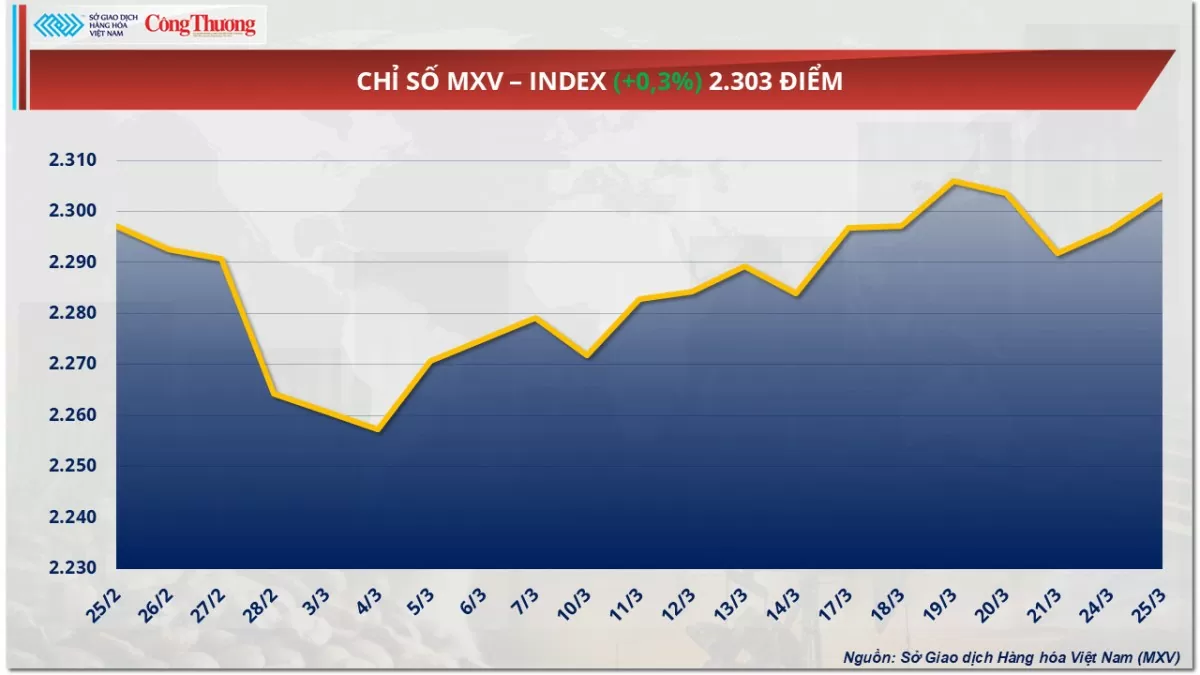

The Vietnam Commodity Exchange (MXV) said that at the end of yesterday's trading day (March 25), the simultaneous increase of commodities in the metal and industrial materials group created a force to pull the MXV-Index to 2,303 points. Notably, in yesterday's trading session, the COMEX copper price exceeded 11,400 USD/ton - an all-time high. Meanwhile, in the opposite direction, the agricultural product price list is still in the red...

|

| MXV Index - Index |

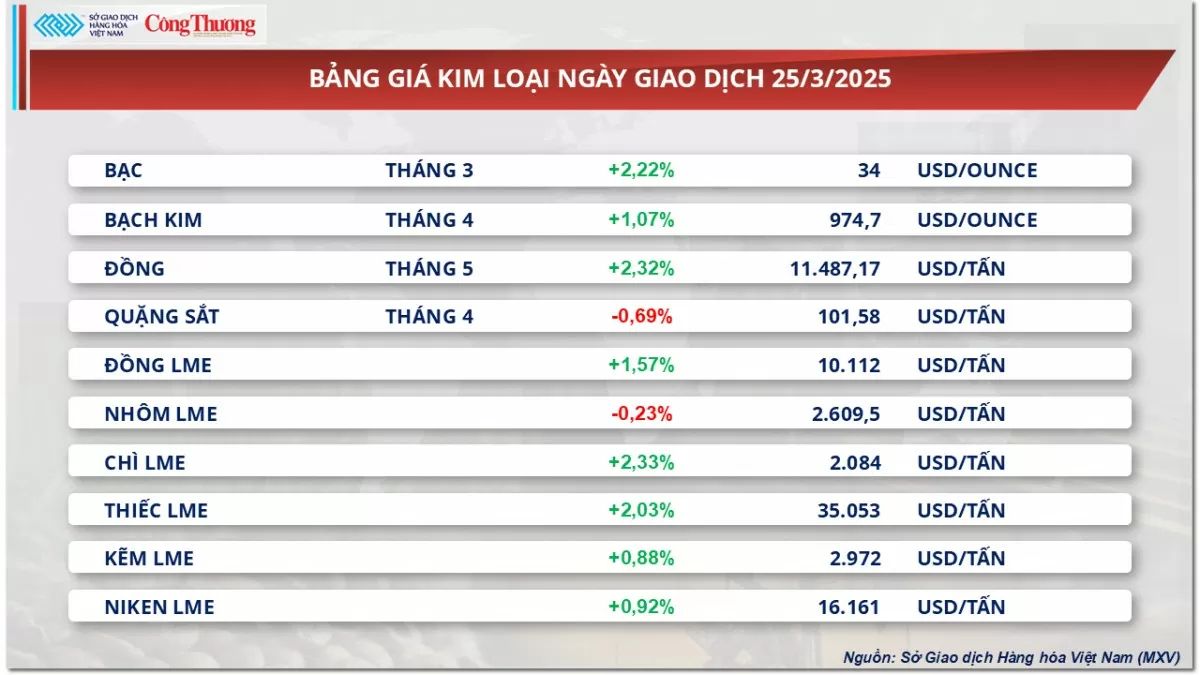

Green covers the metal market

According to MXV, the market witnessed green all over the metal price board in yesterday's trading session. In the base metal market, COMEX copper price continued to increase by 2.32% to an unprecedented record - 11,487 USD/ton.

|

| Metal price list |

COMEX copper is one of the fastest-growing commodities in the metals market, up about 25-28% since the beginning of the year. It is currently at a record high amid concerns about US President Donald Trump's tariffs and further Chinese stimulus measures announced last week.

The industrial metal is becoming increasingly important as demand for electrification of battery-powered vehicles soars, artificial intelligence (AI) takes off and the world transitions to renewable energy.

Late last month, the US President signed an executive order asking US Commerce Secretary Howard Lutnick to launch an investigation into copper imports into the country. The White House said the investigation would assess the national security threat posed by the country’s growing dependence on imported copper and its products. Immediately after the news was released, COMEX copper prices climbed to over $10,000 per tonne.

In addition, China's retail sales data showed a 4% increase in the first two months of this year - the fastest pace since October last year. In addition, both industrial output and fixed asset investment grew more than estimated in February, which has had a significant impact on market sentiment.

China is the world’s largest producer and consumer of copper and a “core” of the global green energy transition. The US moves, along with this positive Chinese economic data, have added to the upward momentum in copper prices.

In the precious metals market, at the end of yesterday's trading session, silver prices reversed and increased by 2.22%, reaching 34 USD/ounce. Meanwhile, platinum also increased by 1.07% to 974.7 USD/ounce. Money flows are shifting to the precious metals group as investors are concerned that US President Donald Trump's tariff policies could weaken economic growth prospects and increase inflation risks. Demand for safe havens increased sharply after the Bipartisan Policy Center (BPC) warned that the US could default on part of its $36.6 trillion debt between mid-July and early October this year if Congress does not quickly raise the debt ceiling.

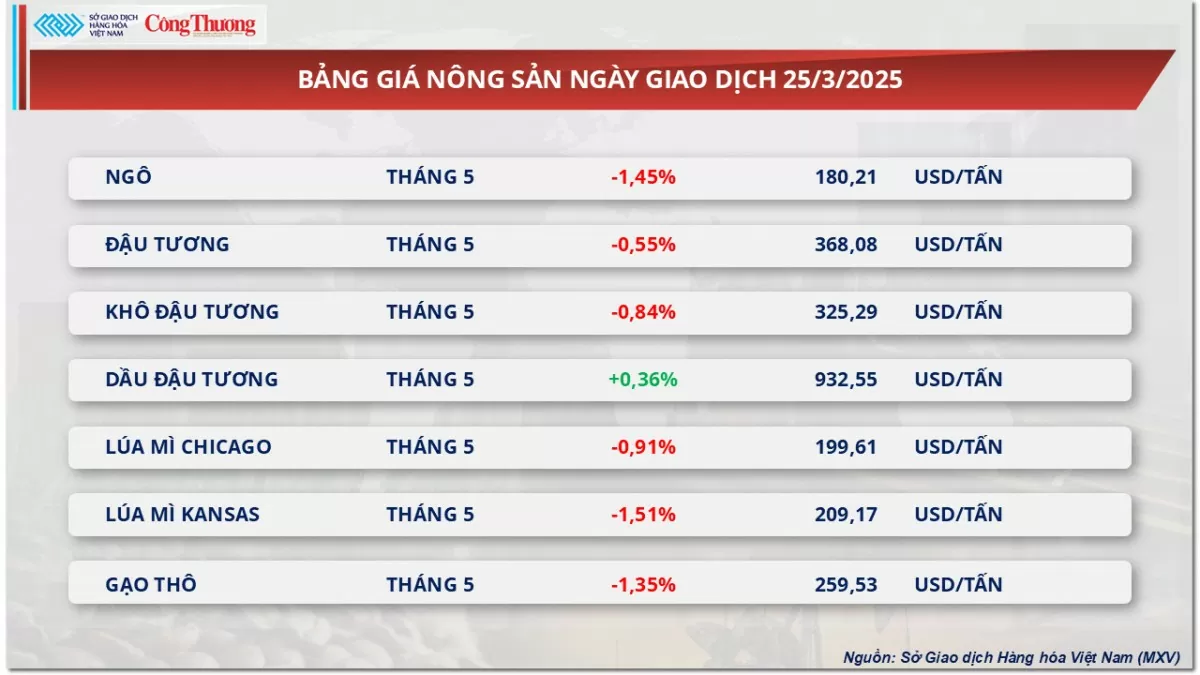

Soybean prices plummet

At the end of yesterday's trading session, the agricultural market continued to be dominated by red. The soybean market continued to decline with a decrease of 0.55% to 368 USD/ton in yesterday's trading session. According to MXV, trade tensions between the US and major partners, especially China, continued to be the main driving factor, while positive signals from the European market and concerns about supply from Brazil were not strong enough to reverse the trend.

|

| Agricultural product price list |

The public hearing on the proposed tariffs on shipping vessels with links to China has put a lot of pressure on the soybean market. Initial responses from stakeholders have been largely negative towards the proposal, adding to the uncertainty about the direction of U.S. trade policy in the near future.

In addition, a series of new tariffs will officially take effect from April 2 on imports from many important US trading partners, including China, Mexico and Canada. Market analysts are extremely concerned about the possibility that these countries will take retaliatory measures, targeting US agricultural exports, including soybeans.

Although the overall trend remains negative, some positive signals have emerged from the European market. According to the latest weekly report from the European Commission (EC), the EU’s cumulative soybean meal imports for the 2024-25 marketing year totaled 13.6 million tonnes as of March 23, up significantly from the 10.7 million tonnes recorded during the same period last year.

Soybean imports also recorded positive growth compared to the previous year, reflecting the continued high demand in the region. However, this positive signal is not strong enough to reverse the current downward trend in global prices.

In a development related to global supply, Dr. Cordonnier - a leading expert on agricultural products in the South American region - has revised down the forecast for Brazil's 2024-2025 soybean production to 169 million tons, down 1 million tons from the previous forecast.

The main cause is the severe drought in southern Brazil, especially in Rio Grande do Sul state - a key soybean growing area. Soybean production in this state is now forecast at only 15 million tons, a sharp decrease of 3 million tons compared to the forecast made in February and may continue to be revised down as dry and hot weather persists in the region.

Despite concerns about yields, Brazil’s soybean harvest is now progressing much faster than it was a year ago, which should help alleviate some of the short-term supply pressure and prevent prices from rising sharply despite the unfavorable production news.

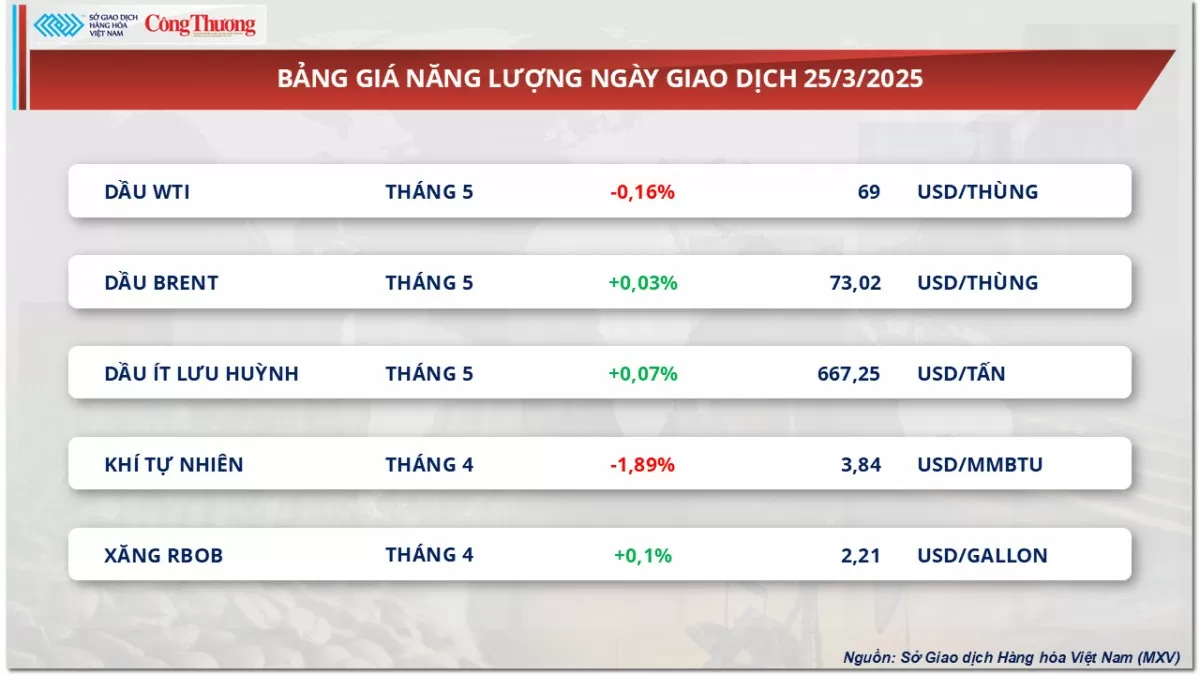

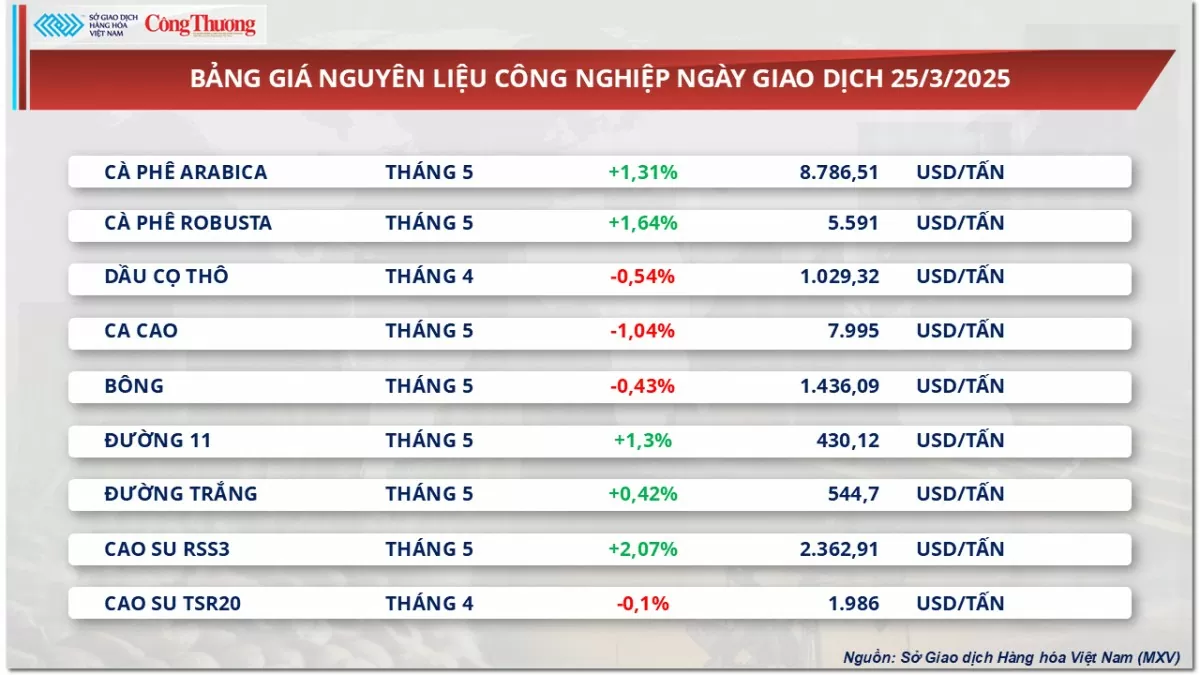

Prices of some other goods

|

| Energy price list |

|

| Industrial raw material price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-gia-dau-tuong-tiep-da-lao-doc-380026.html

![[Photo] Readers line up to visit the photo exhibition and receive a special publication commemorating the 135th birthday of President Ho Chi Minh at Nhan Dan Newspaper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/85b3197fc6bd43e6a9ee4db15101005b)

![[Photo] More than 17,000 candidates participate in the 2025 SPT Competency Assessment Test of Hanoi National University of Education](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/e538d9a1636c407cbb211b314e6303fd)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on science and technology development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/ae80dd74c384439789b12013c738a045)

![[Photo] Nearly 3,000 students moved by stories about soldiers](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/21da57c8241e42438b423eaa37215e0e)

Comment (0)