dang Tran Phuc, Chairman of AzFin Financial Consulting and Training Company, also said that the "flat" tax collection mechanism of 0.1% will reduce the time for personal tax settlement, as well as the process of determining the purchase/sale price of stocks.

Meanwhile, tax settlement for securities investment activities is very complicated because securities accounts are not fixed and even fluctuate hourly.

Furthermore, the issue of dividends, additional issuance rights and many other factors can distort the investor's cost of capital, so it will be very difficult to determine what percentage of profit or loss...

"The most reasonable thing is to apply it to all transactions in a year. If investors make a profit, they will have to pay tax. If investors make a loss, they will be able to deduct tax for the following years when they make a profit," Mr. Phuc suggested.

According to Mr. Phuc, the 20% income tax is very complicated and needs to be carefully studied to be able to build appropriate and effective tax regulations, both to avoid tax losses and avoid incorrect taxation, creating fairness in stock investment.

"To make tax collection effective for the State and convenient for investors, it is necessary to promote solutions to synchronize data between securities companies and optimize tax-related procedures," Mr. Phuc proposed.

Mr. Nguyen Hoang Hai (Vice President of Vietnam Association of Financial Investors - VAFI):

High stock income tax is unreasonable

If the tax rate of 20%/income (profit) from securities as previously proposed is not appropriate. Because this tax rate is equivalent to corporate income tax, while enterprises can account for all incurred costs, individual investors cannot record the costs incurred.

Investors have to pay margin interest, brokerage fees and living expenses. If the costs cannot be accounted for and family deductions cannot be made, the 20% rate for individual investors is not feasible, especially for investors who choose securities trading as their main source of income and livelihood.

In developed markets like the US and many parts of Asia, income from securities for tax purposes is calculated based on the total income of the following year. Accordingly, low income can be exempted or reduced from tax, and losses this year can be recovered in the following years.

Vietnam cannot apply the method of developed countries. Therefore, it is possible to consider collecting securities tax in the form of lump-sum tax, but if the selling price minus the purchase price makes a profit, a 5% tax is paid, but if there is a loss, there is no tax. In addition, it is recommended to reconsider the tax rate for bonus shares because it is too high, while many investors are suffering heavy losses.

Specifically, according to current regulations, when receiving bonuses or dividends, investors will have 5% personal income tax deducted. However, on dividend payment closing dates, stock prices have decreased corresponding to the dividend percentage.

In essence, investors’ assets do not increase, and stock prices may even decrease when the market is unfavorable. Therefore, imposing a 5% tax on dividends or bonus shares is too high and unreasonable.

Research on additional separate tax regulations for derivative securities

The 2019 Securities Law stipulates that securities include stocks, bonds, derivatives and other types of securities. However, many experts believe that calculating tax based on the entire sale value for derivative securities investors is not reasonable.

The Ministry of Finance also acknowledges that there is a difference in nature between underlying securities and derivative securities. Accordingly, the value of derivative securities depends on the value of one or more underlying assets, and investors holding derivative securities do not enjoy shareholder rights as when holding underlying securities.

In addition, in the derivatives market, there are no transactions transferring the entire transaction value and transferring assets from the seller to the buyer like in the underlying market. The transfer payment between investors is only the price difference value (profit/loss).

Therefore, the Ministry of Finance agrees that it is necessary to study and supplement specific regulations on personal income tax for derivative securities to ensure consistency with the reality and characteristics of this activity, creating favorable conditions for taxpayers as well as tax authorities in the implementation process.

Source: https://tuoitre.vn/dau-tu-chung-khoan-co-lai-moi-nop-thue-nhieu-rac-roi-kho-kha-thi-20241213080341756.htm

![[Photo] President Luong Cuong receives former Vietnam-Japan Special Ambassador Sugi Ryotaro](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/20/db2d8cac29b64f5d8d2d0931c1e65ee9)

![[Photo] Prime Minister receives a number of businesses investing in Ba Ria-Vung Tau province](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/20/8e3ffa0322b24c07950a173380f0d1ba)

![[Photo] President Luong Cuong receives Ambassador of the Dominican Republic Jaime Francisco Rodriguez](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/20/12c7d14ff988439eaa905c56303b4683)

Comment (0)