DNVN - The outlook for gold prices in 2025 is forecast to continue to rise, as UBS and Goldman Sachs - two major banks - both adjusted their forecasts, citing sustainable demand from central banks and ongoing macroeconomic fluctuations.

Gold has gained 10% since the start of the year, hitting $2,900 an ounce. Against this backdrop, UBS continues to raise its forecast for the precious metal.

UBS analyst Joni Teves notes that unprecedented market volatility has provided a major boost to gold prices in 2024, and that momentum is likely to continue into this year. She points out that bullish sentiment on gold remains strong as investors view it as a safe haven amid a risky global environment.

After missing out on many opportunities in 2024, investors are worried about repeating mistakes and may take advantage of price corrections to buy, according to Ms. Teves.

UBS now predicts gold will hit $3,200 an ounce by the end of this year, then ease slightly and close the year above $3,000 an ounce.

In another development, Goldman Sachs on February 17 adjusted its forecast for gold prices at the end of 2025 from $2,890/ounce to $3,100/ounce.

The bank estimates that increased demand for gold from central banks, along with increased buying by gold ETFs amid falling interest rates, will push the precious metal up another 9% by year-end.

In addition, Goldman Sachs also adjusted its forecast for central banks' gold purchases from 41 tons to 50 tons per month, contributing significantly to the upward trend in gold prices.

If the average purchase level reaches 70 tons/month, gold could reach $3,200/ounce by the end of 2025. Conversely, if the US Federal Reserve maintains current interest rates, gold prices could stop at $3,060/ounce by the same period.

Both UBS and Goldman Sachs noted that uncertainties surrounding tariffs, the risk of stagflation and geopolitical tensions continue to increase gold's appeal as a safe-haven asset.

UBS expects higher-than-expected demand for gold from the public sector. For example, China’s pilot program allowing insurance companies to invest in gold is helping to strengthen the market.

However, if policy uncertainty, especially tariff concerns, remain high, Goldman Sachs believes gold prices could rise sharply to $3,300 an ounce by the end of the year due to the impact of prolonged speculative activities.

Reiterating its bullish stance on gold, Goldman Sachs stressed that while cooling periods may cause gold prices to correct, long positions still play an important role in the precious metal's upward trend.

In addition, if concerns about the US financial situation increase, the bank believes that gold could increase by another 5% and reach $3,250/ounce by December 2025.

Rising inflation and financial risks could spur flows into gold and ETFs, while concerns about the sustainability of U.S. debt could prompt central banks — especially those with large holdings of U.S. government bonds — to buy more gold, according to Goldman Sachs.

Alec Cutler, director at Orbis Investments, said that despite the strong price of gold, Western investors have not really paid much attention. He pointed out that the rally is mainly driven by central banks and investors in Asia. He predicted that if Western money starts to join in, the upward trend of gold will be stronger.

Cao Thong (t/h)

Source: https://doanhnghiepvn.vn/kinh-te/hang-loat-ngan-hang-lon-the-gioi-dong-loat-nang-du-bao-gia-vang/20250219105958527

![[Photo] Official welcoming ceremony for the King and Queen of the Kingdom of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/9e1e23e54fad482aa7680fa5d11a1480)

![[Photo] National Assembly Chairman Tran Thanh Man meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/c6fb3ef1d4504726a738406fb7e6273f)

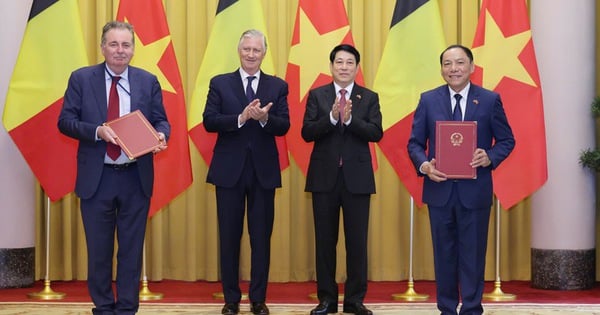

![[Photo] President Luong Cuong and the King of Belgium witness the Vietnam-Belgium document exchange ceremony](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/df43237b0d2d4f1997892fe485bd05a2)

![[Photo] Queen of the Kingdom of Belgium and the wife of President Luong Cuong visit Uncle Ho's Stilt House](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/9752eee556e54ac481c172c1130520cd)

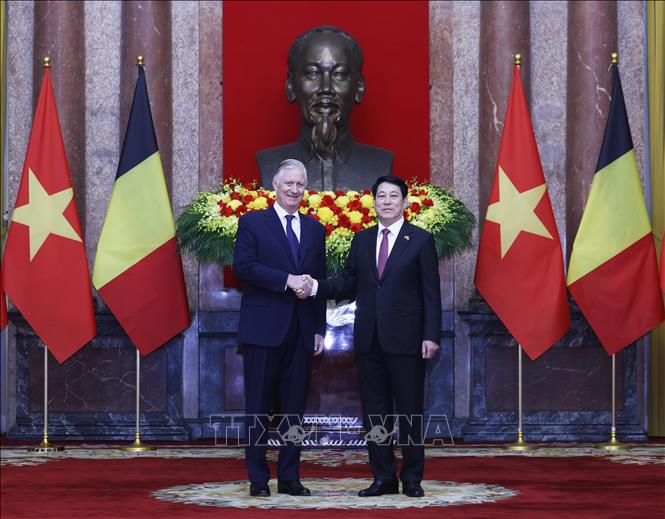

![[Photo] President Luong Cuong meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/1ce6351a31734a1a833f595a89648faf)

![[Infographic] 10 factors to consider when deciding to buy or rent a house](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/d6e87dce074b455d95231a4c3e22353a)

Comment (0)