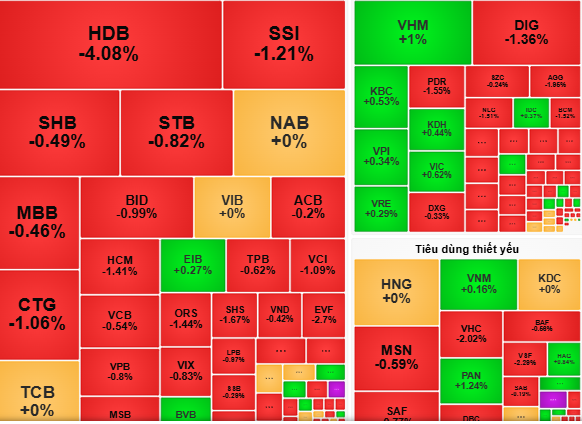

(NLDO) - Selling pressure from banking stocks in the January 9 stock market session has spread to many other groups, and the pressure to supply stocks may not stop yet.

At the end of the session on January 9, the VN-Index closed at 1,245 points, down 5 points, equivalent to 0.42%.

In the morning session, the market had a sharp decline when some large stocks in the banking sector fell in price, most notably BID (-2.4%), VCB (-0.6%) and CTG (-1.2%).

Entering the afternoon session, the general index still could not regain green when the selling pressure of bank stocks and Hoa Phat Company (HPG) stocks was strong. Liquidity almost "frozen" reflected the gloomy trading sentiment that often appears when the market is nearing the long Lunar New Year holiday.

At the end of the session, the VN-Index closed at 1,245 points, down 5 points, equivalent to 0.42%.

According to VCBS Securities Company, the market is lacking demand and supply pressure has not ended. The liquidity of the January 9 session decreased sharply by 20% compared to the trading session, showing that the momentum of the general index is quite low, and money is gradually leaving the market.

Therefore, investors can consider restructuring stocks that do not have a recovery trend, while maintaining holding stocks with potential to increase in price in the future" - VCBS Securities Company recommends.

Meanwhile, Dragon Capital Securities Company (VDSC) commented that the supporting cash flow is getting weaker, leading to a gloomy state in the market. Therefore, Vietnamese stocks need more time to retest the support zone around 1,240 points - the lowest level of December 2024.

Source: https://nld.com.vn/chung-khoan-ngay-mai10-1-ap-luc-cung-co-phieu-chua-cham-dut-196250109180109601.htm

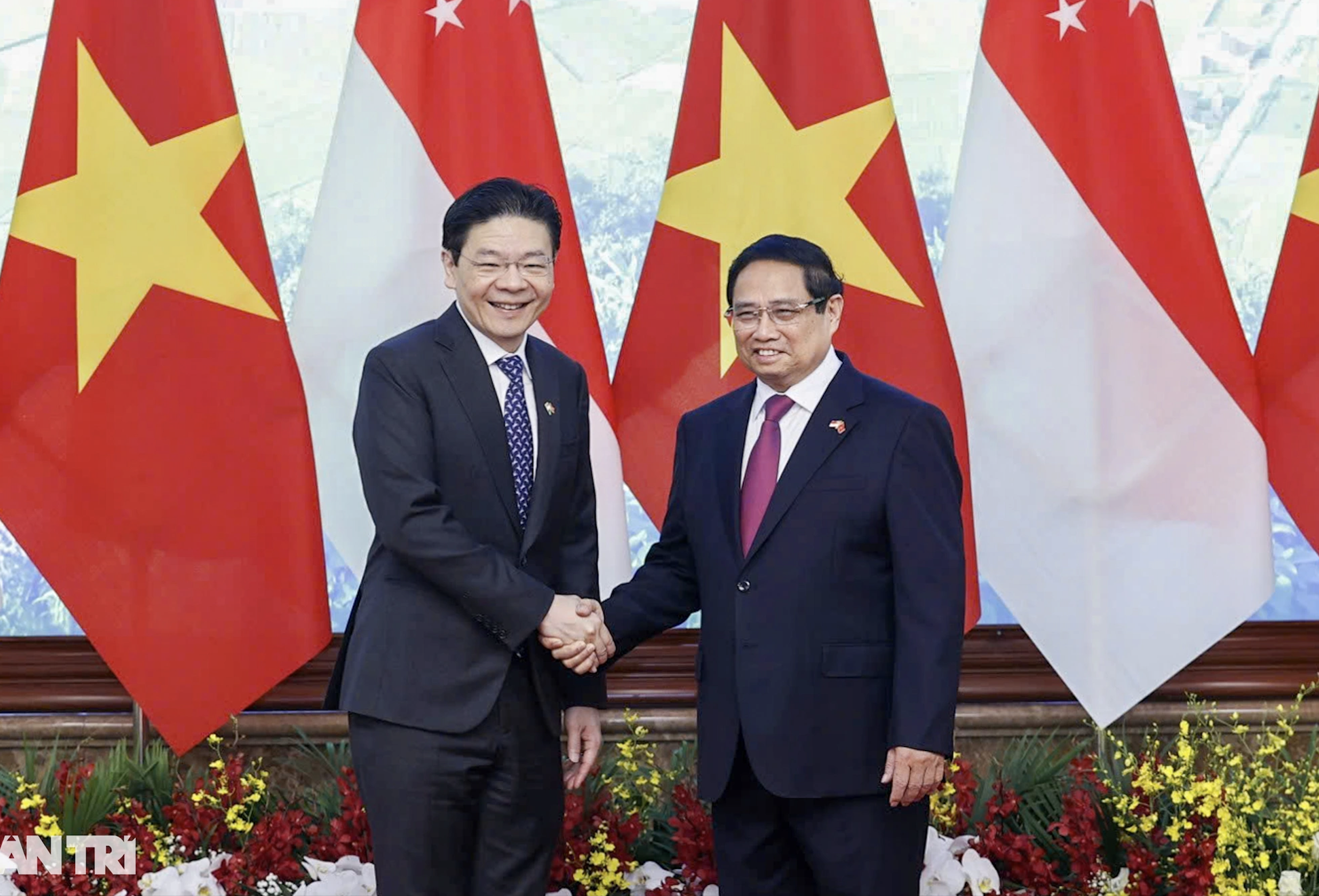

![[Photo] Welcoming ceremony for Prime Minister of the Republic of Singapore Lawrence Wong on an official visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/445d2e45d70047e6a32add912a5fde62)

![[Photo] Head of the Central Propaganda and Mass Mobilization Commission Nguyen Trong Nghia works with key political press agencies](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/3020480dccf043828964e896c43fbc72)

Comment (0)