Strong enough to take over a 0 bank transfer

According to Vice Chairman of the Board of Directors Bui Hai Quan, VPBank is planning to take over a compulsory transfer of a credit institution. The new Law on Credit Institutions has created favorable conditions for the bank to take over.

Since the project has not been officially approved, the Board of Directors cannot announce the details of this plan. However, the Board of Directors submits to the General Meeting of Shareholders to authorize the Board of Directors to decide on related issues.

“Shareholders can be completely assured because we have carefully considered this, this is entirely based on the interests of the bank and shareholders,” said Mr. Bui Hai Quan.

Responding further to shareholders, VPBank Chairman Ngo Chi Dung said that not all banks have the capacity to accept a mandatory transfer. Mr. Dung said frankly that all zero-dong banks have accumulated losses, so not everyone wants to take them over. However, with the participation of partner SMBC, VPBank has enough financial potential to participate in restructuring a zero-dong bank.

“We will be able to increase the credit growth limit higher than the general level when participating in the zero-dong bank restructuring, and open the room for foreign investors to be higher than 30%. In terms of finance, banks may not be interested, but the mechanism and policies when participating are suitable and attractive to VPBank. Moreover, this is also VPBank's contribution to the banking system," Mr. Dung convinced shareholders.

According to the document submitted to VPBank's General Meeting of Shareholders, at the time of compulsory transfer of a credit institution as approved by the competent authority, the scale of operations of the compulsory transferred credit institution (in terms of total assets and equity) shall not be higher than 5% of the corresponding scale of VPBank at December 31, 2023; the charter capital of the compulsory transferred credit institution shall not exceed VND 5,000 billion.

After receiving the compulsory transfer, the transferred credit institution will operate in the form of a limited liability bank owned by VPBank, an independent legal entity.

FE Credit is getting better

At the congress, VPBank General Director Nguyen Duc Vinh frankly admitted to shareholders that the bank's problems stemmed from the bad debt story at its subsidiary FE Credit.

According to Mr. Vinh, 2 years of Covid-19 have made many customers unable to pay their debts, so FE Credit's bad debt has increased.

FE Credit's business results (loss of more than VND 3,000 billion) were still the bank's dark spot last year, leading to the overall picture of the bank's profits not meeting expectations.

“The positive signal is that FE Credit's loan portfolio is currently leading the market. Disbursement growth in the fourth quarter of 2023 and the first quarter of 2024 is both above 20%, and bad debt has dropped below 20%. FE Credit has found cheaper sources of capital. FE Credit's positive factors have made us see more clearly the opportunities this year,” said Mr. Vinh.

Mr. Vinh also confidently affirmed that FE Credit's profit in 2024 will reach about 1,200 billion VND, thereby gradually bringing this business back to its original position. In the past, this consumer finance company contributed up to 40% of VPBank's profit.

Outstanding real estate loans are about 90,000 billion

Another issue that shareholders are interested in is lending to the real estate sector. Mr. Ngo Chi Dung said that lending to real estate is still safe, but lending during a hot market will lead to negative consequences.

“VPBank does not participate in financing highly speculative loans, but I think real estate is still a safe sector if properly assessed,” said Mr. Ngo Chi Dung.

In addition, CEO Nguyen Duc Vinh said that bad debt of individual homebuyers affected by CIC (bad debt from other banks) is a problem for many banks and has the biggest impact, up to 40%.

According to Mr. Vinh, real estate lending is still a potential and important field, but it must be managed and tightened. The risks in the past are lessons for banks to consider lending in the future.

VPBank's current real estate lending ratio is in the following groups: Real estate construction (19% of total outstanding loans), homebuyer loans (16% of total outstanding loans). The total outstanding real estate loans at VPBank are currently about VND90,000 billion (34-35%).

Mr. Vinh affirmed that VPBank is one of the three largest home loan banks in the market and most of the loans are real demand. Therefore, this field is still an important direction for the bank this year.

“Real estate debt is the debt with the highest potential to be resolved when the market recovers. Up to now, we have recovered nearly 100% of the principal debt, the real loss rate from real estate is much lower than lending to other sectors,” Mr. Vinh informed.

2024 profit increased by 114%, cash dividend for 5 consecutive years

VPBank's General Meeting of Shareholders approved the 2024 plan with the following targets: Total consolidated assets of VND 974,270 billion (up 19% compared to 2023); capital mobilization of VND 598,864 billion (up 22%), outstanding credit of VND 752,104 billion (up 25%), pre-tax profit of VND 23,165 billion (up 114%).

The meeting also approved the 2023 cash dividend plan at a rate of 10% (1 share receives 1,000 VND). The budget for dividend payment is up to 7,934 billion VND. This is the second consecutive year that VPBank shareholders have received cash dividends. The expected dividend payment date is the second or third quarter of 2024.

In 2024, VPBank will also issue up to 30 million additional ESOP shares at a price of VND 10,000/share.

The General Meeting of Shareholders approved a plan to issue up to 400 million USD in sustainable international bonds. The bonds have a term of 5 years, with an expected issuance date in 2024 or the first quarter of 2025.

Foreign shareholders join VPBank's Board of Directors:

Shareholders voted in favor of adding two new members to the Board of Directors, Mr. Takeshi Kimoto and Ms. Pham Thi Nhung.

Thus, VPBank's Board of Directors has 7 members, including Mr. Ngo Chi Dung, Chairman of the Board of Directors; Vice Chairmen are Mr. Bui Hai Quan, Lo Bang Giang. The remaining 4 members include Mr. Nguyen Duc Vinh (also General Director), Ms. Pham Thi Nhung (also Permanent Deputy General Director), Mr. Takeshi Kimoto representing strategic shareholder SMBC and independent member of the Board of Directors Nguyen Van Phuc.

Mr. Takeshi Kimoto was born in 1970 in Japan and has more than 30 years of experience working at SMBC Bank, one of the largest banks in Japan.

Before being elected to the Board of Directors of VPBank, he held the position of Head of the Asian Market Development Department of SMBC (Singapore) and SMBC (Japan). At the same time, he was also a member of the Supervisory Board of PT Bank BTPN Tbk in Indonesia, a subsidiary of SMBC.

Meanwhile, Ms. Pham Thi Nhung was born in 1980 in Tien Hai, Thai Binh, and has nearly 20 years of experience working in the banking industry at banks such as Habubank (merged into SHB in 2012), SHB, and VPBank.

Ms. Nhung joined VPBank in 2016 and was appointed to the position of Deputy General Director of this bank from April 2021. She is currently a member of the Board of Directors, Permanent Deputy General Director and Director of Partner Management and External Relations at VPBank.

Source

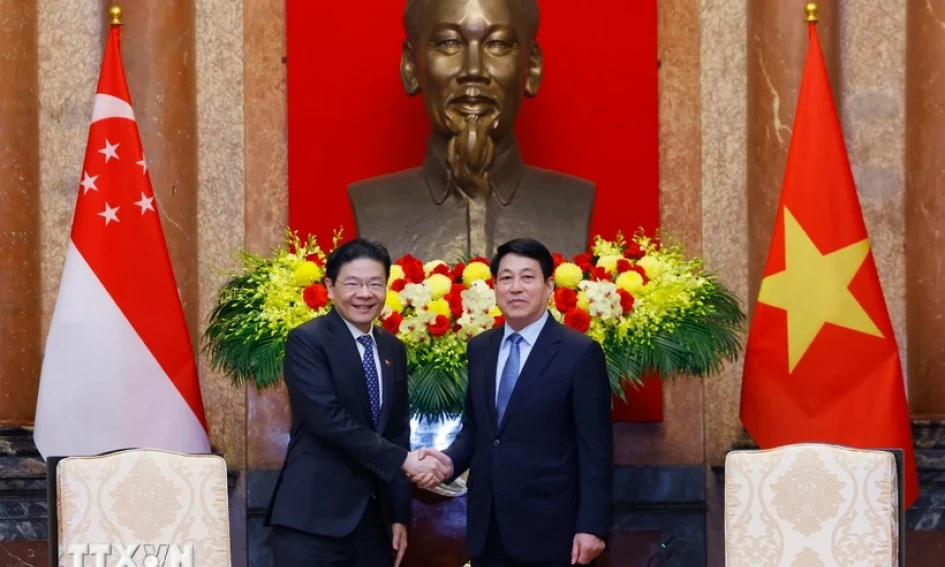

![[Photo] General Secretary To Lam receives Singaporean Prime Minister Lawrence Wong](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/4bc6a8b08fcc4cb78cf30928f6bd979e)

![[Photo] The two Prime Ministers witnessed the signing ceremony of cooperation documents between Vietnam and Singapore.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/294b2d9cbf494db29dbdc47951d8313a)

Comment (0)