Keep customers with automatic "number-jumping" change application

After the Automatic Profit feature has been operating since the end of 2023, Techcombank has recently updated version 2.0 for this application to add a more superior and flexible profit mechanism for customers' money in their payment accounts.

Specifically, previously, when a customer's account balance had a minimum of VND10 million, Techcombank's system would automatically start calculating interest up to 4%/year. However, with version 2.0, this bank has removed the minimum financial limit, allowing interest to be earned on any balance in the account.

“Since its launch, Techcombank’s automatic profit feature has attracted nearly 3 million customers to activate and use. This feature has helped optimize more than VND74,000 billion in customer accounts,” a representative of this bank affirmed.

Not only Techcombank, currently the "race" of automatic interest-bearing accounts has attracted dozens of commercial banks to participate with many attractive features and interesting experiences for customers.

For example, at VPBank, this bank has implemented the “Super Profit” feature with a maximum yield of 3.5%/year. Customers only need to log in to VPBank NEO and select this feature on the bank’s app to receive an interest rate of 1-3.5%/year instead of only receiving 0.5%/year for non-term deposits in payment accounts as before.

Or at LPBank, the profit feature is designed with a minimum balance threshold of 5 million VND. Accordingly, when a customer's payment account has more than 5 million VND, the bank's application system will automatically transfer the excess amount to the "Prosperity Profit" compartment, applying a preferential interest rate of up to 4.3%/year. For the part below 5 million VND, customers will still enjoy the normal current interest rate for non-term deposits.

Other banks such as OCB and VIB have similar situations. OCB has applied the Max Savings feature, allowing customers to receive interest 0.5% higher than the traditional 6-month savings interest rate for amounts from VND 50 million to VND 1 billion in their payment accounts. Meanwhile, VIB has applied the "Super yield" feature on MyVIB digital bank, allowing customers to optimize their idle money continuously every day with an interest rate of 2.5% - 4.3%/year and flexible withdrawals.

|

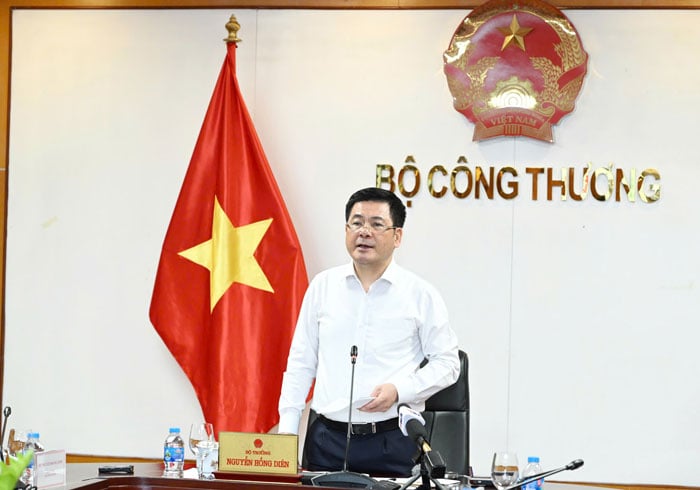

| Commercial banks have many products that encourage customers to maintain balances in their checking accounts. |

New weapon in attracting deposits

According to analysts, the fact that banks are racing to deploy the automatic interest-generating feature for customers' payment account balances as mentioned above is a vivid manifestation of the competition to attract idle deposits. This is also a solution to help commercial banks retain customers in the context of increasingly widespread cashless payments and the increasing rate of people keeping money in payment accounts for daily spending.

According to experts at VPBank Securities JSC (VPBankS), the competition to attract non-term deposits (CASA) among banks is still very active. Most banks have plans to better serve retail customers to maintain their loyalty in using the bank as their main payment account. Therefore, banks will have to invest more in technology.

Creating automatic profit-making features and investing in this feature into a strategic application or product will help commercial banks diversify their deposit attraction channels and encourage customers to increase their balances in their payment accounts. These applications also help banks easily deploy links with businesses to launch payroll products and services; integrate payment accounts with stock investment, insurance, credit cards, etc.

According to experts, in order to attract and retain customers, many banks have long “sacrificed” revenue from service fees. For example, almost no banks charge fees for money transfers and withdrawals. Banks have also waived account maintenance fees, applied point accumulation programs, given gifts, integrated a series of services for bill payment, investment, shopping, etc.

In the context of increasingly high proportion of cashless payments, having money in e-wallets and payment accounts for daily spending is gradually becoming a necessary need for people, small traders and businesses. Therefore, banks are required to increase automatic profit-making features to help customers optimize profits from idle money.

This, from a market perspective, can be considered a “weapon” for banks when competing to retain customers. In fact, in the past few years, fintechs that own e-wallets such as Momo, Moca, and VNPay have also launched features such as “lucky bags” and “postpaid wallets” (integrated into the app of each e-wallet) with attractive interest rates and attracted a large number of users. If they are slow and lack convenience, commercial banks may not be able to attract many customer groups who need to deposit money into their payment accounts as a small-scale savings channel.

Source: https://thoibaonganhang.vn/gio-moi-trong-canh-tranh-huy-dong-tien-nhan-roi-161786.html

![[Photo] More areas of Thuong Tin district (Hanoi) have clean water](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/55385dd6f27542e788ca56049efefc1b)

![[Photo] Prime Minister Pham Minh Chinh and Japanese Prime Minister Ishiba Shigeru visit the National Museum of History](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/93ae477e0cce4a02b620539fb7e8aa22)

![[Photo] Prime Minister Pham Minh Chinh receives Cambodian Minister of Commerce](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/be7f31fb29aa453d906df179a51c14f7)

![[Photo] Prime Minister Pham Minh Chinh and Japanese Prime Minister Ishiba Shigeru attend the Vietnam - Japan Forum](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/fc09c3784d244fb5a4820845db94d4cf)

Comment (0)