Some stocks to watch on July 29

Investors should still be cautious and patient.

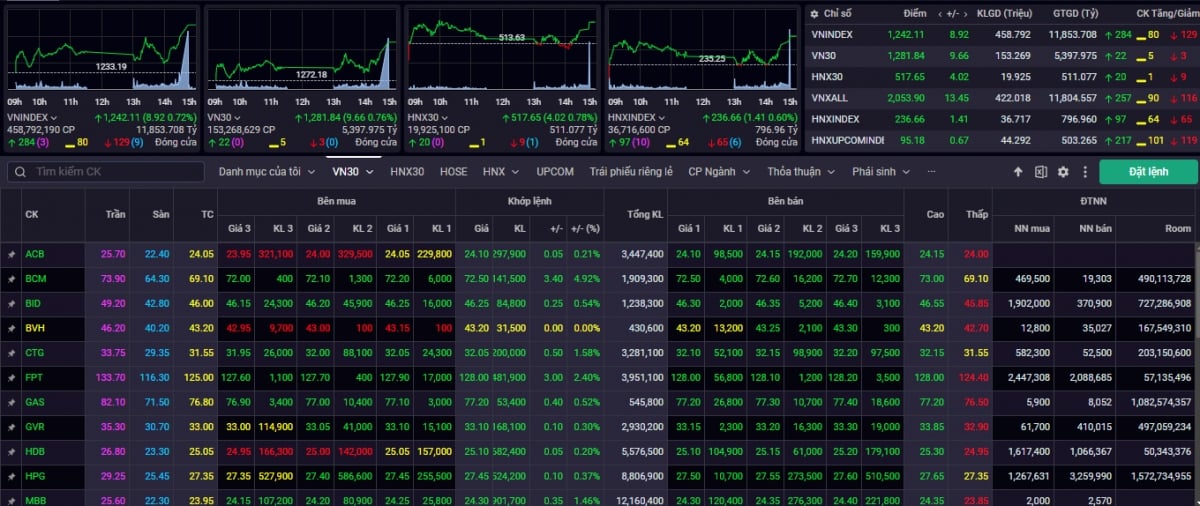

After a "dreamy" trading week in early July, the Vietnamese stock market experienced 3 consecutive weeks of adjustment and hit its lowest point at 1,218 points last week. Strong selling pressure pushed the market deep in the first 2 trading sessions of the week, the following sessions witnessed efforts to rebalance the cash flow. The bottom-fishing effort helped the index recover more than 20 points from the lowest point of the week. The large-cap group suffered the same fate as the Midcap and Penny stocks, the selling pressure spread across the market and only really cooled down in the last trading session of the week. Another notable highlight was that liquidity returned to the "gloomy afternoon market" state in the last 2 trading sessions of the week when caution dominated the market sentiment. Closing the trading week of July 22-26, the VN-Index closed at 1,242.11 points -22.67 points (-1.79%).

Liquidity last week decreased by 19.8% compared to the average of 20 trading weeks. Accumulated for the whole trading week, average liquidity on the HSX floor reached 623 million shares (-17.46%), equivalent to VND 16,096 billion (-17.42%) in trading value.

Demand showed signs of increasing in the last trading session of the week, but was not strong enough to overcome the strong supply pressure in the first two sessions of the week. Therefore, the number of sectors that decreased in points still dominated last week with (17/21 sectors decreased in points). Profit-taking pressure increased in the Telecommunications Technology group (-11.61%) after the previous hot growth. The market-sensitive group Securities (-6.02%) also witnessed strong selling pressure during the week, followed by Chemicals (-5.84%), Textiles (-5.76%)... On the rise were Plastics (+2.66%), Pharmaceuticals (+0.97%), Aviation (+0.72%), all of which are groups with medium and small capitalization.

According to experts from Kien Thiet Securities Company (CSI), the downward trend has shown signs of slowing down, but the upward reversal has not been confirmed yet as the recovery sessions have decreased volume and are at a very low level. The positive point is that VN-Index has tested the support level of 1,219 points and increased quite well in terms of points. The possibility that VN-Index is in a recovery signal with the expectation of moving towards the resistance level around 1,255 points (the support level that was broken last week) before accumulating to form a newer trend.

“At present, investors should still be cautious, patiently wait for clearer signals before opening new buying positions and limit selling after the VN-Index has successfully maintained the support level of 1,219 points,” CSI experts noted.

VN-Index can build a foundation and accumulate again in the 1,230-1,260 point range.

According to the analysis team of VNDIRECT Securities Company, technically, the VN-Index has shown signs of forming a short-term bottom and recovering after reaching the lowest level of 1,218 points in the last trading week. It is worth noting that the selling pressure has weakened significantly while the buying pressure has shown signs of slight improvement in the last trading sessions of the week. Entering the trading week of July 29 - August 2, the market trend can be confirmed when important information is about to be announced, including: domestic macroeconomic data in July, the Fed giving updates in the meeting at the end of July on the roadmap for interest rate cuts and the deadline for announcing the second quarter business results reports of listed enterprises.

“In the base scenario, the VN-Index could build a foundation and accumulate again in the 1,230-1,260 point range during the trading week of July 29-August 2. With market valuations now at a more attractive level, medium- and long-term investors can “start building a portfolio for the next 6-12 months”, focusing on some sectors with improved business prospects such as Banking, Consumer-Retail and Import-Export. Meanwhile, short-term traders need to wait for the market to “confirm the short-term trend” and “improve cash flow” before increasing their stock holdings,” said VNDIRECT experts.

Meanwhile, experts from Saigon - Hanoi Securities Company (SHS) said that in the short term, VN-Index is tending to retest the price zone around 1,255 points, the highest price zone in 2023, as well as the short-term and medium-term trend line connecting the lowest price zones in November 2023, April 2024 and July 2024. The short-term trend of VN-Index is still less positive when it cannot maintain the above short-term and medium-term growth trend line. In a positive case, VN-Index needs to surpass the resistance zone around 1,255 points, the highest price in 2023, to improve the short- and medium-term trend. The positive point is that the market is strongly differentiated, many stocks are quite active in increasing prices, aiming to surpass the old peak when having good business results in the second quarter of 2024, such as some stocks in the industrial park real estate group, gas distribution, plastics, oil and gas transportation, gasoline... some technology stocks tend to recover to the old peak.

In the medium-term trend, VN-Index has accumulated less positively, similar to the short-term trend when it failed to maintain the price trend line from November 2023 to present, as well as the equilibrium price zone of 1,245 points -1,255 points of the price channel of 1,180 points - 1,200 points to 1,300 points - 1,320 points. Thereby, VN-Index will shift to accumulate in the range of 1,180 points - 1,200 points to 1,245 points - 1,255 points, with 1,200 points being the highest price range in 2018, 1,245 points - 1,255 points being the highest price range in 2023. If VN-Index can overcome the resistance around 1,255 points corresponding to the highest price in 2023 as well as the average price of 120 current sessions, we still expect the medium-term trend to return to the accumulation channel of 1,250 points - 1,300 points.

“In the short term, stocks that have been under strong correction pressure last week and early this week will recover when the VN-Index also recovers to the 1,250 point price range. Investors should maintain a reasonable weight, at an average level, and should not chase the market when the VN-Index recovers to around 1,250 points. For positions that have been disbursed at around 1,250 points, with a high weight, and a stop-loss level if any, it is also necessary to consider selling at a discount when recovering. Medium- and long-term investors should hold their current portfolios, and positions considering increasing their weight should be carefully evaluated based on the second quarter business results and year-end prospects of leading companies,” SHS experts recommended.

Source: https://vov.vn/thi-truong/chung-khoan/nhan-dinh-chung-khoan-297-28-vn-index-tich-luy-tro-lai-trong-vung-1230-1260-post1110583.vov

Comment (0)