VN-Index fluctuates at 1,275 points; Vinamilk plans to start construction of a trillion-dollar factory; Dividend payment schedule; LPBS announces female leader in charge of Board of Directors activities.

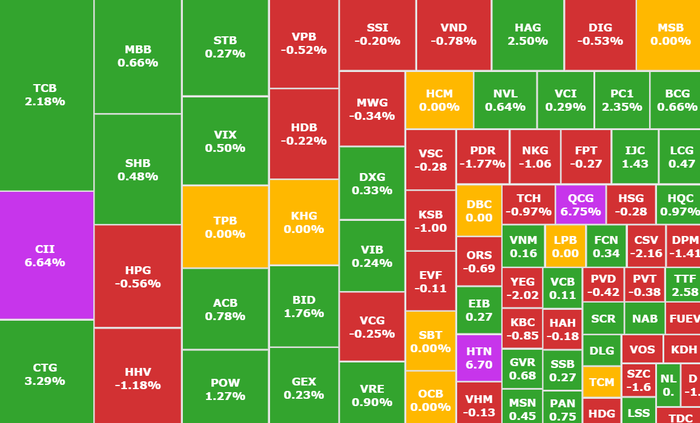

VN-Index increases smoothly, struggling at 1,275 points

Cash flow focused on the banking group, helping the VN-Index continue its smooth recovery after the first trading week of the Year of the Snake. However, profit-taking pressure appeared in many stocks of the mid- and small-cap group, creating a barrier for the index. The VN-Index struggled, closing the week at 1,275 points, up 10.15 points compared to the beginning of the week.

The HNX and UPCoM floors closed the week with 2,129.49 points and 97.24 points, respectively.

Liquidity improved somewhat, with total trading volume on February 7 reaching more than 619 million shares (up 9% compared to the previous session), equivalent to VND14,693 billion (up 13.7%). On the entire HOSE floor, there were 237 stocks increasing, 212 stocks decreasing and 71 stocks remaining unchanged.

Banking group leads the market to maintain "green color" (Photo: SSI iBoard)

The banking group led the market, in which CTG (VietinBank, HOSE) increased to a historical high, followed by BID (BIDV, HOSE) and TCB (Techcombank, HOSE). Other banking stocks such as ACB (ACB, HOSE), MBB (MBBank, HOSE), SSB (SeABank, HOSE), STB (Sacombank, HOSE), VIB (VIB, HOSE), ... also maintained green but the increase was not too strong.

At the same time, foreign investors still maintained their net selling position with VND 1,050 billion on the HOSE floor, which somewhat increased negative sentiment among investors.

The focus belongs to MSN (Masan, HOSE) with nearly 900 billion VND, followed by MWG (Mobile World, HOSE) and VCB (Vietcombank, HOSE).

LPBank Securities Company elects female leader in charge of Board of Directors activities

Recently, Ms. Vu Thanh Hue, Vice Chairwoman of the Board of Directors, was assigned by the Board of Directors of LPBank Securities Joint Stock Company (LPBS) to be in charge of the activities of the Board of Directors.

This change in senior personnel aims to ensure stability in LPBS's operations, while maintaining the Company's sustainable development orientation.

Ms. Vu Thanh Hue, Vice Chairman of LPBS Securities Board of Directors (Photo: Internet)

It is known that Ms. Vu Thanh Hue has held the position of Vice Chairman of LPBS Board of Directors since December 2023 and currently owns 14% of the company's shares.

The change in senior leadership comes from Mr. Pham Phu Khoi's resignation to focus on his new role as Vice Chairman of the Board of Directors at Loc Phat Vietnam Bank (LPBank).

Regarding business performance, in 2024, LPBS recorded nearly VND 193 billion in operating revenue and more than VND 80 billion in net profit, respectively 4.6 times and 5.7 times higher than the figures in 2023. In addition, in the past year, LPBS completed the increase in charter capital from VND 250 billion to VND 3,888 billion.

Tan Viet Securities Company reported a loss of nearly 70 billion VND.

According to the Q4/2024 business results announcement of Tan Viet Securities (TVSI), total operating revenue reached VND35.7 billion, coming from 3 main sources of revenue: FVTPL financial asset valuation difference, securities brokerage and margin lending. However, after deducting expenses, TVSI reported a loss after tax of VND35.3 billion.

For the whole year of 2024, TVSI recorded total operating revenue of VND 168.5 billion, down 17% year-on-year. Profit after tax was negative VND 68.7 billion, an improvement compared to the loss of VND 397.9 billion in 2023.

TVSI plays a "link" role in the mining scam at Van Thinh Phat (Photo: Internet)

TVSI is the company of Ms. Truong My Lan, assigned by the Ho Chi Minh City Judgment Enforcement Department to guide bondholders in the Van Thinh Phat case to complete the documents to receive compensation, because Ms. Truong My Lan indirectly owns 91.54% of the charter capital (through 6 individuals and 4 companies under her name).

TVSI Securities played an important role in the Van Thinh Phat fraud, appropriating more than VND30,000 billion from issuing bonds to more than 35,000 bondholders. This amount was mobilized through 4 companies: An Dong, Quang Thuan, Sunny World and Setra.

Accordingly, TVSI was selected as the consulting and bond issuing unit, responsible for completing documents, procedures, disclosing information and representing the four issuing companies in signing purchase and transfer contracts with bondholders.

Vinamilk plans to start construction of a trillion-dollar milk factory in the second quarter of 2025

SSI Securities has released its latest forecast for 2025 that Vietnam Dairy Products Joint Stock Company - Vinamilk (VNM, HOSE) will focus more on the domestic market with new dairy farms and meat factories.

Accordingly, the Hung Yen milk factory project can increase the total capacity of Vinamilk (VNM) factories by about 40% to nearly 1.2 billion liters of milk per year. The project is expected to begin construction in the second quarter of 2025. The project has a total estimated investment of VND 4,600 billion (nearly 200 million USD), on an area of nearly 25 hectares, with a total designed capacity of about 400 million liters per year, and is expected to be built in 2 phases.

Many factory projects to increase productivity at Vinamilk are expected to start construction and come into operation this year (Photo: Vinamilk)

In addition, Vinamilk is also operating phase 1 of the Lao-Jagro project with a scale of 24,000 cows, with a long-term orientation to increase to 100,000 cows. The Moc Chau Milk Paradise project has also completed the breeding farm, and the remaining components of the project are in the process of resolving land procedures.

Regarding business results, according to the consolidated financial report for the fourth quarter of 2024, Vinamilk's cumulative revenue for the year reached a record VND61,800 billion, up nearly 3% over the previous year. Of which, net revenue from foreign markets reached nearly VND11,000 billion, up 12.9%. Growth drivers, in addition to traditional markets, also come from high-end markets such as Taiwan (China), Korea, Japan, Canada and the US.

As a result, after-tax profit reached nearly VND9,500 billion, slightly exceeding the yearly plan.

Comments and recommendations

Mr. Truong The Vinh, Investment Consultant , Mirae Asset Securities, Comments, the stock market last week traded positively with a recovery trend. Short-term technical analysis shows that VN-Index is approaching the resistance zone of 1,270 - 1,285, facing a tug-of-war between supply and demand.

The market "struggles" when entering the old resistance zone

Positive information on the macro economy when the General Statistics Office recently announced that the macro economy data for January 2025 was quite positive in some industry groups and despite being affected by the long Lunar New Year holiday, industrial production (IIP) and realized public investment still grew positively compared to the same period.

However, one factor that investors need to pay special attention to is that foreign net selling pressure has been maintained throughout the 5 trading days of the past week, possibly due to exchange rates, the difference in domestic and foreign interest rates, potential instability for emerging and frontier markets facing the risk of a global trade war...

The criteria for selecting stocks for new investors will still be based on the business results of the fourth quarter of 2024, he recommended:

The retail industry with industry-wide profits expected to continue to increase strongly above the low base level of the same period in 2023 when consumer demand and purchasing power recover, potential stock is FRT (FPT Retail, HOSE).

The real estate industry is in the peak period of handover of businesses, the market is gradually warming up, many investors have started to launch and open for sale in the last phase of 2024 and 2025, especially in the Northern region, potential stocks are DPG (Dat Phuong Group, HOSE).

In addition, there is industrial park real estate with KBC (Kinh Bac Urban Area, HOSE), export with PTB (Phu Tai, HOSE).

BSC Securities believes that VN-Index continues to fluctuate at high prices, the market breadth is quite balanced with 6/18 sectors gaining points, in which Insurance leads, followed by Banking with positive trading performance. Other sectors have no significant fluctuations. The recovery of VN-Index has slowed down since the middle of last week, showing the cautious sentiment of investors as the market approaches old resistance levels.

Phu Hung Securities assessment, current signals show that the index may surpass the 1,280 point mark, however, it is necessary to pay attention to the resistance zone of 1,285 - 1,300 points which is quite close above, there may be a correction when approaching this area. The general strategy of investors should prioritize holding the position, and can consider taking partial profits if the VN-Index increases strongly to the resistance zone of 1,285 - 1,300 points.

Dividend schedule this week

According to statistics, there are 5 enterprises that have decided to pay dividends in cash, of which 4 enterprises pay in cash and 1 enterprise issues additional shares.

The highest rate is 45%, the lowest is 6%.

1 additional issuer:

Masan Consumer Goods Corporation (MCH, UPCoM), ex-rights trading date is February 11, 2025, last registration date is February 12, 2025. Ratio is 1000:451, price is 10,000/share (1 share is 1 right, 1,000 rights can buy 451 new shares).

Cash dividend payment schedule

*Ex-right date: is the transaction date on which the buyer, upon establishing ownership of shares, will not enjoy related rights such as the right to receive dividends, the right to purchase additional issued shares, but will still enjoy the right to attend the shareholders' meeting.

| Code | Floor | GDKHQ Day | Date TH | Proportion |

|---|---|---|---|---|

| PNJ | HOSE | 10/2 | 10/3 | 6% |

| CLC | HOSE | 11/2 | 27/2 | 15% |

| TDM | HOSE | 11/2 | 2/7 | 14% |

| PGI | HOSE | 13/2 | 4/3 | 10% |

Source: https://phunuvietnam.vn/chung-khoan-tuan-10-14-2-vn-index-chung-nhip-hoi-phuc-tai-vung-1270-1285-diem-20250210085046314.htm

![[Photo] Bustling construction at key national traffic construction sites](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/2/a99d56a8d6774aeab19bfccd372dc3e9)

![[Photo] Binh Thuan organizes many special festivals on the occasion of April 30 and May 1](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/1/5180af1d979642468ef6a3a9755d8d51)

![[Photo] "Lovely" moments on the 30/4 holiday](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/1/26d5d698f36b498287397db9e2f9d16c)

Comment (0)