SGGPO

Many opinions suggest that the ATC session should be abolished to avoid "drivers" (big investors with a lot of money) manipulating the market, affecting trading psychology as well as investor confidence.

The Vietnamese stock market increased quite nicely on the last trading session of the week, November 24, although during the session, the VN-Index market "surged" like a speedboat. Although there was no more selling pressure after the previous day's shocking drop, the market still faced great supply pressure throughout the session, causing the VN-Index to drop more than 10 points at times. However, in just the last 30 minutes of trading, especially in the last 15 minutes of the ATC session, strong demand poured into the market, causing the VN-Index to turn around and increase by nearly 8 points at the close of the session, which means a recovery of nearly 20 points from the lowest price of the session.

|

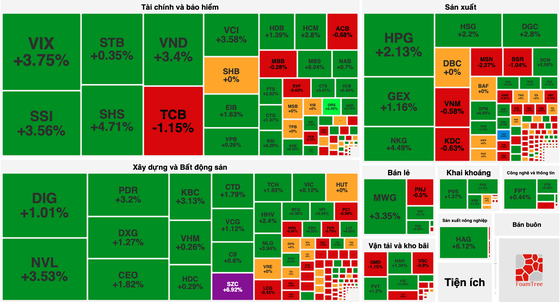

The market closed the weekend session of November 24 with a good increase. |

The two groups of stocks that turned around the strongest were still real estate - construction and securities. Of which, securities stocks were the first group to turn green, with BSI increasing by 6.29%, AGR increasing by 4.73%, VIX increasing by 3.75%, CTS increasing by 3.41%, VCI increasing by 3.58%, VND increasing by 3.4%, SSI increasing by 3.56%, FTS increasing by 2.82%, HCM increasing by 2.8%...

Many real estate - construction stocks also turned around and increased strongly: SZC increased to the ceiling, NLG increased by 3.94%, PDR increased by 3.2%, KBC increased by 3.13%, NVL increased by 3.53%, HHV increased by 2.4%, IDC increased by 2.3%, BCG increased by 2.38%...

Banking stocks also leaned towards green: HDB increased by 1.39%, CTG increased by 1.37%, EIB increased by 1.63%, BID increased by 1.51%; VCB, VPB, SSB increased by nearly 1%. Some stocks decreased, including TCB decreased by 1.15%; ACB, OCB, MBB decreased by nearly 1%...

Manufacturing stocks also traded well at the end of the session, with NKG up 4.49%, HPG up 2.13%, HSG up 2.2%, DGC up 2.8%, BMP up 3.37%, SAB up 4.3%...

At the end of the trading session, VN-Index increased by 7.12 points (0.65%) to 1,095.61 points with 146 stocks increasing, 381 stocks decreasing and 77 stocks remaining unchanged. At the end of the session on the Hanoi Stock Exchange, HNX-Index also increased by 1.56 points (0.69%) to 226.1 points with 57 stocks increasing, 102 stocks decreasing and 62 stocks remaining unchanged. Liquidity decreased with the total transaction value on the whole market being about VND22,100 billion, down VND2,000 billion compared to the previous session. Another positive point for the market was that foreign investors ended the previous net selling streak, returning to net buying nearly VND410 billion on the HOSE.

With the ATC session (periodic order matching at the end of the session in 15 minutes), many recent trading sessions have always fluctuated strongly: pulling up or pushing down, making investors passive and frustrated. Mr. Hung Cuong (District 3, Ho Chi Minh City) - a long-time investor in the stock market said that the VN-Index was "judged" by the "blindfolded" ATC session, which no longer reflects the true supply and demand of the market, but only represents a transaction agreement between the "big guys". From there, it affects the trading psychology of investors because when seeing the market suddenly drop sharply, investors often sell off, causing the market to fall even more sharply. "Hopefully, when the KRX trading system is put into operation, it will eliminate the ATO session (15 minutes of trading at the beginning of the session) and ATC so that these trading sessions do not assist in the market manipulation of big investors", Mr. Cuong expressed.

Regarding this, experts said that the reason why ATC sessions often fluctuate greatly is mainly due to the market leadership of "drivers". Experts as well as investors in the market believe that it is necessary to eliminate ATC and ATO trading sessions to avoid "price manipulation". At the same time, the State Securities Commission as well as competent authorities need to strengthen inspection and examination of unusual transactions; at the same time, increase sanctions against investors who manipulate the market, thereby helping the stock market develop in a more transparent and sustainable way; especially Vietnam is in the process of upgrading the market in the near future.

Source

Comment (0)