Newly listed stocks can be counted on the fingers.

At the end of July, the HOSE stock exchange added one new stock, code ADP of Son A Dong Joint Stock Company, which started trading at a reference price of VND 19,550/share. According to the previous announcement from HOSE, in the first 6 months of 2023, this floor also had only one new listed stock, code PVP of Pacific Petroleum Transportation Joint Stock Company. This is the lowest number of newly listed stocks in a year in history. Thus, after 7 months, HOSE only had 2 new stocks.

The number of listed stocks from the beginning of the year until now can be counted on the fingers.

The situation on the HNX is better as the number of newly listed stocks is increasing. For example, in July, HNX had 2 new stocks: DTG of Tipharco Pharmaceutical Joint Stock Company and VFS of Nhat Viet Securities Joint Stock Company. However, the total number of newly listed stocks on HNX in the first 7 months of this year can be counted on one hand with only 5 stocks.

Most of the new stocks traded on HNX and HOSE since the beginning of the year have been traded on UPCoM before, so for many investors, these are not completely "new" goods. However, the move to official listing floors is also expected to create a new vitality for both stocks in particular and the stock market in general.

Notably, while the number of new "goods" listed on the floor is too small, the two official listing floors have stopped trading and delisted many stocks due to violations of information disclosure regulations, losses... In July, the HNX floor had 2 newly listed companies and also delisted 2 companies at the same time. At the end of July, the HNX floor had 332 stocks traded. Compared to the beginning of 2023, the number of stocks traded decreased by 9 stocks. Similarly, the HOSE floor had 393 stocks traded by the end of July, also a decrease of 9 stocks compared to the beginning of the year.

Absence of large enterprises

Not only is there a lack of quantity, new listings on the two exchanges, especially HOSE, have also recently lacked large enterprises. Many enterprises have announced their plans to list their shares for a while but have not yet implemented them for various reasons.

Vietnam Stock Market: More Companies Go Down Than Go Up

For example, Ton Dong A Joint Stock Company unexpectedly sent a dispatch to HOSE in April regarding the withdrawal of its initial listing application. The reason for the withdrawal was the macroeconomic situation at home and abroad, leading to unfavorable business results in 2022 for the entire industry in general and the company in particular; the company has not yet met the listing conditions as prescribed. Previously, the company's stock listing plan was approved at the 2022 Annual General Meeting of Shareholders with a plan to be implemented in the same year.

Lack of new goods will make the stock market less exciting

Or Binh Son Refining and Petrochemical Joint Stock Company (stock code BSR) - the company that manages and operates Dung Quat oil refinery - which has been considered a giant in the oil and gas industry since 2017, has proposed a plan to move to a listed exchange after trading on UPCoM for 1 year. Up to now, after more than 5 years, BSR shares are only traded on UPCoM. At the 2023 Annual General Meeting of Shareholders, the company submitted to shareholders for approval to list all BSR shares on HOSE.

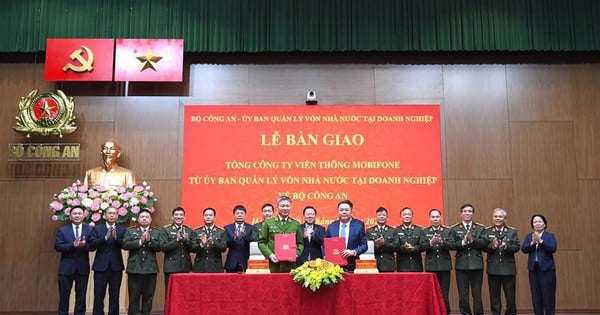

Meanwhile, the state-owned enterprises on the equitization list that are really of interest to investors such as Agribank, Vinacomin - TKV, MobiFone, VNPT, SJC, Vinafood1... the implementation process is still unclear.

Dr. Dinh The Hien, an economic expert, said that the lack of new "goods" in the stock market since the beginning of the year is mainly due to the fact that businesses have not yet realized the favorable time for listing. Because the main goal of businesses when listing shares on the stock exchange is to raise capital and expand their operations. However, after a difficult year, the stock market has only slightly recovered, so it is not yet suitable for businesses to list on the stock exchange to raise capital at a reasonable cost.

State-owned enterprises are often very large in scale, so when implementing an IPO - initial public offering - to divest state capital and then list shares, there must be a strategic partner to participate. However, from 2020 - 2021, when the Covid-19 pandemic occurred and then the world economy faced difficulties, many manufacturing corporations and financial investors also reduced their operations. Therefore, state-owned enterprises are slowing down in the equitization process because of difficulties in finding strategic investors.

"In general, the market will be more vibrant when there are new products, and there will be more new investors who are shareholders of current businesses. The more businesses listed and the better quality stocks, the more investors will be attracted to participate and thereby promote the development of the capital market," added Dr. Dinh The Hien.

Source: https://thanhnien.vn/vi-sao-chung-khoan-thieu-hang-moi-hang-khung-185230813101518423.htm

Comment (0)