SJC gold aims for 75 million VND/tael

In recent days, the gold market has been hot, the price of SJC gold and gold rings continuously set new records. On the morning of November 29, the price of SJC gold reached a new high of 74.60 million VND/tael and is heading towards 75 million VND/tael.

Specifically, Doji Group is the unit with the highest selling price of SJC gold, up to 74.60 million VND/tael, an increase of 300,000 VND/tael compared to the end of yesterday. The buying price of SJC gold at Doji is 73.20 million VND/tael. The difference between the buying and selling price at Doji is up to 1.4 million VND/tael.

Phu Nhuan Jewelry Company – PNJ has the second highest selling price of SJC gold in the market (VND74.50 million/tael). The buying price at PNJ is VND73.20 million/tael. Saigon Jewelry Company – SJC adjusted the price of SJC gold up VND200,000/tael to VND73.20 million/tael – VND74.40 million/tael.

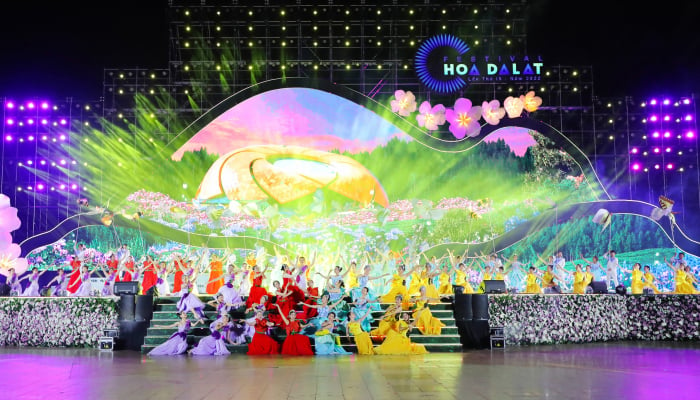

SJC gold price continues to increase strongly, towards the mark of 75 million VND/tael and is much more expensive than world gold. Illustrative photo

The lowest selling price of SJC gold belongs to Bao Tin Minh Chau Company at 74.38 million VND/tael, but the buying price is slightly higher than Doji when listed at 73.22 million VND/tael.

SJC gold prices increased sharply, but non-SJC gold prices increased even more impressively. The price of Thang Long Dragon gold of Bao Tin Minh Chau increased by VND500,000/tael to VND61.88 million/tael - VND62.88 million/tael. At PNJ Company, PNJ gold prices were traded at a much lower level: VND61.20 million/tael - VND62.40 million/tael.

It can be seen that the price of gold is increasing very strongly. However, it should be noted that the stores listed the selling price to increase more than the buying price, causing the gap between the two prices to widen. If before, this gap was only less than 1 million VND/tael, now this number has increased to 1.5 million VND/tael. This is a big risk for buyers.

SJC gold is expensive compared to world gold

In overnight trading in the US market, gold prices rose for a fourth consecutive session on Tuesday and hit a more than six-month high, due to a weaker dollar and expectations that the US Federal Reserve (Fed) has completed its interest rate hike.

Spot gold was last up 1.35% at $2,040.87 an ounce. U.S. gold futures for December delivery rose 1.47% to $2,042.00.

Gold continues to rally in the near term, with the dollar index in a downtrend on hopes the Fed will not raise interest rates again and may even cut rates in the spring, said Jim Wyckoff, senior analyst at Kitco Metals.

However, “if the US GDP and inflation numbers come in stronger than expected, that will dampen traders’ enthusiasm for bullion,” Wyckoff added.

Traders expect the US central bank to keep interest rates unchanged in December and see a roughly 50% chance of a rate cut in May next year, CME's FedWatch Tool shows.

Lower interest rates reduce the opportunity cost of holding non-yielding bullion.

Fed Governor Christopher Waller said he was “increasingly confident” that the policy was the right one. Making bullion cheaper for foreign buyers, the dollar index hit its lowest level since mid-August.

Investors will be watching Thursday's U.S. Personal Consumption Expenditures (PCE) data, the Fed's preferred inflation indicator. Also in focus is the revised U.S. third-quarter GDP figure due Wednesday.

In the trading session this morning, in the Asian market, precious metals continued to heat up. The world gold price is currently trading at 2,047.6 USD/ounce. At one point, the gold price reached 2,050 USD/ounce. There are many opinions that gold will soon reach 2,090 USD/ounce.

At the world gold price of 2,047.6 USD/ounce, the converted SJC gold price is about 60.78 million VND/tael. Thus, the SJC gold price is 13.82 million VND/tael more expensive than the world gold price.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)