Trading slows ahead of holiday

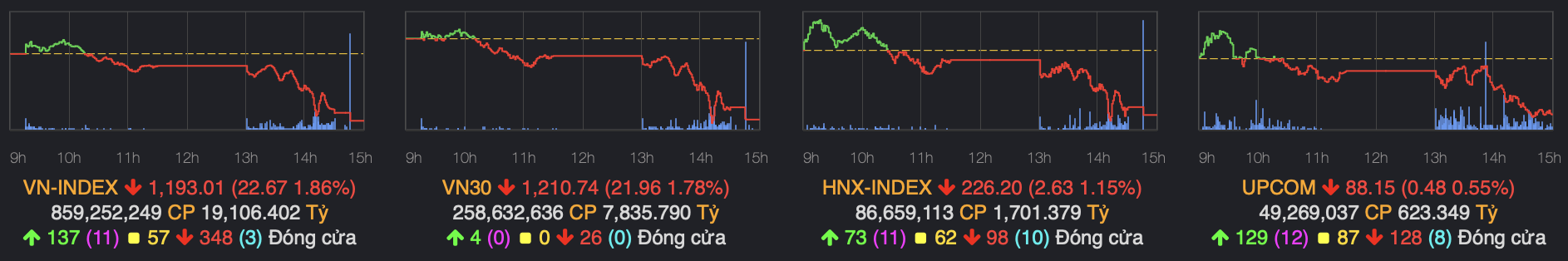

It seemed that the decline had been slowed down thanks to yesterday's candle with a shortened leg, but selling pressure continued today (April 17). In less than half of the morning session, the VN-Index could not stay above the reference level and turned red. The decline widened further towards the end of the day with the main index plunging 22.68 points, equivalent to 1.86% to 1,193 points.

Today, buyers were more hesitant to spend money when liquidity reached VND19,106 billion, down 36% compared to the previous day. Foreign investors returned to the net selling trend with a net value of VND987 billion, mainly in FUEVFVND fund certificates. VHM (-2.11%) continued to be net withdrawn by foreign investors with an additional VND145 billion.

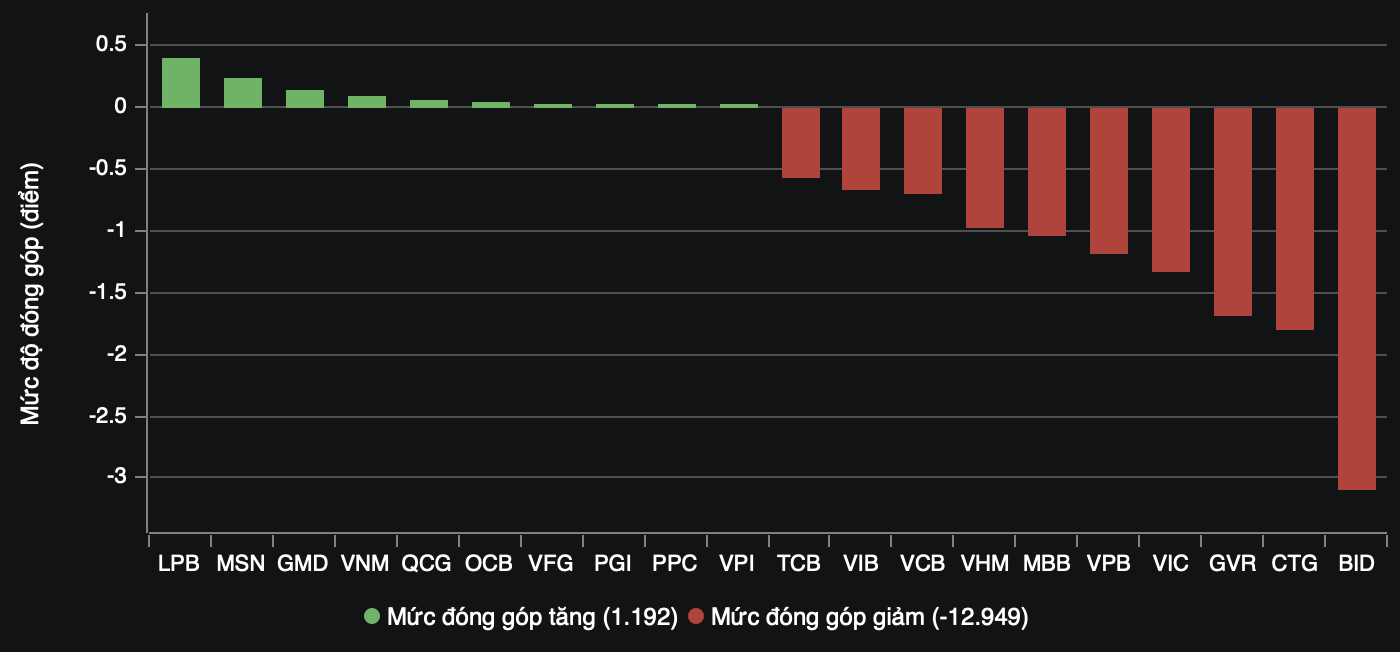

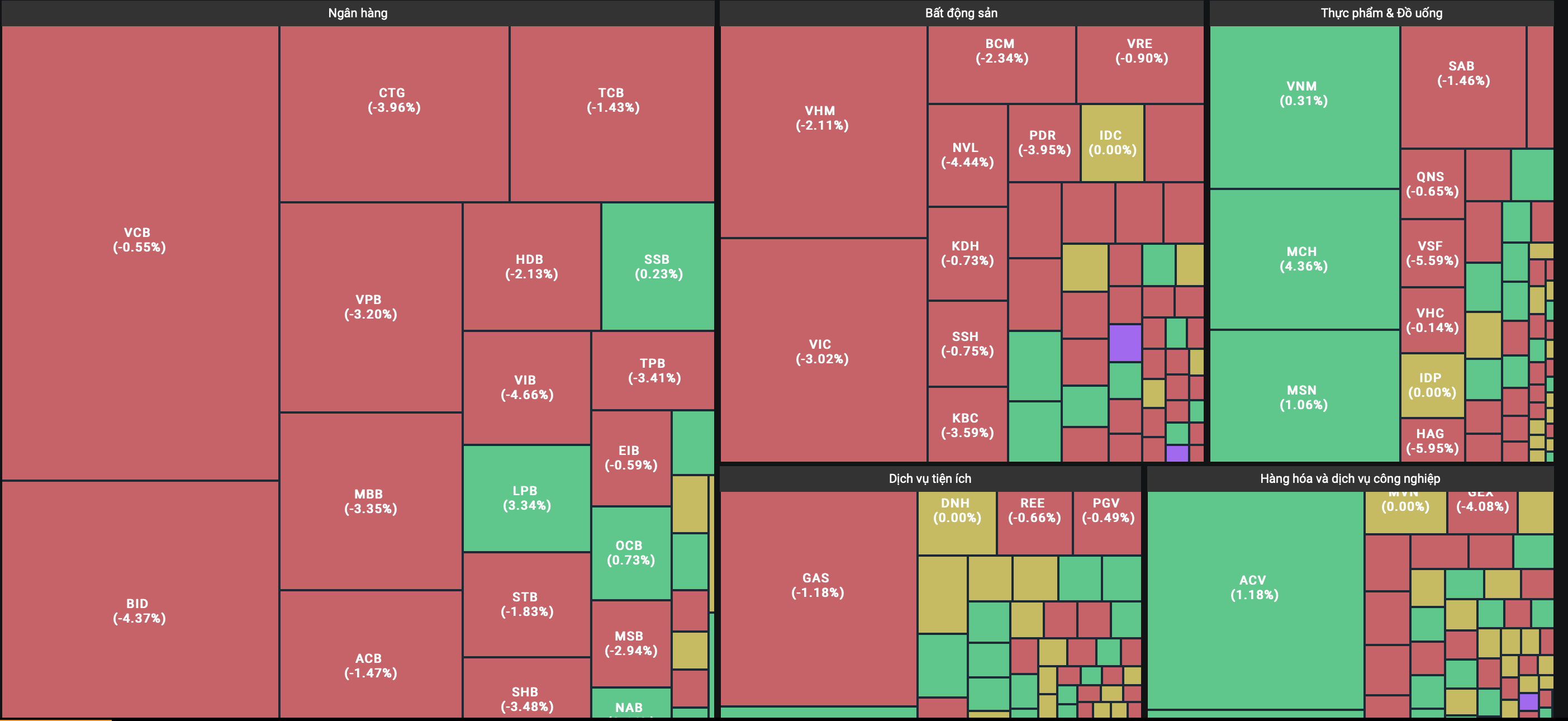

The locomotive pulling VN-Index broke the important psychological support level of 1,200 points, named financial and real estate stocks. In the securities group, FTS decreased to 53,100 VND/share, VCI, MBS, BSI, CTS, ORS... lost more than 5%. A series of banking stocks weakened by more than 3% such as CTG, BID, VPB, MBB, SHB, TPB... BID alone became the biggest pressure on the market today when it decreased by 4.37% to 48,100 VND/share, taking away more than 3 points from VN-Index.

The real estate group was not much more positive with VIC losing 3.02%; NVL down 4.44%; PDR down 3.95%... There were still a few stocks going against the trend, typically VPI up 1.08%; SZC up 1.82%; QCG purple ceiling.

Analysts recommend that investors should proactively restructure and reduce their portfolios. Take advantage of the bounces to bring the proportion of stocks in the portfolio to a safe level of under 30%. At the same time, they should not use leverage during this period in order to maximize short-term portfolio risk management.

Market correction is when "big hands" buy in

Mr. Vo Nguyen Khoa Tuan - Senior Director of Securities at Dragon Capital - assessed that in the short term, the correction may continue but this will not affect the medium-term uptrend of the market. The correction will create a new cycle for the market to continue to conquer new peaks.

According to Mr. Tuan, as soon as the adjustment period was predicted, Dragon Capital prepared a plan to increase the proportion of cash and reduce the proportion of stocks. This is also the time to soberly re-evaluate investments to restructure the portfolio. In particular, taking advantage of the opportunity to buy stocks with good prospects at cheap prices so that when the market increases again, the fund's portfolio will also recover strongly.

"In fact, when small investors sell at all costs, that's when we prepare to buy," Dragon Capital expert revealed.

He also said that investors are having a lot of worries during this period when information about the FED's interest rate policy, geopolitical tensions, exchange rates, domestic monetary policy... appears frequently. However, reading too much news does not necessarily lead to making the right decision. Instead, investors need to stick to their strategy and have a longer-term vision.

Source

Comment (0)