|

| Governor Nguyen Thi Hong said she will continue to direct credit institutions to increase credit growth for production and business, including the private sector. |

Promote private enterprise development

At the working sessions, representatives of the People's Committees of provinces, departments, branches and local enterprises proposed that the working delegation representing the Government study and propose to the Government mechanisms and solutions to increase support for the private economic sector, promote the development of private economic models in localities, thereby creating conditions for strong development of strong production, business and export sectors; helping "locomotive" enterprises in localities to make breakthroughs, supporting the growth of macroeconomic indicators.

In Ben Tre, a group of businesses in the field of production and processing of coconut products said that recently, investment activities in developing the coconut industry have received a lot of attention from local leaders, with the formation of many models of production and product consumption linkages, support for building raw material areas, and brand development.

In particular, in the banking sector, credit institutions in Ben Tre have also played a significant role in capital supply activities, participating in value chains as members. As of January 2025, outstanding loans for the coconut industry in Ben Tre reached over VND 4,100 billion, thereby demonstrating this role.

However, currently, for coconut enterprises in particular, and other agricultural and rural sectors in general, most of them are SMEs with limited financial potential and limited collateral for loans. Therefore, not only the banking sector but also other ministries and sectors need to create more mechanisms and policies for enterprises to have more opportunities to receive financial and credit incentives, thereby boldly investing in large ideas and projects, working with localities to develop products, replicate OCOP models, and expand export markets.

Similarly, Mr. Nguyen Tan Thu, Chairman of the Young Entrepreneurs Association of Vinh Long province, said that although there are many preferential policies for SMEs, the actual access of enterprises is not large. In the context of business activities still facing many difficulties, the private economic sector needs to continue to be supported in a substantial way. For example, in the Mekong Delta provinces, enterprises are in great need of financial support, mechanisms and policies to improve digital transformation; increase the ability to accumulate land; find clean land funds to serve production and business, and build raw material areas.

In addition to banks supporting interest rate reduction and maximizing credit limits for businesses, ministries, branches and localities also need to guide and create conditions for private businesses to participate in key projects, participate in components of small and medium-sized public-private partnership (PPP) projects to take advantage of preferential mechanisms and policies.

Stick to reality to increase support effectiveness

According to Mr. Le Hong Phuc, Deputy General Director of Agribank, currently, for the Mekong Delta localities, although Agribank in particular and the system of commercial banks in general have implemented many preferential interest rate credit programs to support both large enterprises and small and medium enterprises. However, the common feature of many provinces in this region is to focus strongly on the agricultural and rural sector. Therefore, when increasing credit growth, commercial banks are also more or less concerned about the risk of bad debt, especially related to developments of epidemics, markets, and export prices of agricultural and aquatic products.

Mr. Phuc recommended that localities should study and incorporate into economic growth plans to develop diverse types of enterprises. In particular, focusing on developing chain linkage models, according to diverse ecosystems and sectors, thereby helping banks participate in expanding lending and developing financial services.

Agribank representatives also recommended that localities consider creating preferential and preferential mechanisms to help businesses access land and convert land use purposes better to increase the value of collateral when borrowing from banks.

On the part of the State Bank, Ms. Ha Thu Giang, Director of the Department of Credit for Economic Sectors, said that up to now, for the agricultural and rural sector, the Government and the State Bank have issued many incentives and priorities related to credit support and interest rate support. Major projects in the agricultural sector such as the Project to build 1 million hectares of high-quality, low-emission rice; the Project to build 5 specialized agricultural production areas; production models linked according to the value chain; key strengths of the region such as rice and aquaculture have all received large capital funding from the banking system.

For example, the credit package supporting loan interest rates for forestry and fishery enterprises has increased 2-3 times since its implementation, reaching tens of thousands of enterprises nationwide. Meanwhile, in the rice sector, after the instructions of the Prime Minister and the State Bank, the banking system in localities has also responded very positively, contributing to supporting capital sources for enterprises to promptly purchase and temporarily store rice.

Regarding this content, as Head of the Government's inter-sectoral working group working with the People's Committees of Ben Tre and Vinh Long provinces, Governor Nguyen Thi Hong said that the promotion of private economic support is currently of great concern to the Party, State and Government, given top priority and considered one of the main driving forces to promote economic growth nationwide. According to the Governor, in terms of legal support for the private economy, especially support for SMEs, there has been 1 Law and 6 Decrees issued and in effect. However, according to surveys of many ministries, sectors and localities, the implementation of legal regulations to support the private enterprise sector has not been effective. Many support policies have not reached businesses in various industries or have reached them but the effectiveness is not as expected.

The Governor said that there are many reasons for the ineffective implementation of policies to support the private economy, including both objective and subjective reasons. Therefore, to dissect and find solutions to overcome these shortcomings, in the coming time, the Government and ministries and branches need to simultaneously summarize and re-evaluate the implementation of the Law on Support for Small and Medium Enterprises and related Decrees and Circulars.

“For example, in the field of credit guarantee for SMEs, the guarantee capacity of the Credit Guarantee Fund system for SMEs in localities is currently quite limited. Therefore, there must be very detailed and specific summaries and assessments, based on the difficulties and shortcomings from the practical implementation of each policy and mechanism in each locality in order to thoroughly resolve them,” the Governor emphasized.

Regarding the banking sector, the Governor affirmed that he would take note of the recommendations of localities related to strengthening credit support solutions for the private enterprise sector, especially SMEs, which are among the five priority sectors under the direction of the Government and are being effectively supported by the credit institution system nationwide, accounting for a high proportion of outstanding loans in many provinces and cities. In the coming time, the Governor said that the SBV will continue to direct the credit institution system to focus on strong credit growth in the fields of production, business, import and export and participate deeply and widely in key programs and projects of the country, region and localities.

The banking sector will also continue to connect with provincial and municipal authorities, businesses, and industry associations to learn and share solutions to promote access to loans, expand credit limits for businesses, create conditions for the private sector to thrive, and make positive and high contributions to local economic growth.

![[Photo] General Secretary To Lam receives Singaporean Prime Minister Lawrence Wong](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/4bc6a8b08fcc4cb78cf30928f6bd979e)

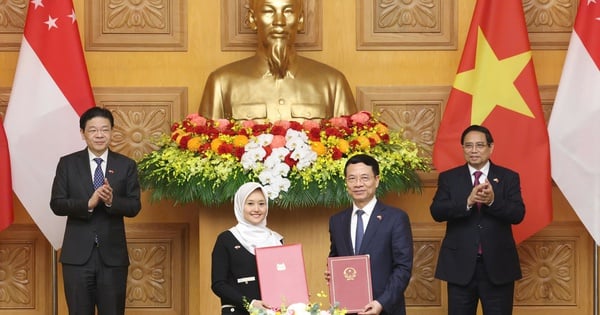

![[Photo] The two Prime Ministers witnessed the signing ceremony of cooperation documents between Vietnam and Singapore.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/294b2d9cbf494db29dbdc47951d8313a)

![[Photo] Singapore and Vietnam Prime Minister's wives visit Vietnam Museum of Ethnology](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/5f7f62b30516402db29e10c1ee43f8e2)

Comment (0)