Strong selling pressure

The stock market had a busy trading week with high liquidity, unfortunately the decline at the end of the week took away almost all the achievements of the previous sessions.

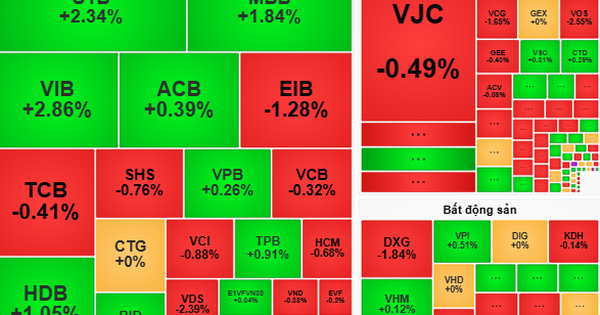

In the last trading session of the week yesterday, strong and decisive selling pressure across the market caused the VN-Index to plummet from the short-term peak of 1,240 points, evaporating nearly 30 points and falling close to 1,210 points. All industry groups changed color, except for the group of seafood stocks that were trying to maintain light green.

Notably, market liquidity has skyrocketed. On the HOSE floor, trading volume has exceeded 1.3 billion units, with a total trading value of over 1.2 billion USD before the market entered the ATC order matching session, the highest since the end of September 2023.

The market witnessed a red trading session at the end of the week and foreign investors also "contributed" by continuing to net sell nearly 800 billion VND, with the focus on VPB and MWG shares. For the whole week, foreign investors continued to net sell nearly 1,510 billion VND on both exchanges. Foreign investors net sold more than 1,470 billion VND on HOSE and net sold nearly 40 billion VND on HNX.

Last week, the market received notable information such as: credit growth by the end of January 2024 decreased by 0.6% compared to the beginning of 2023; the State Bank continued to maintain the current operating interest rates, at least in the first half of 2024. During the week, the most easily noticeable general trend in the market was the cash flow to banking stocks, helping liquidity increase significantly and many stocks increased positively, before facing profit-taking pressure in the last session of the week.

Favorable capital flow for stock market

The stock market is often influenced by both cash flows and fundamentals. The movement between cash flows and fundamentals may lead to different market reactions in 2024. Regarding the fundamentals that may affect the market, since 2023 is a year with many measures to “delay time” waiting for the real estate and financial markets to return to normal, a recovery is expected to help the financial system avoid major challenges in 2024.

In a recently published report by SSI Securities Company, analysts from this company said that economic recovery is likely to be more evident in the second half of 2024, with exports increasing thanks to lower global interest rates and a gradual return of consumer confidence.

Domestically, the main focus will still be on the recovery of the real estate industry in the context that real estate businesses need to quickly resolve legal issues of projects and the real estate lending rate is still high. If liquidity in the real estate market and corporate bonds does not recover quickly, consumer confidence will be affected.

Both retail and foreign investor flows have been favorable for the stock market this year, while fundamentals remain a concern with a number of factors to watch. 2024 is expected to be a volatile year, with a sharp recovery likely to follow shortly after a deep correction.

SSI Research believes that the fair value for the VN-Index at the end of 2024 is 1,300 points, although there may be times during the year when the market exceeds this threshold. Regarding investment themes for the year, profit growth will be the main driving force for stocks to increase significantly this year. In addition, in the context of record low interest rates, high dividend yields are becoming an attractive factor.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)