(NLDO) - Liquidity decreased compared to the previous session, showing that cash flow has slowed down, but investors can take advantage of the recovery to take profits.

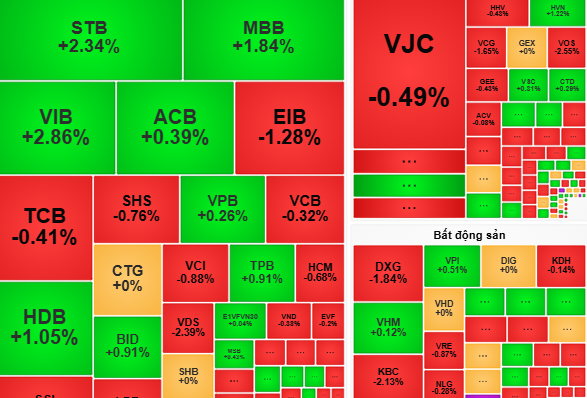

At the end of the session on December 26, the VN-Index decreased by 1.1 points (-0.09%), closing at 1,272 points.

Vietnamese stocks were green when entering the trading session on December 26. However, the increase was quite modest and the market quickly returned to a tentative state. The main development of this session was investors buying and selling stocks in a tug-of-war.

At the end of the session, the VN-Index decreased by 1.17 points (-0.09%), closing at 1,272 points.

According to Dragon Capital Securities Company (VDSC), with the cautious market performance, the green color has narrowed significantly, but overall, stock prices have only increased and decreased slightly. Banking stocks are making efforts to support the market. On the contrary, retail, steel, technology stocks, etc. have retreated.

"The decline in liquidity with 502.1 million shares matched on the HOSE shows that cash flow has slowed down. This development is showing supply and demand exploration activities. However, investors can still expect the market to increase in the next session to hold stocks with positive developments" - VDSC commented and recommended.

Meanwhile, VCBS Securities Company stated that the differentiation of cash flow is continuing, and the demand for disbursement is still present. This shows that the VN Index is moving stably around the resistance level of 1,275 points. Therefore, investors should take advantage of this opportunity to disburse stocks with upward signals, and consider realizing profits from stocks with strong selling pressure.

Source: https://nld.com.vn/chung-khoan-ngay-mai-27-12-tien-chay-vao-co-phieu-cham-lai-196241226182823848.htm

Comment (0)