ANTD.VN - Gold prices have escaped the lowest level in many weeks, but the precious metal still faces obstacles from new statements from Fed officials, making expectations about the timing of interest rate cuts uncertain.

In the domestic market, after yesterday's recovery sessions, gold prices this morning tended to remain stable.

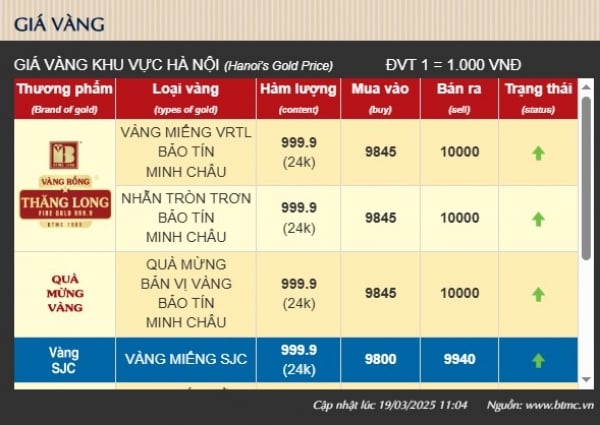

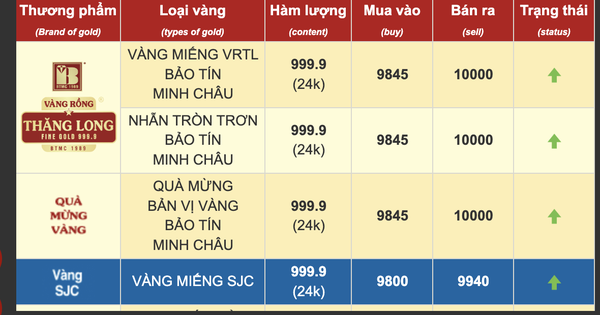

Saigon Jewelry Company (SJC) kept the price of gold bars at 71.50 - 74.52 million VND/tael.

DOJI Group slightly increased by 100 thousand VND per tael in both buying and selling directions, to 71.55 - 74.55 million VND/tael. Phu Quy Group remained unchanged at 71.60 - 74.40 million VND/tael; Bao Tin Minh Chau 71.65 - 74.35 million VND/tael...

Similarly, non-SJC gold also fluctuated little. Specifically, SJC 99.99 rings were listed at 61.95 - 63.00 million VND/tael; PNJ Gold was listed this morning at 61.90 - 62.95 million VND/tael; Bao Tin Minh Chau's Thang Long Dragon Gold was 62.73 - 63.83 million VND/tael...

|

Gold price recovers but cannot break out |

In the world market, gold prices are also recovering from the lowest level in nearly 3 weeks, currently trading around 2,030 USD/ounce.

According to experts, the positive change in the precious metal is mainly due to the decrease in inflation expectations of US consumers, which has fueled market speculation that the Federal Reserve could start cutting interest rates as early as March.

A recent report from the New York Fed showed that US consumers' short-term inflation expectations fell to their lowest level since January 2021, reinforcing dovish expectations.

However, various data are showing that uncertainty about when the Fed will start its rate cut roadmap is keeping gold in a neutral state, unable to break out.

Based on the resilience of the US labor market and hopes for a stable economy is one of them.

Additionally, hawkish comments from some Fed officials have also complicated the scenario. Atlanta Fed President Raphael Bostic and Fed Governor Michelle Bowman both appeared to be on the fence about imminent cuts.

This supported Treasury yields and the US dollar, putting pressure on the precious metal. At the same time, positive sentiment towards Asian stocks also limited gold's safe-haven appeal.

Traders are now cautious, awaiting the latest US consumer inflation figures due out on Thursday. These figures are expected to significantly influence the USD price dynamics and subsequently provide fresh directions for gold prices.

Source link

Comment (0)