|

| Overview of shareholders meeting |

On March 20, 2025, Nhat Viet Securities Joint Stock Company (stock code: VFS) held the 2025 General Meeting of Shareholders (GMS). The GMS approved the contents, including the 2025 business plan, the plan to increase charter capital, pay dividends in shares and approve the resignation of two senior personnel in the Board of Directors (BOD).

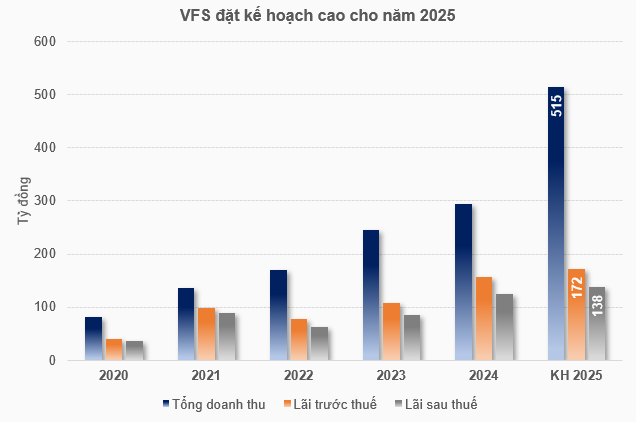

In 2024, VFS's revenue reached VND 293.67 billion, an increase of 20.1% compared to 2023 and completing 104% of the plan. Profit after tax was recorded at VND 125.17 billion, completing 101% and growing strongly by 46% compared to 2023.

All key business segments achieved positive results, VFS's proprietary trading activities reached VND 129.14 billion, + 34% over the same period; financial services revenue reached VND 96.64 billion, + 76% over the same period; brokerage revenue reached VND 48.82 billion, + 8% over the same period. VFS still maintains its attraction with the number of newly opened accounts increasing by 26% compared to the end of 2023.

VFS has also invested in deploying a new Derivatives Core system on the VGAIA 2.0 platform, ready to operate immediately after being approved by the State Securities Commission.

In 2025, VFS maintains a positive view on the stock market. VN-Index is expected to fluctuate within the range of 1,260 - 1,400 points with improved liquidity, about 18 - 20 trillion VND/session when cash flow shifts from investment channels such as deposits, gold... to the stock market. In addition, the expected official operation of the KRX system and the upgrade story will be the driving force to boost the market as well as foreign capital to return after consecutive net selling in 2024.

|

VFS sets a target of total revenue in 2025 of VND 515,155 billion, an increase of 75% compared to 2024; of which profit after tax is VND 137.98 billion, an increase of 10% compared to 2024.

Also within the framework of the congress, the Board of Directors submitted to the General Meeting of Shareholders for approval a plan to pay 8% stock dividends in 2024. This figure is expected to be 10% in 2025. In addition, the company also plans to offer 120 million shares to existing shareholders in 2025, after completing the share issuance to pay dividends in 2023 and 2024. The capital raised from the issuance will be allocated to two main activities: margin loans and proprietary trading.

Mr. Tran Anh Thang - General Director of VFS said that putting the KRX system into operation is a special thing that helps the stock market score points with foreign investors and increase liquidity. According to Mr. Thang, securities companies have received instructions to conduct a test scheduled for the upcoming April 30 - May 1 holiday. With 4-5 days off, this will be the time to block and test the system one last time before the Ministry of Finance and the State Securities Commission decide to put the KRX into operation.

“From the end of 2023 until now, VFS has always fully met all requests and inspections, testing and testing the trial connection system for the State Securities Commission, the Exchanges, and VSDC. The scoring results from VDSC and the Exchanges of VFS reached 99.98%. The remaining 0.02% are due to minor errors encountered by many securities companies. Currently, VSDC is editing to suit all core systems of securities companies. It can be said that VFS has basically completed 100% of all operating conditions for the KRX system to be put into operation in the coming time,” said Mr. Thang.

![[Photo] President Luong Cuong receives former Vietnam-Japan Special Ambassador Sugi Ryotaro](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/20/db2d8cac29b64f5d8d2d0931c1e65ee9)

![[Photo] Prime Minister receives a number of businesses investing in Ba Ria-Vung Tau province](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/20/8e3ffa0322b24c07950a173380f0d1ba)

Comment (0)