Negative sentiment from foreign investors spreads; VN-Index likely to fall to 1,200 points; Vinpearl returns to the stock market; Dividend payment schedule; November stock list.

VN-Index drops sharply by 34 points under foreign pressure

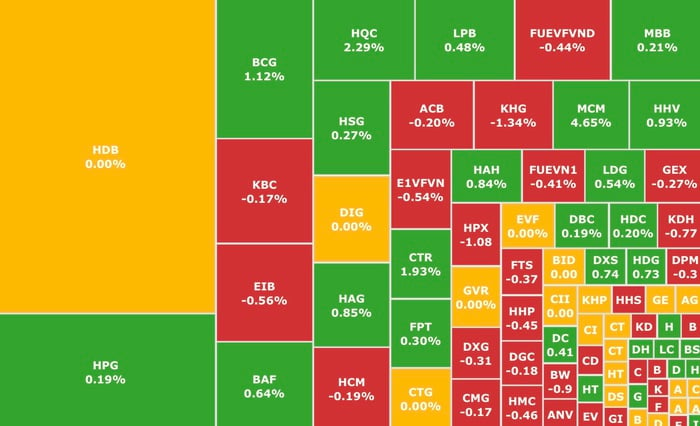

VN-Index continued to end a week of gloomy trading, with a sharp drop of 13.32 points (equivalent to 1.08%), to 1,218.6 points, the lowest in more than 3 months. On the HOSE floor, liquidity increased to nearly 18,650 billion VND, up 15.6% compared to the previous session, but was heavily tilted towards the selling side with 305 stocks decreasing and 75 stocks increasing.

Pillar stocks from the VN30 group were under great pressure when they fell nearly 15.5 points with 26/30 stocks decreasing, of which, SSI (SSI Securities, HOSE) decreased the most with 3% when foreign investors net sold 8.5 million units.

In addition, cash flow focused on banking, securities, and real estate groups with the main selling side, VIX (VIX Securities, HOSE) led liquidity with nearly 29.5 million units, down 2.2% in value.

Cash flow focuses on banking, securities, and real estate groups, but the selling side dominates (Photo: SSI iBoard)

The net selling trend of foreign investors spread in a negative direction to the entire market, the accumulated net selling value in 5 sessions reached 3,806 billion VND in the entire market. The two stocks VHM (Vinhomes, HOSE) and FPT (FPT, HOSE) were under the strongest pressure, at 868 billion VND and 606 billion VND respectively.

Rare “bright spots” appeared at KBC (Kinh Bac Urban Area, HOSE) and SZC (Sonadezi Chau Duc, HOSE) in the real estate group, increasing by more than 2%. Besides, VTP (Viettel Post, HOSE) continued to “go against the current” and increased to the peak with purple color, improving market price by 7%, reaching 122,500 VND/share, liquidity of nearly 2.5 million units.

Summing up the whole week, the VN-Index lost 34 points, marking the sharpest weekly decline amid widespread selling pressure.

VN-Index has retreated from its peak of more than 6% to its lowest level in the past 3 months. Liquidity has improved in recent sessions, but the index has continued to adjust and break near support levels, showing that unstable and negative sentiment still appears mainly among investors.

Novaland has 2 new Deputy General Directors

No Va Real Estate Investment Group Corporation - Novaland (NVL, HOSE) has just announced the appointment of Mr. Cao Tran Duy Nam and Ms. Tran Thi Thanh Van as Deputy General Directors of Novaland, effective from November 15, 2024. In the resolution of the Board of Directors, the appointment of two senior leaders is part of the plan to perfect the executive apparatus, contributing significantly to helping Novaland complete the transformation, restructuring and implementation of plans and strategies in the next phase.

2 new Deputy General Directors at Novaland, Mr. Cao Tran Duy Nam and Ms. Tran Thi Thanh Van ((Photo: Internet)

Mr. Cao Tran Duy Nam and Ms. Tran Thi Thanh Van are known as senior personnel, with more than 10 years of association with Novaland, contributing to important results for the Group's development process, especially during the restructuring period.

Previously, on November 1, Novaland's Board of Directors also appointed Mr. Duong Van Bac as the company's General Director (CEO) to replace Mr. Dennis Ng Teck Yow.

NVL shares are trading at their lowest level since the beginning of the year (Photo: SSI iBoard)

Regarding business situation, although in the third quarter of 2024, this real estate "giant" reported a record profit of 2,950 billion VND, in the first 9 months of this year, Novaland still reported a loss of 4,376 billion VND.

On the stock exchange, NVL shares have fallen sharply since mid-April and are currently at their lowest price since the beginning of the year.

Since July 2024, Sunrise Riverside (HCMC), a project of No Va Real Estate Investment Group - Novaland, has continuously handed over hundreds of pink books to residents. According to the plan, from now until the third quarter of 2025, the project will complete the paperwork and hand over about 3,000 pink books, demonstrating Novaland's efforts in fulfilling its commitments and ensuring the rights of home buyers.

Vinpearl returns to HOSE

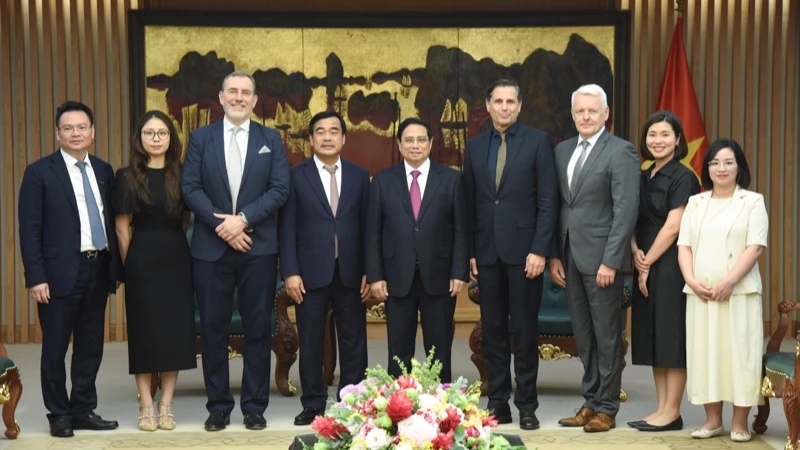

On November 15, the State Securities Commission completed the registration of Vinpearl JSC as a public company. This is an important step for this enterprise to prepare for listing on the stock exchange. This is part of the plan announced by Vingroup's leaders at the 2024 Annual General Meeting of Shareholders held last April.

Vinpearl JSC is registered at Hon Tre Island, Vinh Nguyen Ward, Nha Trang City, Khanh Hoa Province. Its main business activities are investment, construction and hotel and restaurant services. As of September 30, Vingroup (VIC, HOSE) owns 85.55% of the company's shares.

Vinpearl prepares to return to stocks (Photo: Vinpearl Nha Trang)

Previously, in 2008, Vinpearl was listed on HOSE with the code VPL, but on December 26, 2011, the company officially delisted. The reason was because Vinpearl merged into Vincom JSC to form Vingroup Corporation as it is today.

At the end of November 2023, before becoming a public company, Vingroup Corporation separated Vinpearl JSC and established a new subsidiary on the basis of the separation of the enterprise. The new company is named Ngoc Viet Trading and Business JSC, with an expected charter capital of VND 20,420 billion, with Vingroup holding over 99.96% of the shares. After that, this company was merged into VinSmart Research and Production JSC on April 22, 2024 to serve the purpose of internal restructuring and streamlining the enterprise system.

Regarding business results, Vinpearl suffered heavy losses during the COVID-19 pandemic with VND 9,570 billion in 2020 and VND 9,459 billion in 2021. However, the company returned to profit in 2022 and 2023. The most recent information is that in the first 6 months of 2024, Vinpearl reported a profit of VND 2,579 billion, nearly 4 times higher than the profit of the whole year of 2023.

Notably, Vinpearl's equity has increased sharply over the past 5 years. At the end of 2019, equity reached only 610 billion VND, but by June 30, 2024, it had increased to 31,513 billion VND, nearly 52 times higher. In the first 6 months of 2024 alone, equity increased by 18,196 billion VND.

Thus, including Vinpearl shares, billionaire Pham Nhat Vuong's Vingroup ecosystem has 5 listed companies in Vietnam, including: Vingroup Corporation (VIC, HOSE); Vinhomes JSC (VHM, HOSE); Vincom Retail JSC (VRE, HOSE); and Vietnam Exhibition Fair Center JSC (VEF, UPCoM). In addition, its subsidiary VinFast (VFS) is listed on the Nasdaq, USA.

REE seafood and KBC real estate stocks expected to increase positively

According to the investment portfolio of the second half of November 2024 of TCBS Analysts (Techcombank Securities), 2 stocks REE (REE Refrigeration Electrical Engineering, HOSE) and KBC (Kinh Bac Urban Area, HOSE) were suddenly added to replace CTG (VietinBank, HOSE) and HCM (HCMC Securities, HOSE).

Recent developments in REE stock (Photo: SSI iBoard)

REE shares are expected to be positive thanks to two main drivers: (1) Hydrology gradually shifting to La Niña phase, helping to improve output and operating efficiency of the hydropower segment; (2) The M&E backlog volume has recovered thanks to large projects such as Long Thanh airport and the occupancy rate at Etown 6 has increased sharply after coming into operation from June 2024.

Meanwhile, KBC recorded a clear improvement in business results. In the third quarter of 2024, revenue reached VND950 billion, more than 3 times higher than the same period, and after-tax profit reached VND196 billion, a sharp increase compared to VND14 billion in the same period last year.

At the same time, TCBS Analysts forecast that 2025 will be a year of positive growth for KBC when the Trang Due 3 project is expected to be approved for investment at the end of 2024 and start selling in 2025. At the same time, the industrial park real estate industry is expected to benefit greatly from the re-election of US President Donald Trump, opening up opportunities to attract FDI capital flows and large-scale projects.

List of stocks that "increased in price" after the market bottomed out

An Binh Securities (ABS) assessed that the market entered November with more positive news than last month.

Regarding international news, Mr. Trump's election as US President is expected to bring many major changes in US foreign policy, and hot spots of conflict in the world such as the Middle East have somewhat cooled down.

Domestically, production has recovered significantly, exports and FDI capital continue to be positive; credit growth has accelerated while the corporate bond market has decreased sharply, causing late-payment bonds; growth momentum is expected to continue to be positive in the remaining 2 months of 2024;...

However, the downside is the undesirable developments in the financial market with deposit interest rates increasing again in the first half of November while the exchange rate has increased again in the last 3 weeks.

Therefore, in the short term, the market still faces difficulties in cash flow as foreign capital continues to net sell in the context of the USD and US government bond yields rising again.

Investors should pay attention to groups of stocks that benefit from macro trends such as: industrial park real estate, textiles, seafood, technology, food, etc. At the same time, they should choose leading stocks with good fundamentals and profit growth prospects, showing more strength than the general market or stocks that form a bottom pattern.

ABS offers a list of recommended stocks for November, including: ELC (Elecom Technology - Telecommunications, HOSE), MSH (Song Hong Garment, HOSE), TCM (Thanh Cong Garment, HOSE), DTD (Thanh Dat Development, HNX), LHG (Long Hau, HOSE), SZC (Sonadezi Chau Duc, HOSE), VHC (Vinh Hoan, HOSE), ANV (Nam Viet, HOSE), BAF (BAF Agriculture, HOSE), VCG (Vinaconex, HOSE), DGC (Duc Giang Chemicals, HOSE).

Comments and recommendations

According to Mr. Nguyen Hung Phat, consultant, Mirae Asset Securities, negative sentiment is likely to continue this week, the support level of VN-Index is around 1,200 points before creating a balance zone when liquidity is quite gloomy.

The market is under pressure from the rising USD and President Trump's economic policies, which will cause foreign capital to continue to sell net in Vietnam and other countries in the region to invest in the US.

In addition, weak market cash flow and increased differentiation in business results have occurred more strongly as some industry groups' growth in the third quarter has not been as expected.

VN-Index meets strong psychological support zone at 1,200 points

However, the last week of November is expected to see a recovery to ease market sentiment in the face of a brighter macro backdrop and export sectors starting to show positive signs from business results.

Specifically, domestic exchange rate pressure will gradually decrease as the US Federal Reserve (Fed) continues to adjust short-term USD interest rates, and domestic USD resources will improve thanks to: trade surplus, remittances and high disbursed FDI.

In addition, the export and shipping sectors are expected to be positive at the end of this year and early next year as the wave of supply chain shifts out of China and countries increase imports in preparation for the year-end holidays.

In the long term, support from Circular 68 and amendments to the Securities Law to remove “pre-funding” obstacles for foreign investors and meet the conditions for upgrading the market will help welcome cash flows from foreign funds investing in Vietnam.

SHS Securities commented that VN-Index is under continuous strong selling pressure, causing the index to fall below the support zone of 1,220 points, liquidity is not very positive with increased trading volume at HOSE, the market tilt is negative. In addition, there is net selling pressure from foreign investors. Therefore, in the short term, the support zone of VN-Index is 1,200 - 1,210 points, this is also a strong psychological threshold, investors should pay attention.

SSI Securities believes that technical indicators continue to reflect negative signals in the short term, the next support point of the index will be around the 1,210 - 1,211 point area.

Dividend schedule this week

According to statistics, there are 19 enterprises that have fixed dividend rights from November 18 to 22, of which 18 enterprises pay in cash and 1 enterprise pays in shares.

The highest rate is 70%, the lowest is 3%.

1 company pays by stock:

Duc Thanh Wood Processing JSC (GDT, HOSE), ex-right trading date is November 19, rate is 10%.

Cash dividend payment schedule

*Ex-right date: is the transaction date on which the buyer, upon establishing ownership of shares, will not enjoy related rights such as the right to receive dividends, the right to purchase additional issued shares, but will still enjoy the right to attend the shareholders' meeting.

| Code | Floor | GDKHQ Day | Date TH | Proportion |

|---|---|---|---|---|

| HJS | HNX | 11/18 | 11/29 | 6% |

| PAT | UPCOM | 11/19 | 12/20 | 70% |

| XMP | UPCOM | 11/19 | 2/12 | 9% |

| NDW | UPCOM | 11/19 | 11/27 | 5.6% |

| BSA | UPCOM | 11/19 | 12/24 | 10% |

| SJD | HOSE | 11/19 | 12/20 | 18% |

| PAI | UPCOM | 11/19 | 12/31 | 9% |

| VEA | UPCOM | 11/19 | 12/20 | 50.4% |

| LLM | UPCOM | 11/19 | 12/20 | 4.5% |

| DGC | HOSE | 11/19 | 12/20 | 30% |

| GMX | HNX | 11/19 | 12/12 | 6% |

| ICN | UPCOM | 11/19 | 11/12 | 15% |

| TIX | HOSE | 11/20 | 12/25 | 12.5% |

| MFS | UPCOM | 11/20 | 12/23 | 25% |

| SFC | HOSE | 11/21 | 16/12 | 15% |

| SJG | UPCOM | 11/22 | 16/12 | 10% |

| VLP | UPCOM | 11/22 | 12/24 | 3% |

| NTC | UPCOM | 11/22 | 12/18 | 60% |

![[Photo] Nearly 2,000 people enthusiastically participated in the Olympic Running Day - For the security of the Fatherland](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/33bed26f570a477daf286b68b14474d4)

![[Photo] Prime Minister Pham Minh Chinh receives Chairman of Skoda Auto Group](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/298bbec539e346d99329a8c63edd31e5)

Comment (0)