The stock market today, March 20, opened with a positive trading performance, helping the VN-Index to jump nearly 8 points at times. Part of the reason was the recovery from the US stock market last night.

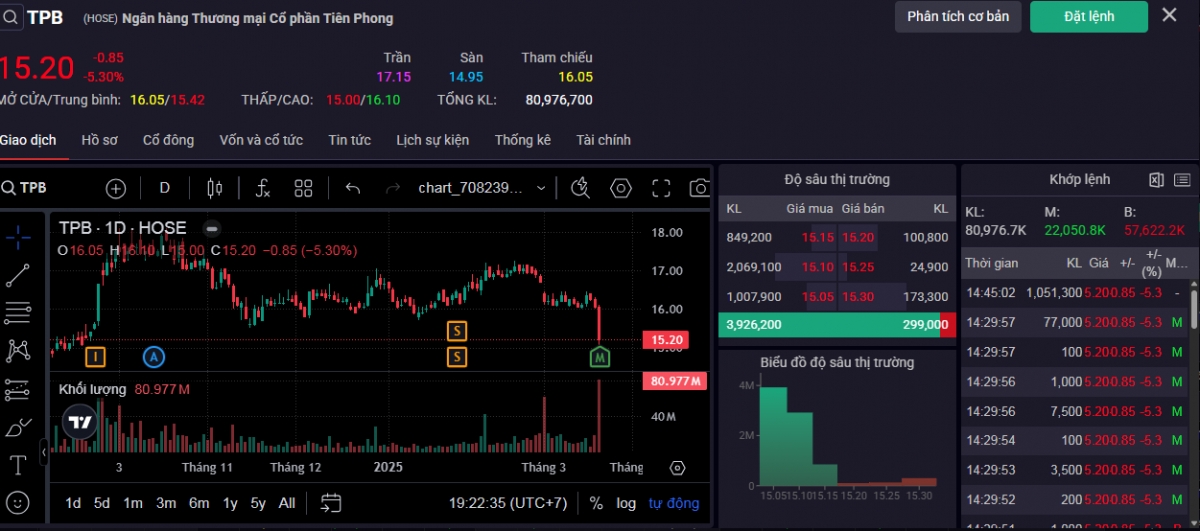

However, in today's trading session, TPB shares of Tien Phong Commercial Joint Stock Bank suddenly dropped sharply. At the end of the session, this stock decreased by 5.3% to 15,200 VND/unit, the lowest in about half a year. The liquidity of this code also exploded to more than 80.9 million shares, about 7 times higher than the average of the previous 10 sessions.

Therefore, TPB stock decreased the most in VN30 and was also in the group of stocks with the most negative impact on the VN-Index basket today.

TPB shares of Tien Phong Commercial Joint Stock Bank, chaired by Mr. Do Minh Phu, were also sold heavily by foreigners in this session. Accordingly, foreign investors net sold nearly 172 billion VND of TPB, second only to HPG (Hoa Phat).

Also in today's trading session, March 20, ORS shares of Tien Phong Securities Company, chaired by Mr. Do Anh Tu (younger brother of Mr. Do Minh Phu - Chairman of Tien Phong Bank - TPBank), continued to be sold off strongly in the afternoon and extended the series of days of decline with a floor price session.

At the close of the session on March 20, ORS hit the floor, losing 6.82%, down to VND12,300/share with millions of units remaining for sale, while buyers were left empty-handed. In just 3 weeks, since February 27, ORS shares have dropped about 23%, equivalent to a market capitalization of more than VND1,100 billion, down to VND4,100 billion.

BCG Land (BCR) shares also fell 3.3%.

At the end of today's trading session, March 20, VN-Index decreased by -0.7 points to 1,323.93 points with 192 stocks increasing, 70 stocks maintaining their price and 285 stocks decreasing. Liquidity on the HOSE floor reached 918.9 million units of matched orders, equivalent to a value of VND 19,675 billion. Although still quite good liquidity, this is the second time in the last 3 sessions that HOSE's liquidity has fallen below VND 20,000 billion. Liquidity on the HOSE floor has been above VND 20,000 billion in the previous 11 consecutive sessions.

On the HNX floor, the HNX-Index reversed to increase points at the close when green reappeared more on the electronic board. At the end of the trading session on March 20, the HNX floor had 80 stocks increasing and 81 stocks decreasing, the HNX-Index increased by 0.49 points (+0.20%), to 245.77 points. The total matched volume reached nearly 66 million units, worth VND1,051.7 billion.

On the UpCoM floor, the reduced supply force also helped the UpCoM-Index gradually recover, but it could not reach the reference point at the close. At the end of today's trading session, the UpCoM-Index decreased by 0.2 points (-0.20%), down to 99.16 points. The total matched volume reached more than 40.8 million units, worth VND470.4 billion.

![[Photo] Paris "enchanted" by the blooming flower season](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/e967dc548ff74f9ca8e89d72c3608825)

![[Photo] President Luong Cuong receives former Vietnam-Japan Special Ambassador Sugi Ryotaro](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/20/db2d8cac29b64f5d8d2d0931c1e65ee9)

Comment (0)