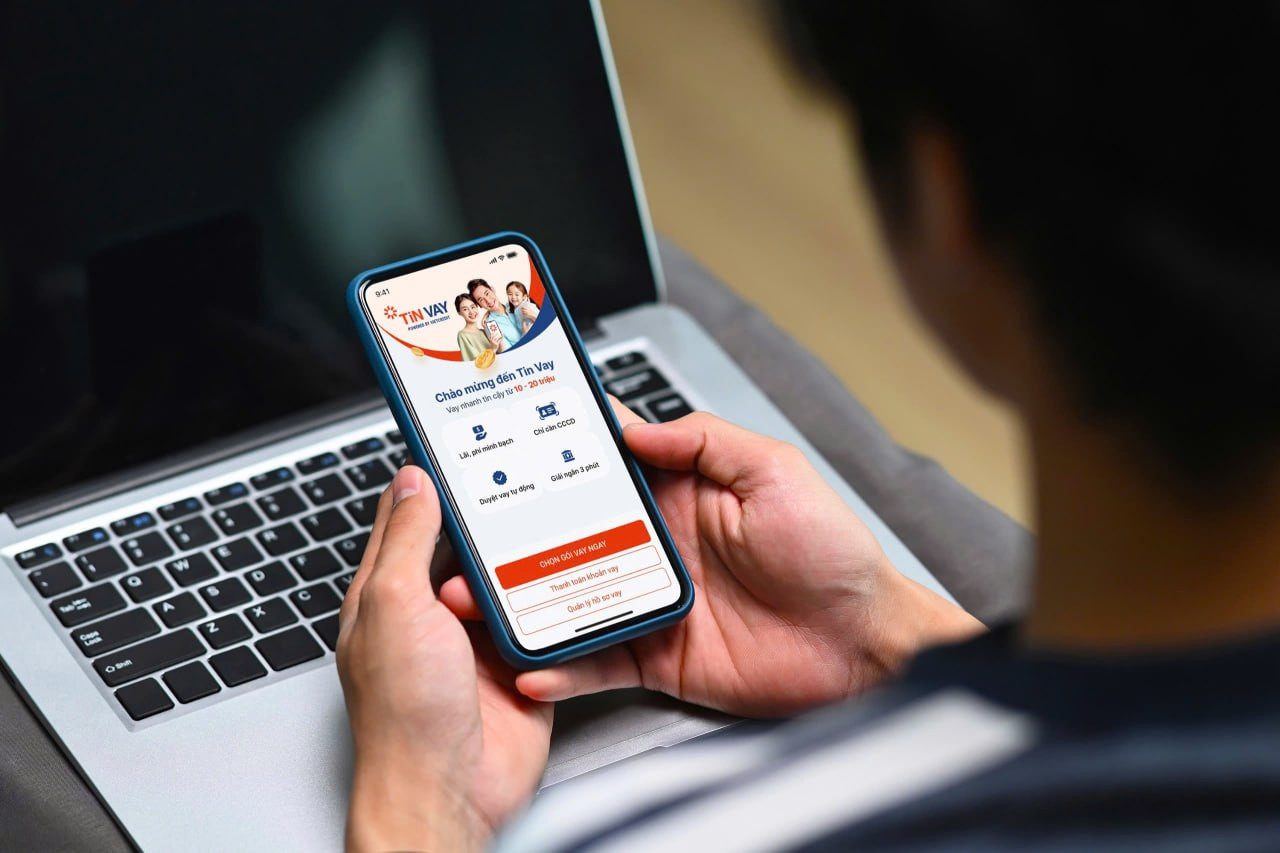

To meet the increasing consumer loan demand of people near Tet, VietCredit launched Tin Vay with many incentives.

According to statistics from VietCredit Joint Stock Finance Company, at the end of the year, the demand for consumer loans from banks and financial companies increased sharply. In addition to large value loan packages, small, fast-term loan packages with limits ranging from several million to several tens of million VND are also popular to solve urgent situations.

VietCredit representative shared that currently, taking advantage of the pressure of people needing to "manage" money urgently, bad guys have been using many tricks to commit fraud through "black credit" lending forms disguised as financial companies. If people fall into these traps, they may have to suffer unfortunate consequences.

To avoid loans with unclear origins and unclear interest rates, people need to research carefully and prioritize choosing reputable and legal financial institutions. Banks and financial companies licensed by the State Bank are providing a variety of loan packages with transparent, clear interest rates and in accordance with the law.

Formal loan services are currently attracting the attention of many customers because of their convenience, helping borrowers access capital quickly without having to spend time going directly to transaction points. These services are highly confidential, clearly disclosing information on interest rates and fees.

One of the current online loan services is Tin Vay - an online loan service brand of Tin Viet Finance Joint Stock Company (VietCredit). Tin Vay is known for its preferential interest rates and "3 no" policy: no additional fees, no insurance fees, no proof of income required. Although it was only launched in October 2024, Tin Vay has quickly appeared on applications such as MoMo, Viettel Money, 1Office, Fiza on Zalo, providing loans of up to 50 million to a large number of customers nationwide.

To apply for a loan on Tin Vay, customers follow 4 simple steps:

- Step 1: Access TIN LOAN on one of the partner platforms such as MoMo, Viettel Money, Fiza Zalo, 1Office.

- Step 2: Select the desired loan amount and term, enter information according to the instructions to register.

- Step 3: Check the loan amount, personal information, read the terms and contract and proceed to sign the contract according to the instructions on the transaction screen.

- Step 4: Wait for automatic application approval and receive immediate disbursement into your account

A representative of VietCredit said: “Tin Vay uses advanced, modern technology, allowing users to receive disbursement in just 1 to 3 minutes with an automatic approval process. In addition, Tin Vay also offers many loan options from 5-50 million VND depending on the platform, repayment period with reasonable interest rates, from only 0.1%/day”.

Minh Hoa

Source: https://vietnamnet.vn/vietcredit-cung-cap-dich-vu-tin-vay-cho-vay-tieu-dung-dip-can-tet-2355900.html

Comment (0)