According to a survey by VTC News , on many online real estate trading floors, there are more and more announcements of "loss-cutting" sales of mini apartments in Hanoi.

For example, with a project on Bui Xuong Trach Street (Thanh Xuan District), the price of a 32 - 50m2 apartment is advertised by the owner for sale at only about 13 million VND/m2.

Another person who owns a 30m2 mini apartment in an alley on Xa Dan Street (Dong Da District) also decided to "cut losses" at a price of 680 million VND, or about 22.6 million VND/m2; along with basic furniture such as a kitchen, refrigerator, air conditioner... This person bought the apartment about a year ago for 730 million VND, without furniture.

Many investors, after spending tens of billions of dong on mini apartment buildings, are selling them at a loss because the rental business is not effective. Especially after the recent fire and explosion on Khuong Ha street, it is predicted that business will become more and more difficult.

Not only apartments for sale, but also on many real estate sites, it is not difficult to come across advertisements for mini apartments for sale. These buildings have an average area of 50-100 m2/floor, 5-8 floors high, priced from 6-10 billion VND.

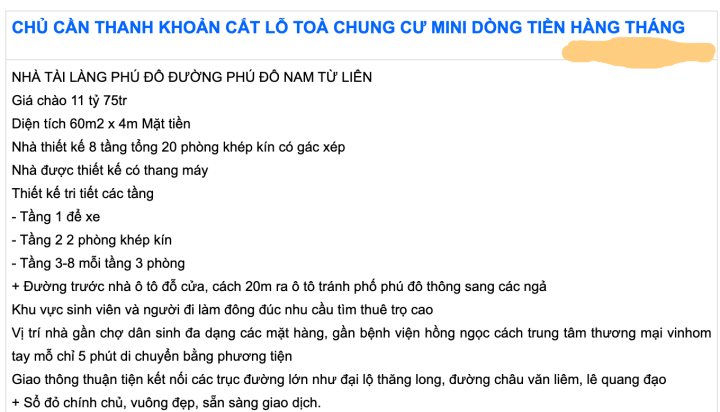

A mini apartment complex for sale at a loss. (Screenshot).

Many real estate experts believe that after the fire at a 9-storey mini apartment building in Thanh Xuan (Hanoi) that killed 56 people, this segment may be severely affected by the strong intervention of authorities in tightening operating conditions.

Commenting on this trend, Mr. Pham Duc Toan, General Director of EZ Real Estate Investment and Development Joint Stock Company (EZ Property) said that in addition to legal and loan issues, the quality of apartments in mini apartments also does not ensure fire prevention. These will be barriers that make many people consider buying mini apartments in the near future.

“ After the fire in Khuong Ha, the mini apartment market will be tightened, so investors will have to invest more money to be able to rent. As for buyers, they will also be more cautious when choosing this type of property ,” Mr. Toan predicted.

According to him, in the near future, the supply of mini apartments will certainly not have new products due to high land prices, while construction licensing requires standards. The authorities will certainly also closely monitor this type, so this is no longer an attractive segment for investors.

Also discussing this issue, real estate expert Nguyen Trung Tuan said that buying and selling mini apartments at this time is relatively "sensitive". There seem to be many sellers, but it is not certain that there will be buyers, even if they are selling at a "loss".

“ Many people are skeptical about the quality of mini apartments today, so they would rather rent a house than buy a mini apartment at a loss. Therefore, this product line is very difficult to sell at present, ” said Mr. Tuan.

According to experts, mini apartment buildings built without permits, violating construction regulations (exceeding floors, lacking fire safety...) may be banned or forced to be renovated in the near future, thereby affecting the revenue and profits of investors. In the worst case, mini apartments may even experience a "frozen" period like karaoke after a series of catastrophic fires.

Therefore, in the short and medium term, this segment will continue to face many difficulties and pressures, requiring investors to consider and calculate carefully before investing.

Meanwhile, Mr. Le Van Tai, a mini apartment broker in Hanoi, said that recently, he has received many products of mini apartment buildings for sale.

The reason is that while investors are doing well, those using financial leverage are struggling. For example, Mr. Tai's company has just received a new product from the owner, a 7-storey mini apartment on a 75m2 plot of land in Nguyen Khoi (Hai Ba Trung district), priced at more than 11 billion VND.

Due to having to borrow nearly 5 billion VND from the bank with a floating interest rate of up to 13 - 14%/year, the homeowner agreed to reduce 500 million VND for customers buying in September.

Mr. Tai said that this mini apartment complex consists of 14 apartments. Initially, the investor planned to build it for rent. Since the beginning of the year, the rental business has not been very favorable, only 50% of the rooms are filled, the rest are empty, with no one living there.

" There are few tenants while operating costs and interest rates are too high, so the landlord had to accept selling to recover capital and pay off bank debt, " said Mr. Tai.

According to Mr. Tai, the mini apartment market is also significantly affected by the general difficulties of the real estate market, the "health" of the economy and the decline in income, causing the rental and hire-purchase profit rates to not meet expectations.

Chau Anh

Source

Comment (0)