Foreign exchange rate update table - USD exchange rate Agribank today

| 1. Agribank - Updated: March 21, 2025 07:30 - Time of website supply source | ||||

| Foreign currency | Buy | Sell | ||

| Name | Code | Cash | Transfer | |

| USD | USD | 25,350 | 25,370 | 25,710 |

| EUR | EUR | 27,304 | 27,414 | 28,527 |

| GBP | GBP | 32,600 | 32,731 | 33,694 |

| HKD | HKD | 3,221 | 3,234 | 3,341 |

| CHF | CHF | 28,561 | 28,676 | 29,582 |

| JPY | JPY | 168.08 | 168.76 | 176.04 |

| AUD | AUD | 15,848 | 15,912 | 16,434 |

| SGD | SGD | 18,850 | 18,926 | 19,470 |

| THB | THB | 740 | 743 | 776 |

| CAD | CAD | 17,497 | 17,567 | 18,078 |

| NZD | NZD | 14,538 | 15,042 | |

| KRW | KRW | 16.74 | 18.47 | |

Exchange rate developments in the domestic market

In the domestic market, according to TG&VN at 8:00 a.m. on March 20, the State Bank announced the central exchange rate of the Vietnamese Dong to the USD increased by 17 VND, currently at 24,807 VND.

The reference USD exchange rate at the State Bank of Vietnam is listed at: 23,617 VND - 25,997 VND.

USD exchange rates at commercial banks are as follows:

Vietcombank: 25,350 - 25,740 VND.

Vietinbank: 25,225 - 25,805 VND.

|

| Foreign exchange rates, USD/VND exchange rate today, March 21: USD 'climbs'. (Source: Xinhua) |

Exchange rate developments in the world market

The US Dollar Index (DXY) measuring the greenback's fluctuations against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF) increased by 0.37% to 103.80.

The US dollar rose as the US Federal Reserve (Fed) said it was in no rush to cut interest rates further this year due to fluctuations surrounding US tariff policy.

“We will not rush into action,” Fed Chairman Jerome Powell stressed.

Mr. Powell's comments and the Fed's statement underscore the challenge policymakers face in the face of President Donald Trump's tariff policies and the impact on the economy.

Data released on March 20 showed that the number of Americans filing new claims for unemployment benefits rose slightly last week, suggesting that the labor market remained stable in March.

Jayati Bharadwaj, global foreign exchange strategist at TD Securities, said that recent US data has helped ease concerns about slowing US growth, causing the greenback to fall by 7% against the euro since mid-January 2025.

Traders are now pricing in about 63 basis points of Fed cuts this year.

In a reverse move, the EUR fell 0.46% against the USD, to 1.0852 USD.

With UK inflation remaining above its 2% target, the Bank of England (BoE) has cut borrowing costs less than the European Central Bank and the Fed since last summer, contributing to the country's sluggish growth.

Sterling had earlier risen to a more than four-month high of $1.3015 in early trading, before falling 0.3% on the day to $1.29665.

The Japanese yen edged down to 148.79 yen after the Bank of Japan decided to keep interest rates unchanged and warned of global economic uncertainties, suggesting the timing of the next rate hike will depend on the impact of US tariffs.

![[Photo] Prime Minister Pham Minh Chinh meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/be2f9ad3b17843b9b8f8dee6f2d227e7)

![[Photo] President Luong Cuong and King Philippe of Belgium visit Thang Long Imperial Citadel](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/cb080a6652f84a1291edc3d2ee50f631)

![[Photo] Close-up of Vietnam's sniffer dog team searching for earthquake victims in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/d4949a0510ba40af93a15359b5450df2)

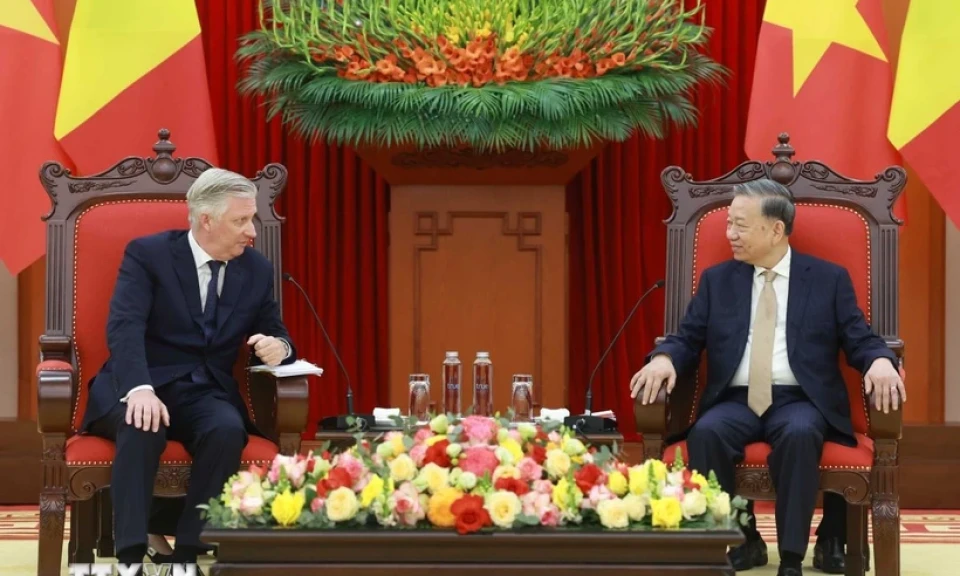

![[Photo] General Secretary To Lam receives King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/e5963137a0c9428dabb93bdb34b86d7c)

![[Photo] Myanmar's capital in disarray after the great earthquake](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/7719e43b61ba40f3ac17f5c3c1f03720)

Comment (0)