Gain points with weak cash flow

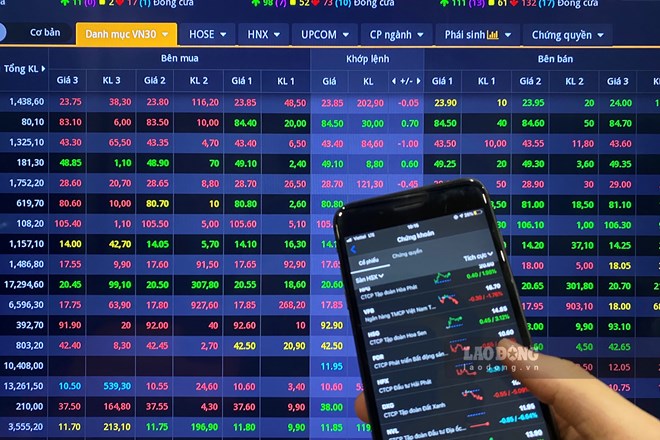

The stock market had a positive trading week (January 15-19) under the influence of important laws, the Land Law (amended) and the Law on Credit Institutions (amended), which were passed. VN-Index increased in most sessions of the week, ending the week at 1,181.50 points, up 2.32% compared to the previous week. HNX-Index was less positive, down 0.36% compared to the previous week to 229.48 points.

During the week, liquidity on HOSE decreased sharply by 28.4% compared to the previous week, only below the average. On HNX, it decreased even more sharply by 35.8%. This shows a strong level of differentiation and a positive upward trend mainly focused on a few stocks and the banking group. After 2 weeks of net selling, foreign investors increased their transactions and returned to net buying with a value of 586.2 billion VND on HOSE.

In detail, the banking stock group is positively affected by the credit growth target assigned at the beginning of the year and the Law on Credit Institutions (amended) being passed. The focus is mainly on the group of large banks and banks with business results growing in the fourth quarter of 2023 such as LPB (+4.82%), VCB (+4.40%), CTG (+3.49%), MBB (+3.28%)...

Financial services and securities stocks are strongly differentiated with quite sudden liquidity when many codes begin to announce financial reports for the fourth quarter of 2023, notably TVB (+14.90%), BSI (+10.11%), DSC (+6.77%), FTS (+2.50%)....

Real estate and industrial park stocks also had quite remarkable developments this week when the Land Law (amended) was passed. Most of them increased well, liquidity increased dramatically in many codes such as NLG (+7.14%), SZC (+6.41%), NDN (+6.12%), TIP (+5.31%), KDH (+5.02%)... Meanwhile, most other industry groups fluctuated within a narrow range, differentiated with decreasing liquidity.

Short-term uptrend prevails

From a short-term perspective, the analysis team from SHS Securities Company assessed that the market has moved positively and formed a new short-term uptrend. However, VN-Index will soon encounter the psychological barrier of 1,200 points and may fluctuate. The real strong resistance of the short-term uptrend will be the upper barrier of the medium-term accumulation channel around 1,250 points.

Short-term investors who bought in previous sessions should continue to hold their portfolios, limit chasing to increase the proportion when VN-Index is gradually approaching the psychological resistance of 1,200 points. For medium and long-term investors, the market is gradually consolidating and forming an accumulation platform, but this process will take a long time. Medium and long-term investors can completely disburse but with the view of buying and accumulating gradually because the time to form a new uptrend will be quite long.

Sharing the same view, Mirae Asset Securities Company also believes that the uptrend of VN-Index is currently dominant when RSI has surpassed the 70 mark but the index continues to increase strongly. After the 1,170 mark is conquered, the index will likely head towards a new resistance at the 1,200 zone.

According to Phu Hung Securities Company, the market continues its short-term recovery trend after the increase on January 19. Investors can continue to make short-term transactions to take advantage of the positive market trend. In particular, priority should be given to stocks with good fundamentals and positive Q4 profit growth reports.

Source

Comment (0)