ANTD.VN - Many people open credit cards but "forget" to pay the debt, or do not use the card, leading to annual fee debt, or bad guys steal information to open cards, commit transaction fraud... These are common causes leading to bad debt cases without knowing it.

Bad debt, also known as bad debt, is when the borrower cannot repay the debt on time as committed in the loan contract with credit institutions such as banks and financial companies.

According to regulations, bad debt is debt that is overdue for more than 90 days. When being included in the list of bad debt customers according to the classification of the National Credit Information Center (CIC), customers will face many difficulties when wanting to borrow capital from any bank or credit institution in the future.

However, in reality, there will be many situations where customers accidentally incur bad debt without knowing it, thereby affecting their CIC credit score.

Currently, many banks have applied credit card management on digital banking apps, so customers can easily manage their debt status, or set up automatic payment features. However, in some cases, customers have opened a card and used it for a long time, but no longer use the banking app, leading to the old debt amount, even if the value is very small, being classified as bad debt.

In addition, with banks racing to issue cards and customers opening cards without careful research, activating cards without using them, leading to annual fee debt, overdue payments also lead to bad debt.

There have been many cases where customers had their identity card information stolen by criminals to open a card and make transactions. Accordingly, the debt was transferred to bad debt and continuously incurred interest while the person whose name is on the credit card did not know anything.

After the recent incident of a customer using a card for 8.5 million and incurring a bad debt of more than 8.8 billion VND, many customers were shocked and tried to find ways to check whether they had bad debt or not.

Accordingly, to check whether you have bad debt or not as well as check your credit score, users need to have an account on CIC.

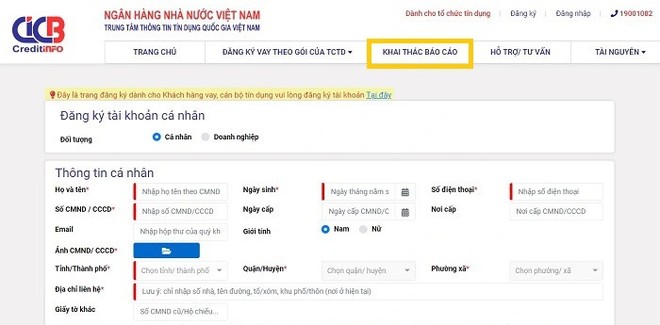

|

Customers can check bad debt on CIC's official website. |

To register, users access the official website of CIC at https://cic.gov.vn/ or the App CIC Credit Connect and proceed to register an account by clicking on the Register section. Then, users enter all their personal information according to the form, including full name, date of birth, phone number, ID card/CCCD photo, and at the same time authenticate facial biometrics to ensure the match with the CCCD...

|

CIC App on phone |

After successfully registering, customers can look up their credit information. The Personal Loan Customer Credit Information Report will include information such as: Current credit relationship information (loan amount and lender), bad debt history information in the last 5 years, loan security information, credit score information.

CIC's personal credit rating has 5 levels: Very good, Good, Average, Below average, Poor.

Credit scores are evaluated on the entire credit relationship data of the borrower at the end of the month closest to the time of assessment. Credit scores are updated periodically by CIC every month according to changes in borrower information.

If any incorrect information is found, customers should report to CIC via Hotline 1800585891 or the "Complaints/Feedback" section on the website: https://cic.gov.vn (attach supporting documents).

Accordingly, in case of errors in data processing, CIC is responsible for correcting the errors and notifying the customer of the results.

In case of incorrect information at the credit institution reporting the information, the staff will guide the customer to work with the relevant credit institution to verify and clarify. In case of determining any errors, the General Director of the credit institution or authorized person is responsible for sending a written request to CIC to update and correct the information.

Customers should also note that credit cards have very high interest rates, usually around 20-40%/year depending on the bank, not including late payment fees. Therefore, credit card users need to pay attention to their spending to pay off debt on time, avoiding interest on interest over a long period of time.

Source link

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)