Specifically, Diamond Properties Joint Stock Company - an organization related to Mr. Bui Thanh Nhon, Chairman of the Board of Directors of Novaland - has just announced a plan to sell 4 million NVL shares from February 26 to March 26 by order matching and/or negotiation. If the transaction is successful, Diamond Properties' ownership ratio will decrease from 8.99% to 8.78%, equivalent to holding 171.38 million shares. At the current price of about VND17,350/share, this organization can earn more than VND69 billion.

|

Notably, another major shareholder, NovaGroup, has just registered to sell another 5 million NVL shares from March 27 to April 4, in order to balance its investment portfolio and support the company's financial restructuring. If completed, NovaGroup will reduce its ownership to 338.79 million shares, equivalent to 17.37% of charter capital. It is estimated that based on the closing price on March 21, this transaction could bring in more than VND54 billion.

Previously, NovaGroup had sold a total of 12.6 million NVL shares since the beginning of February, including the part that was sold for liquidation. At the same time, Mr. Bui Cao Nhat Quan - son of Chairman Bui Thanh Nhon - is also planning to sell 2.9 million shares for personal reasons.

In the market, NVL shares recorded a slight recovery, closing at VND10,750/share on March 21, up nearly 24% from the bottom of VND8,700/share set earlier. However, the current market price is still 35% lower than the same period last year.

The active trading situation surrounding NVL shares reflects the pressure on the company's financial restructuring, while also showing the flexible moves of major shareholder groups to respond to market fluctuations. NVL's average liquidity since the beginning of 2025 has reached more than 9.3 million shares per session.

Source: https://thoibaonganhang.vn/co-phieu-nvl-tiep-tuc-chiu-ap-luc-ban-nhom-co-dong-lon-day-manh-thoai-von-161735.html

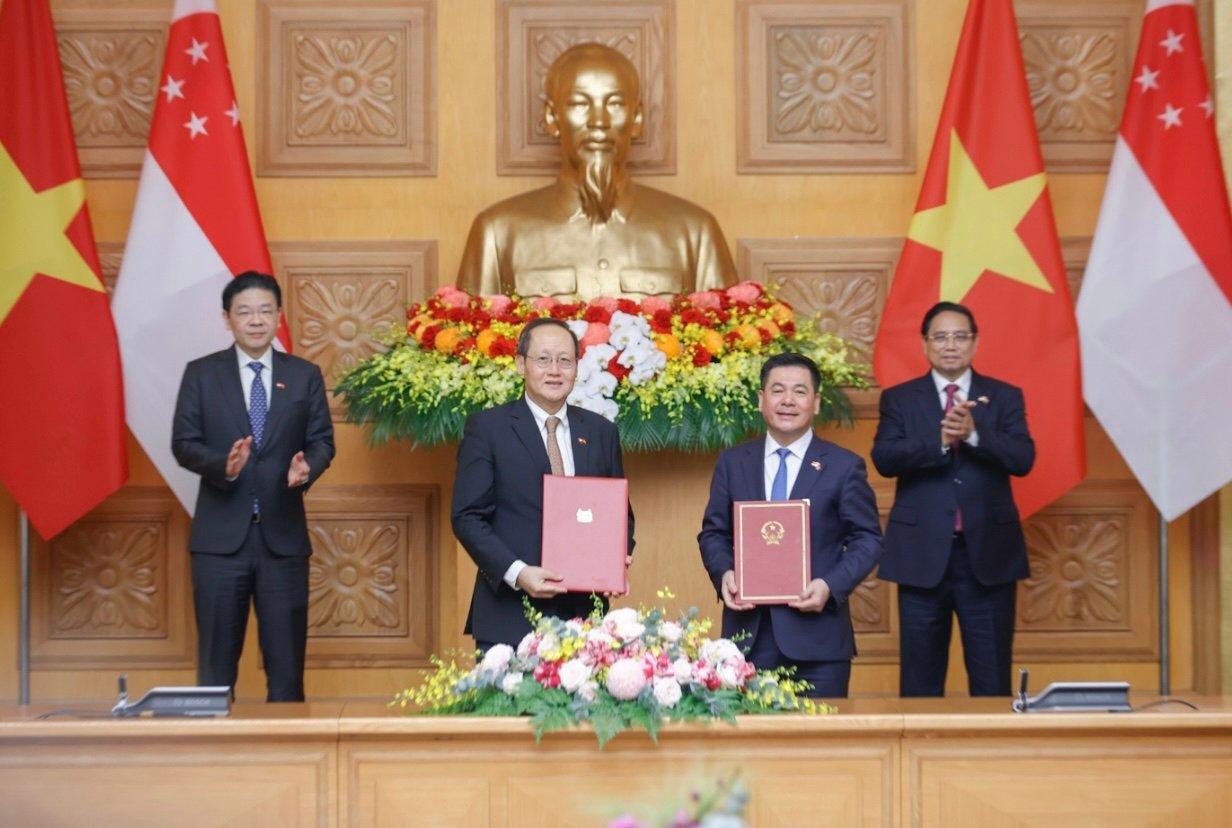

![[Photo] General Secretary To Lam receives Singaporean Prime Minister Lawrence Wong](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/4bc6a8b08fcc4cb78cf30928f6bd979e)

![[Photo] Prime Minister Pham Minh Chinh attends the launching ceremony of the "Digital Literacy for All" Movement](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/a58cb8d1bc424828919805bc30e8c348)

![[Photo] Editor-in-Chief of Nhan Dan Newspaper Le Quoc Minh receives Iranian Ambassador Ali Akbar Nazari](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/269ebdab536444818728656f8e3ba653)

![[Photo] Students of the Academy of Posts and Telecommunications visit the editorial office of Nhan Dan Newspaper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/51093483a84448ccb39d59333ead674e)

![[Photo] President Luong Cuong attends the 90th Anniversary of Vietnam Militia and Self-Defense Forces](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/678c7652b6324b29ba069915c5f0fdaf)

Comment (0)