2024 is a year of profound and unpredictable economic fluctuations, so the banking industry will be in a more special situation where it is difficult to forecast and predict business results. Thoi Dai had a short conversation with Mr. Nguyen Thanh Tung, Chairman of the Board of Directors of Vietnam Joint Stock Commercial Bank for Foreign Trade (Vietcombank) about Vietcombank's operating results and the bank's future policies.

-Sir, will Vietcombank's credit growth reach the set level in 2024?

-In general, Vietcombank's credit growth this year will reach the set target. The figure of 12% is within Vietcombank's capacity. What we focus on now, besides growth, is credit quality, and in this aspect, Vietcombank's loans are very reassuring.

-So it can be understood that in the last quarter of 2024, Vietcombank does not have to face much pressure on growth targets?

-That's right.

-What about bad debt, sir?

-Currently, Vietcombank's bad debt is only over 1.1%, which is a very low rate. With our bad debt reserve ratio estimated at around 200%, bad debt is generally not a matter of concern.

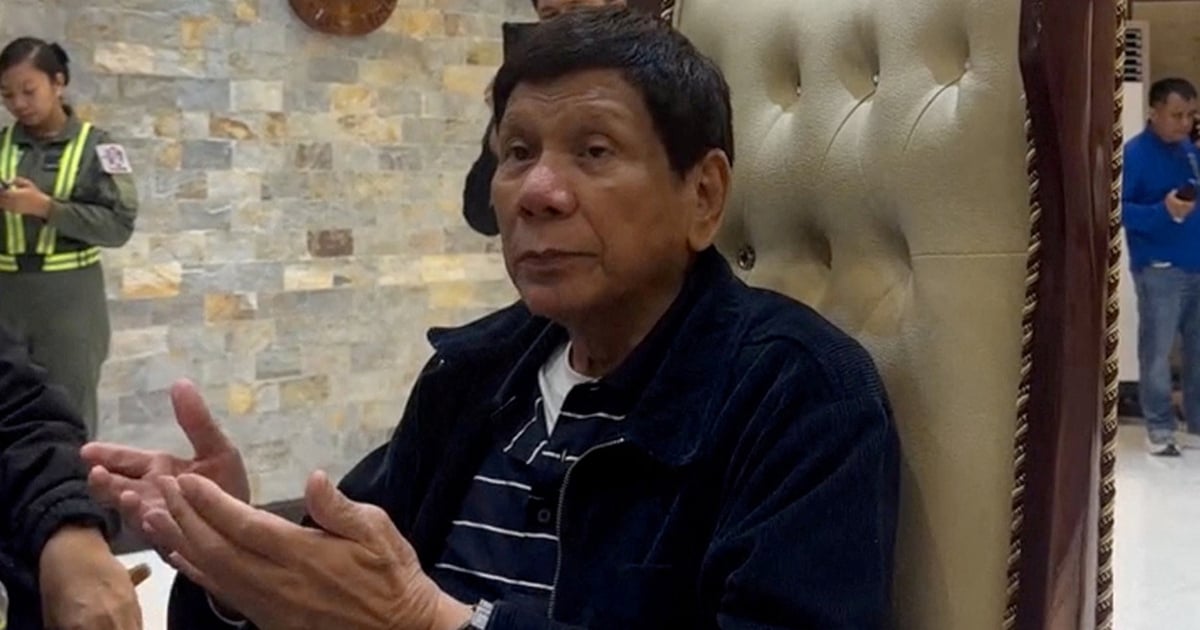

|

| Mr. Nguyen Thanh Tung, Chairman of the Board of Directors of Vietcombank |

-Recently, there have been some fields, such as wind power, where some projects have fallen into bad debt. Does Vietcombank have any projects in this group?

-No, the wind power projects that borrowed capital from Vietcombank have all sold electricity at Fit price, so it can be affirmed that they operate very well, the cash flow is stable, so the outstanding debt for these projects is not a problem.

-Sir, to ensure credit quality, what types of projects will Vietcombank focus on?

- Vietcombank lends quite diversely, across many fields, but in terms of priority, we always aim for large transport infrastructure projects such as seaports, highways, and renewable energy such as wind power or offshore wind power... In general, these are large-scale projects, meeting the practical needs of the economy in the future. Along with that, Vietcombank continues to strongly promote credit relations with the foreign-invested business community. This is a group of customers with good credit quality and suitable for the nature and strengths of Vietcombank.

-Currently, mobilization interest rates are on the rise. Does this put pressure on Vietcombank, sir, when output interest rates still need to be maintained to support businesses?

-It is true that some banks are currently raising deposit interest rates, which also puts pressure on Vietcombank in mobilization. However, Vietcombank will optimize its operations to continue its current lending interest rate policy.

-Last question, the recent storm Yagi has had a huge impact on some northern provinces, how will Vietcombank customers be supported?

-We are currently calculating the extent of the damage, but we can confirm that Vietcombank will share and provide practical support to customers affected by this devastating storm. Vietcombank will announce the specific support in detail in the near future.

-Thank you very much!

Source: https://thoidai.com.vn/ong-nguyen-thanh-tung-vietcombank-se-dat-tang-truong-tin-dung-12-trong-nam-nay-204758.html

Comment (0)