Agribank is a commercial bank that always takes the lead in implementing the policies of the Party and the State. In the coming time, Agribank determines the goal of sustainable development, becoming a modern bank, actively contributing to the effective implementation of the banking industry development strategy to 2025, with a vision to 2030 and the National Digital Transformation program.

Agribank has a wide network of operations across the country, from urban to rural areas, remote areas, islands with nearly 2,300 branches, transaction offices, 68 mobile transaction points using specialized cars, over 3,700 ATMs/CDMs, nearly 24,000 POS/EDC machines and Digital Banking service - Agribank Digital... serving the payment transaction needs of more than 22 million customers opening accounts and using payment services, nearly 4 million customers borrowing capital at Agribank.

|

Agribank Digital is a miniature bank branch model, suitable for many different locations, especially agricultural and rural areas that Agribank is serving. |

Digital transformation at Agribank is carried out in the direction of "Customer-centricity", enhancing customer service on electronic channels, bringing the best experiences in using payment services on digital technology applications for customers. Agribank focuses on developing modern distribution channels to serve customers' payment transaction needs, gradually adapting to the digital economy under the direction of the Government and the State Bank.

Thanks to that, the digital transformation in Agribank's operations has achieved positive results. For ATM/CDM and EDC/POS distribution channels, Agribank has developed more than 18 million domestic debit cards across the system, nearly 1 million overdraft cards, Loc Viet cards in the agricultural and rural markets, card products and services have been expanded, ensuring convenience, speed and safety, contributing significantly to the development of the payment network, towards digitizing all card services. Card services with full basic functions such as: Registering customer information by facial biometrics/fingerprints; opening payment accounts, issuing cards, financial transactions at CDM (withdrawal, deposit, transfer ...), helping customers easily access banking services.

Agribank has been promoting the development of card services in the rural market with the Loc Viet card product using technology that integrates the functions of domestic credit cards and domestic debit cards, contributing to the effective implementation of the policy of cashless payments in the context of the strong development of Fintech companies, payment intermediaries, improving the micro-credit market, contributing to limiting black credit in agricultural and rural areas.

|

Agribank is one of the first banks to deploy an ATM system capable of withdrawing money using CCCD. |

It is noteworthy that in recent times, Agribank has continued to develop and promote the application of the national population database in banking activities. Currently, Agribank's digital banking product and service ecosystem has provided customers with full utilities such as opening accounts, registering for digital banking/e-banking services, registering for loan information or making online appointments... quickly and effectively. By authenticating customers based on data and information from the Citizen Identification Card (CCCD) with a chip attached to the Ministry of Public Security, Agribank customers can confidently register and use digital services conveniently, safely and effectively without having to worry about the risks of forgery/appropriation of account usage rights for illegal acts in the digital space.

Agribank is one of the first banks to deploy an ATM system capable of withdrawing money using CCCD. Users with a bank account at Agribank, without a card or phone, can still withdraw cash from an ATM using a chip-embedded CCCD. The device uses contact technology, placing the CCCD on the machine for a few seconds, the account information and card are ready to make a transaction. Not having to insert the CCCD into the machine like a traditional ATM card also avoids the risk of having the card held, making it more convenient and flexible.

|

Agribank Plus e-banking service has had positive changes to help customers have better experiences with cashless payment services and other added utility services. |

In particular, for the Agribank Plus e-banking service, Agribank has made positive changes to help customers have better experiences with non-cash payment services and other added utility services. The latest Agribank Plus version was updated in mid-2024 with new features in the interface and convenient payment ecosystem, providing customers with seamless and convenient experiences from computers (PC/laptop) to mobile devices (phones, tablets). Agribank Plus is used on many different platforms with unified username and password, the username is also the phone number that the customer registered with the bank. In addition, the entire interface of Agribank Plus on the web browser as well as on the mobile application is renewed in a simple, youthful, and friendly style; aiming to improve the experience of users of all ages and regions.

For Agribank eBanking electronic banking service, Agribank has upgraded and added many outstanding features. Agribank eBanking electronic banking is used synchronously on two platforms, Internet Banking and Mobile Banking phone application, providing unified experiences for customers on electronic devices such as computers (PC/laptop) and mobile devices (phone/tablet). Customers only need 1 login name/phone number to register for the service and 1 unique password for the eBanking service to use on all platforms. When using Agribank eBanking service, customers will experience financial utilities: Fast money transfer 24/7, online savings, bill payment, public administrative service payment, automatic bill payment, online social insurance payment, batch money transfer, online inquiry request...

With Agribank eBanking, customers can perform all types of banking transactions via an online platform right at their office or anywhere with an internet connection, saving time and without having to go to a bank branch. In addition, Agribank has developed a separate Agribank Corporate eBanking solution to serve the corporate customer segment with new features, ensuring safety through encryption, secure authentication and fraud monitoring. In addition, Agribank also regularly updates safety measures to support customers to be more vigilant and enhance security in the online transaction environment.

In the connection of payment for goods and services for customers, Agribank has deployed a centralized bill payment system (BillPayment), with nearly 7,000 service providers, e-wallets, fintech companies, e-commerce platforms, VETC, electricity and water companies, telecommunications... allowing connection of all Agribank transaction points, providing modern online banking payment methods 24/7 instead of traditional bill payment methods, without having to go directly to the service provider to pay for many types of monthly bills. Agribank Billpayment is built on an open platform system, with large load capacity on a new multi-connection technology architecture platform, even for partners who have not connected online, at the same time, providing virtual account payment channels and QR code payment so that customers without an Agribank account can still pay for services connected to Agribank.

|

Agribank representative received the Vietnam Digital Transformation Award 2024 for the Agribank Open API Platform. |

Along with developing payment services on digital channels, Agribank prioritizes investment in technology projects to upgrade the infrastructure of data centers, network systems, develop application systems to serve management and operation requirements and develop new products and services, new distribution channels on the basis of cooperation with partners in the field of information technology, reputable partners, experienced in the field of banking, finance domestically and internationally to improve the quality of services provided to suit each customer segment.

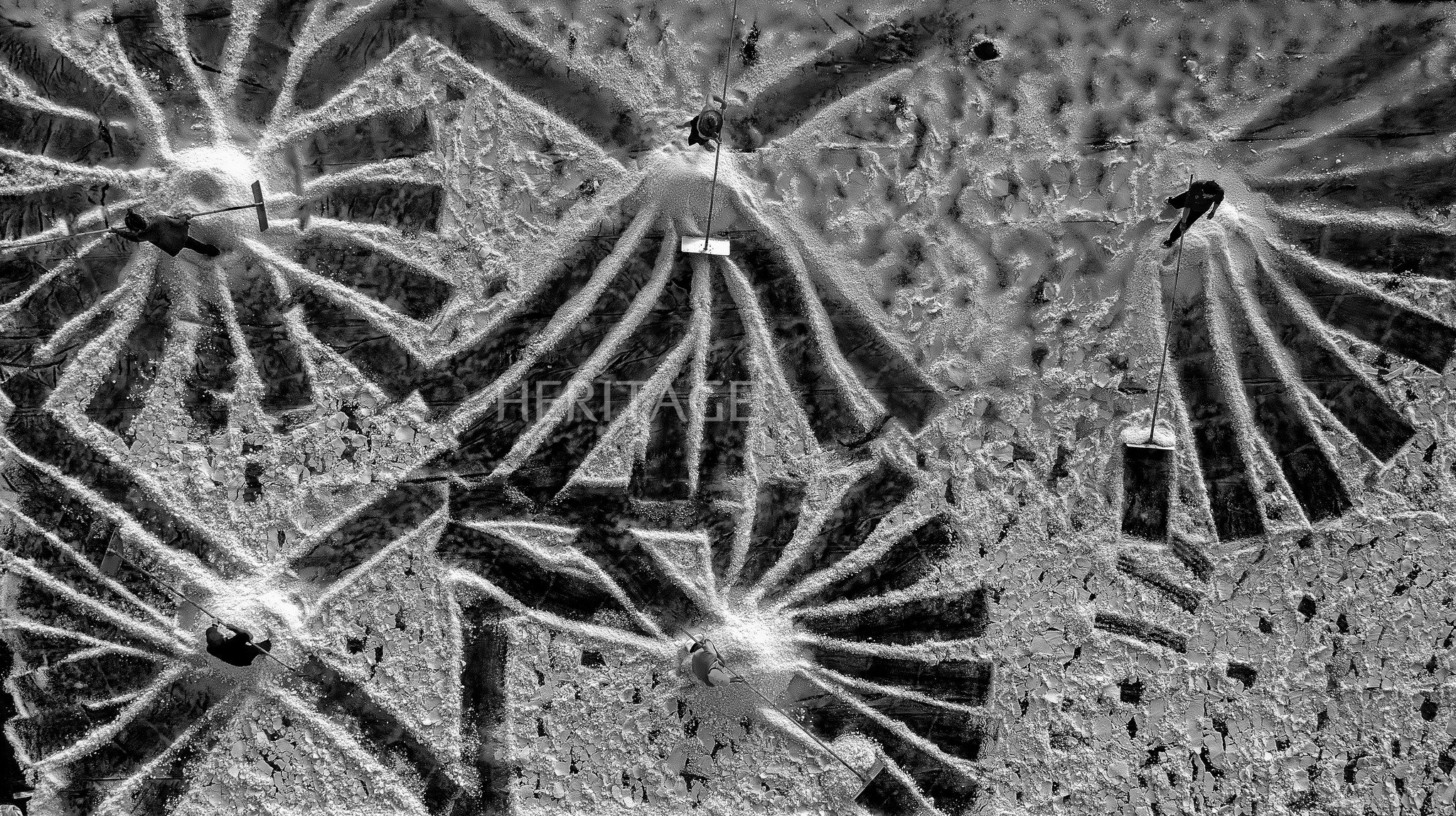

As a leading bank in credit investment and providing banking services for the agricultural and rural areas, Agribank has identified its consistent goal in its operations as promoting its network advantages, diversifying, and providing high-quality retail banking products and services based on modern technology platforms, meeting the increasingly diverse needs of customers, especially customers in agricultural and rural areas. Agribank has been contributing to the Vietnamese banking system to soon complete the goal of developing Vietnam's digital economy and digital society by 2025, with a vision to 2030.

| With its continuous efforts in the digital transformation process, Agribank has been honored with prestigious titles and awards by many domestic and international organizations: 09 Sao Khue awards for outstanding IT systems/software in the field of Finance/Banking from 2016 to present (Agribank E-Mobile Banking, BillPayment, AgriTax, EMV standard Chip Card, Agribank CDM 24/7, Agribank Payment Hub...); "Excellent international payment quality" award presented by JPMorgan Chase and Wells Fargo; for many consecutive years, Agribank has been in the top 10 most valuable brands in Vietnam according to the assessment of Brand Finance brand valuation consulting company... |

Comment (0)