Not only does Techcombank offer 3 incentives for international money transfer customers on the occasion of the New Year, it has also officially launched the international money transfer feature on the Techcombank Mobile application to increase convenience and optimize customer experience.

International money transfer right on Techcombank Mobile app in just 2 hours

In Vietnam, the demand for international money transfers of people for purposes such as studying abroad, working, traveling, visiting, medical treatment, supporting relatives, settling down, etc. is increasing. From understanding the needs and desires of customers, recently, Techcombank officially launched the free online international money transfer feature on Techcombank Mobile for all customers who transfer tuition fees, pay medical examination and treatment costs, living expenses for studying abroad, living expenses for medical examination and treatment, living expenses for business trips/travel/visiting, and supporting relatives.

Accordingly, in addition to using the convenient features of the leading digital bank in Vietnam, customers can transfer money for international payments quickly and conveniently. Updating online profiles and performing simple, easy transactions will be processed within just 2 hours; customers can manage and track transaction status directly on the Techcombank Mobile application.

In case the customer's profile needs to be supplemented or edited, or the transaction is canceled due to invalid profile, the customer will not bear any risk regarding the exchange rate. Techcombank commits to maintain the transaction exchange rate during the time the customer supplements the profile (maximum 2 days). In case the transaction must be canceled, Techcombank will refund the entire amount the customer has paid.

In particular, the money transfer limit and exchange rate are calculated instantly and displayed transparently right on the Techcombank Mobile application when customers make transactions with a limit of up to 100,000 USD/transaction or equivalent conversion with diverse foreign currencies with preferential exchange rates of up to 70 points.

"I often use Techcombank's international money transfer service to transfer money to relatives abroad. The consultants are very enthusiastic and the required documents are also very simple." Ms. Thanh Hoa - Ho Chi Minh City shared.

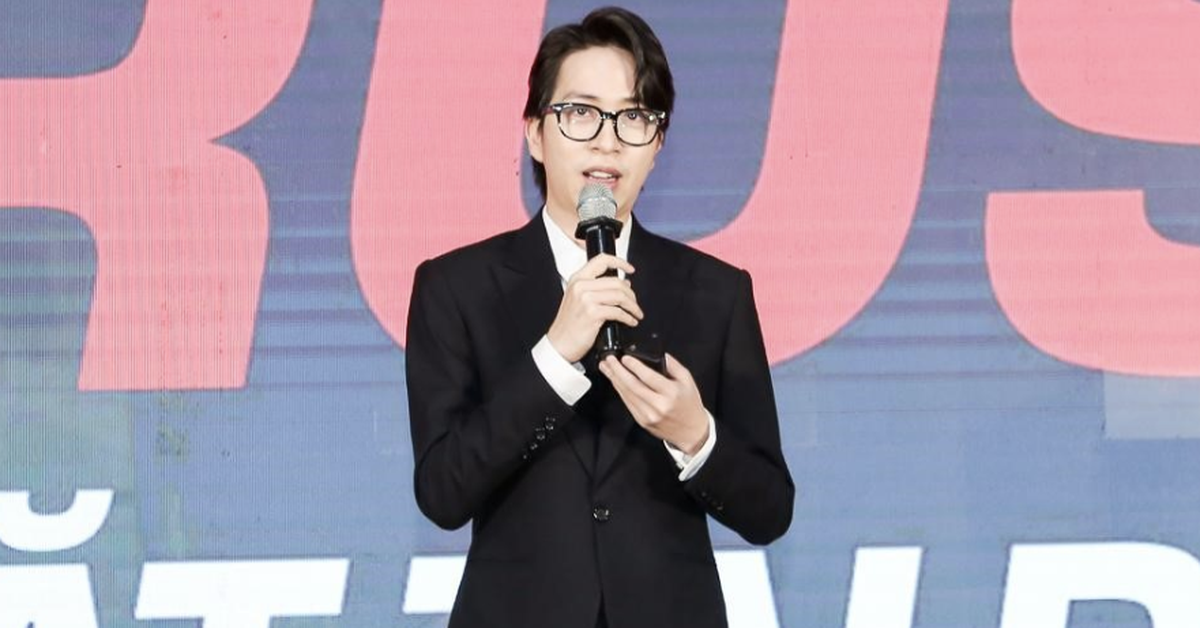

“The International Payment Transfer feature right on the e-banking app will extend the convenience and experience for customers when transacting with Techcombank. Along with many outstanding incentives, Techcombank always affirms its commitment to focusing on customers and serving all financial needs not only domestically but also aiming to accompany customers to reach international standards” - Techcombank leaders affirmed.

Triple the benefits for international money transfer customers

With the desire to increase incentives for customers, Techcombank has launched a combo of great incentives for international payment transactions such as: First foreign currency transaction with free international money transfer service fee or foreign currency cash withdrawal fee up to 1,000,000 VND; Exchange rate incentives for customers who are owners of businesses that are/have the potential to conduct international money transfer transactions at Techcombank; Incentives for customers who are paid through Techcombank: free foreign currency cash withdrawal after crediting or depositing cash into the account for more than 10 days and free money transfer for studying abroad, medical treatment, and family allowances; Spot exchange rate incentives: 30-80 points off when transacting from 10,000 USD.

One of the outstanding features of Techcombank that is highly appreciated by customers is the feature "buy foreign currency in the future, enjoy today's exchange rate". Accordingly, customers can buy exchange rates with the bank right at the time of signing the contract today to schedule foreign currency purchases and international money transfers for future needs. This feature helps customers prevent financial risks arising from future increases in foreign currency prices.

Ms. Minh Ha, living in Hanoi, highly appreciates the outstanding features of Techcombank: "In the next 3 months, my family has to transfer money for my grandchild to study abroad, and the exchange rate is increasing every day. Thanks to using the feature "buy foreign currency in the future, enjoy today's exchange rate" of Techcombank, my family is less worried about the exchange rate increase".

For the priority customer segment, Techcombank Private and Techcombank Priority members will receive many more super preferential privileges such as: free international money transfer, receiving remittances with all transactions; exchange rate incentives up to 100 points...

For more details, customers can visit Techcombank website or Techcombank Mobile application at: Explore products, select International money transfer or contact Techcombank Hotline 1800 588 822.

Bui Huy

Source: https://vietnamnet.vn/uu-dai-dac-biet-cua-techcombank-danh-rieng-khach-hang-chuyen-tien-quoc-te-2374006.html

![[Photo] Schools and students approach digital transformation, building smart schools](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/29/9ede9f0df2d342bdbf555d36e753854f)

![[Photo] Unique Ao Dai Parade forming a map of Vietnam with more than 1,000 women participating](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/29/fbd695fa9d5f43b89800439215ad7c69)

![[Photo] Training the spirit of a Navy soldier](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/29/51457838358049fb8676fe7122a92bfa)

![[Photo] Flower cars and flower boats compete to show off their colors, celebrating the 50th anniversary of Da Nang Liberation Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/086d6ece3f244f019ca50bf7cd02753b)

Comment (0)