Foreign investors are net sellers while Vietnam's stock market is still struggling with finance, banking, and real estate, while the world is "hot" with AI.

Foreign investors sell net "jerky"

With 2025 just 16.6% of the way through, the Vietnamese stock market has attracted attention as foreign investors have been net sellers. Previously, in 2024, this move had been strong.

On the last trading day of February 2024, VN-Index stopped at 1,305.36 points after decreasing by 2.44 points, equivalent to 0.19%. Along with that, liquidity was relatively low when only nearly 819 million shares, equivalent to 18,662 billion VND were successfully transferred.

While domestic investors have yet to return to a state of excitement with the market, foreign investors recorded another net selling session, thereby recording a record high net selling level in the first two months of the year.

Specifically, on February 28 alone, the total buying volume of foreign investors was 52 million shares but the selling volume was up to 81.4 million shares. Foreign investors net sold 29.4 million shares.

In terms of transaction value, on the last day of February 2025, the total purchase value of foreign investors reached VND 1,796 billion but the selling volume was up to VND 2,732 billion. Foreign investors net sold VND 936 billion.

In general, in the first two months of 2025, foreign investors recorded a very large amount of selling. Accordingly, from January 1, 2025 to February 28, 2025, the net selling volume of foreign investors reached 300 million shares, equivalent to a transaction value of VND 16,008 billion.

|

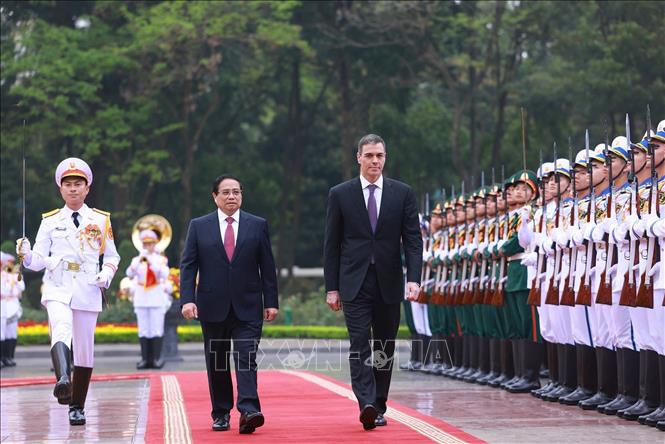

With just 16.6% of the way through 2025, the Vietnamese stock market has attracted attention as foreign investors have been net sellers. Illustrative photo |

The net selling value of VND16,008 billion is a record high if calculated based on the first two months of the year. In the same period in 2024, this figure was only nearly VND2,400 billion. In the same period in early 2023, foreign investors even net bought 120 million shares, equivalent to VND2,131 billion.

In terms of net selling price, some of the top stocks include FPT (VND 2,885 billion), VNM (VND 1,410 billion), STB (VND 1,195 billion), VCB (VND 976 billion), FRT (VND 863 billion), MSN (VND 859 billion), SSI (VND 831 billion), MWG (VND 830 billion), CTG (VND 801 billion),...

On the other hand, some stocks that foreign investors bought the most include: VGC (477 billion VND), GEX (327 billion VND), SHS (303 billion VND), HDB (242 billion VND), TCH (233 billion VND), GVR (227 billion VND),...

It can be seen that foreign investors tend to trade many stocks in the finance, banking, and retail sectors.

AI is hot globally

Analyzing the net selling situation of foreign investors, Mr. Phan Dung Khanh, Investment Consulting Director of Maybank Investment Bank, said that this move is not new but has been happening massively since 2024.

Specifically, in 2024, although the net selling of foreign investors in the first two months of the year was only "light" with nearly VND 2,400 billion, but for the whole year, foreign investors net sold more than 2.4 billion shares, equivalent to VND 80,130 billion (about USD 3.2 billion), a sharp increase compared to the net selling value of VND 19,512 billion in 2023.

Mr. Dung Khanh assessed: "A sad record in 2024 is the net selling value of foreign investors."

According to Mr. Khanh, there are many reasons for this situation. Firstly, although US interest rates have been lowered, they are still high, and USDX has increased by more than 100 points. The high USDX has caused foreign investors to not only sell net in the Vietnamese market but also in many other markets.

|

| Foreign investors tend to trade many stocks in the finance, banking, and retail sectors. Illustrative photo |

The US dollar rallied on Wednesday to move further away from its recent 11-week low, Reuters reported, as investors assessed the strength of the economy and the prospect of tariffs following recent comments from US President Donald Trump.

However, the good news is that only FII (foreign indirect investment) in the stock market was withdrawn, while FDI (foreign direct investment) was still a net inflow.

“And another important thing is that in large stock markets like the US, technology stocks dominate the AI and semiconductor wave, but in the domestic market, technology stocks are absent, about 50% of capitalization is concentrated in banking and real estate stocks,” commented Mr. Dung Khanh.

While the world trend is technology and AI, the Vietnamese market is still revolving around banking and real estate. The consequence is that while the US stock market surpassed its historical peak dozens of times last year, the VN-Index had to touch 1,300 dozens of times to surpass this mark. This is much lower than the peak of more than 1,510 points.

If compared with VN-Index, Mr. Khanh gave an example that currently, VN-Index is only hovering around 1,300 points, while FPT stock, the "big brother" of technology stocks, has surpassed its historical peak 42 times last year.

Specifically, closing the last session of 2024, FPT stopped at 152,500 VND/share, an increase of 56,400 VND/share, equivalent to 58.6% compared to the end of 2023. Thanks to that, FPT Group's market capitalization increased by 96,208 billion VND (equivalent to 3.8 billion USD).

To attract foreign capital back to the market, according to Mr. Khanh, one of the most important factors is upgrading the market. If this is achieved, Vietnam can attract stronger capital flows, creating a positive spillover effect to domestic investors.

| According to data from the Vietnam Securities Depository and Clearing Corporation (VSDC), as of December 31, 2024, foreign investors owned more than VND 323,531 billion worth of securities (about USD 12.65 billion), accounting for 7.35% of the total value of securities registered at VSDC. |

Source: https://congthuong.vn/khoi-ngoai-ban-rong-do-viet-nam-khong-bat-trend-ai-376148.html

![[Photo] Visiting Cu Chi Tunnels - a heroic underground feat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/8/06cb489403514b878768dd7262daba0b)

Comment (0)